Lucid Staff (LCID 0.82%) is anticipated to record profits on Would possibly 6. There is a lot at stake. The corporate just lately skilled some management adjustments, with its longtime CEO departing quite . The brand new CEO will want to supply vital updates to the corporate’s Gravity SUV gross sales trajectory, in addition to updates on a number of new mass marketplace cars below construction.

All in all, it’s going to be a crucial quarter for Lucid Staff. There are two causes to believe purchasing stocks earlier than the announcement date arrives.

Two causes to shop for Lucid Staff inventory earlier than Would possibly 6

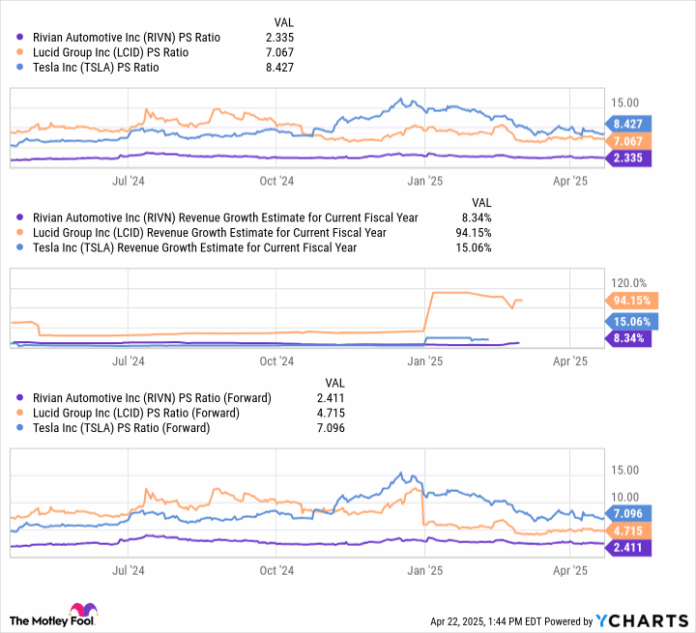

Following the release of its Gravity SUV platform previous this yr, Lucid’s earnings progress has picked up significantly. Analysts consider the corporate may just just about double its gross sales base in 2025. In comparison to competition like Tesla and Rivian Automobile, Lucid’s gross sales progress this yr will have to be impressive. And but the corporate’s valuation is the bottom it’s been all yr, in large part because of the steep marketplace correction skilled so far in 2025.

At the moment, Lucid stocks seem like a cut price in comparison to different EV producers. Enlargement estimates are so prime that stocks business at simply 4.7 occasions ahead gross sales. This comes at a time when analysts be expecting 85.8% gross sales progress in 2025, with any other 86.4% progress anticipated in 2026. Plus, the corporate is anticipated to start out manufacturing on 3 new mass marketplace cars subsequent yr, all of which can be anticipated to be priced below $50,000. Those extra reasonably priced fashions will have to supply but any other progress inflection level for Lucid in 2027 and past.

Put merely, Lucid inventory is a cut price at this time for long-term buyers. The valuation is sexy on a ancient foundation, and but progress charges are having a look very promising over the following few years. However earlier than you soar in, there are a number of crucial dangers to pay attention to as neatly.

RIVN PS Ratio knowledge via YCharts

This EV inventory has some large pink flags

Because the previous pronouncing is going: There is no such factor as a unfastened lunch. The similar rule applies for Lucid inventory at this time. Sure, stocks are reasonable simply as the corporate’s gross sales begin to take off. However there are some critical dangers to this tale.

The departure of Lucid’s CEO simply as the corporate’s progress hits an inflection level is a worrisome signal, regardless that he were with the trade for over a decade. With best $1.6 billion in money and money equivalents, Lucid’s liquidity will have to even be below query. It’ll take billions of bucks to get those new fashions to marketplace, and it isn’t transparent that Lucid has the monetary firepower to scale in line with its timeline.

At minimal, there might be sizable dilution to present shareholders. Plus, there is merely the problem of execution threat. As Tesla and Rivian have confirmed over time, it may be tough to get cars to marketplace on time and on finances. Lucid will face the similar hurdles as each and every different EV start-up.

Are stocks value a speculative funding at those ranges? In case you are on the lookout for most progress possible, Lucid Staff is usually a welcome boost to a growth-oriented portfolio. However there is also a lot of volatility as the corporate makes an attempt to scale in 2025 and past. In case you are unwilling to abdomen sturdy swings within the inventory value, it is most probably very best to depart Lucid to extra risk-tolerant buyers.

Ryan Vanzo has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Tesla. The Motley Idiot has a disclosure coverage.