Nvidia (NVDA -2.09%) and Palantir (PLTR -3.72%) were two of the best-performing shares in the marketplace this 12 months, and synthetic intelligence is the main reason why.

Nvidia wishes little creation at this level. The chip inventory has come to dominate the marketplace for information middle GPUs (graphics processing gadgets) within the AI growth, which has pushed its inventory charge up kind of 10 instances because the get started of 2024. Palantir, in the meantime, has emerged as the most important winner in instrument from AI as its enjoy with deep information mining, referred to as information fusion, has paid off, particularly because the release of its synthetic intelligence platform (AIP) ultimate 12 months.

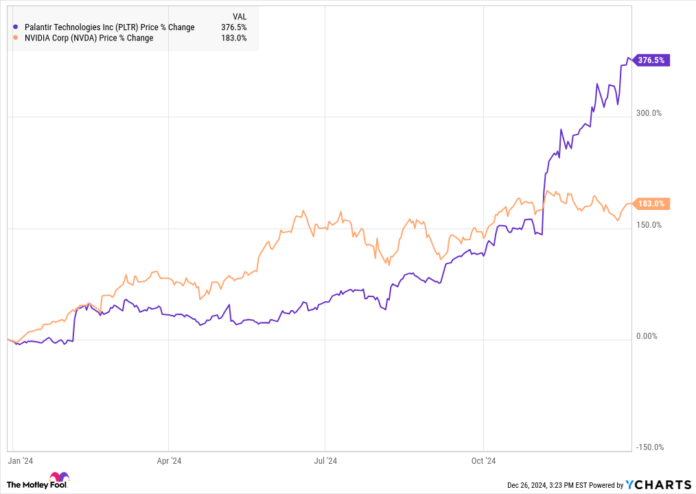

Because the chart beneath displays, each shares have soared this 12 months.

PLTR information through YCharts

So, which is the simpler purchase nowadays? Let’s get into the main points on what every inventory has to provide.

Symbol supply: Getty Pictures.

Industry style: Nvidia vs. Palantir?

Nvidia has established itself because the main chip design corporate, because of its prowess in AI and its investments in spaces like its CUDA instrument library, which offer it a aggressive benefit.

On account of its extensive lead in AI-focused elements like the brand new Blackwell platform, Nvidia these days generates huge benefit margins with a normally authorized accounting rules (GAAP) working margin of 62% within the 3rd quarter.

The corporate has constructed an all-star tradition occupied with innovation, and it sort of feels more likely to stay forward of the contest on AI chips. It is dependent upon foundries like Taiwan Semiconductor Production Corporate for production and is liable to cyclicality and broader issues a couple of bubble in AI. The semiconductor trade is notoriously cyclical and costs and stock ranges can alternate briefly. Subsequently, Nvidia’s biggest possibility is most probably a transformation in trade dynamics that may threaten its expansion quite than a aggressive danger.

Palantir were given its get started serving U.S. intelligence companies after 9/11, serving to them attach information issues to search out threats they another way would have ignored. Palantir has since expanded its product suite to concentrate on quite a lot of trade wishes, together with cryptocurrency, information coverage, and the prevention of cash laundering.

Its predominant instrument platforms come with Gotham, Foundry, Apollo, and Synthetic Intelligence Platform (AIP). Gotham and Foundry are occupied with taking huge quantities of knowledge and making it into an invaluable dataset.

Apollo is a layer for business consumers that permits them to run their instrument in just about any atmosphere, and AIP works with Gotham and Foundry to make use of gadget studying to boost up insights.

Palantir has a slightly small selection of high-paying consumers, that means it offers in huge contracts. The dimensions and complexity of its contracts imply the corporate faces slightly little pageant from different instrument firms. As an alternative, it sees the inner instrument building efforts of its consumers as its largest competitor.

Like Nvidia, Palantir may be susceptible to a sectorwide pullback, regardless that its aggressive place turns out resilient, given the specialised nature of its trade.

Financials: Nvidia vs. Palantir?

Each Nvidia and Palantir have delivered spectacular effects, however one corporate is obviously rising quicker than the opposite.

Nvidia reported 94% earnings expansion within the 3rd quarter to $35.1 billion, with $19.3 billion in internet source of revenue, up 109% from the 12 months ahead of.

Palantir, alternatively, reported 30% earnings expansion to $726 million with sturdy leads to the U.S. and its business section. Web source of revenue jumped 103% to $149.3 million as its margins all of a sudden scaled up.

Valuation: Nvidia vs. Palantir?

Palantir’s explosive expansion this 12 months has come in large part from a couple of expansions. Because of this, the inventory is buying and selling at a sky-high valuation. Palantir now trades at a price-to-sales ratio of 75 and a price-to-earnings ratio of 411 in response to GAAP income.

Nvidia inventory seems to be extra affordable. It these days trades at a price-to-sales ratio of 31 and a price-to-earnings ratio of 55.

Which is the simpler purchase?

Either one of those firms have so much to provide traders, particularly if call for for AI continues to develop, however having a look at each shares holistically, Nvidia is the simpler purchase.

Palantir’s trade is unquestionably intriguing. It is demonstrated its worth to consumers and turns out to have a significant aggressive benefit. Then again, its valuation gifts an important possibility because the inventory may just simply plunge if it misses expectancies.

Nvidia, alternatively, additionally seems to be poised for an identical expansion however with much less drawback possibility.

Jeremy Bowman has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Nvidia, Palantir Applied sciences, and Taiwan Semiconductor Production. The Motley Idiot has a disclosure coverage.