Stocks of puppy e-commerce corporate Chewy (CHWY -3.03%) dropped on Wednesday after the corporate’s monetary effects for the 3rd quarter of 2024 overlooked expectancies on the base line. As of eleven:20 a.m. ET, Chewy inventory used to be down about 8%.

Gross sales are up however earnings fell in need of expectancies

In Q3, Chewy added about 200,000 internet new shoppers, attaining 20.2 million overall. And over the past twelve months, those shoppers have spent $567 on moderate when put next with a mean of $565 within the earlier quarter. This buyer and spending expansion shaped the root of the corporate’s just about 5% internet gross sales expansion, which used to be somewhat forward of expectancies.

Chewy’s Q3 gross margin stepped forward to 29.3%, which used to be just right. Additionally, the corporate had internet source of revenue of just about $4 million when put next with a $35 million loss within the prior-year length. Whilst stepped forward, buyers had was hoping for larger earnings particularly in mild of its higher-than-expected gross sales. That is why Chewy inventory dropped nowadays.

Chewy’s expansion is heating up

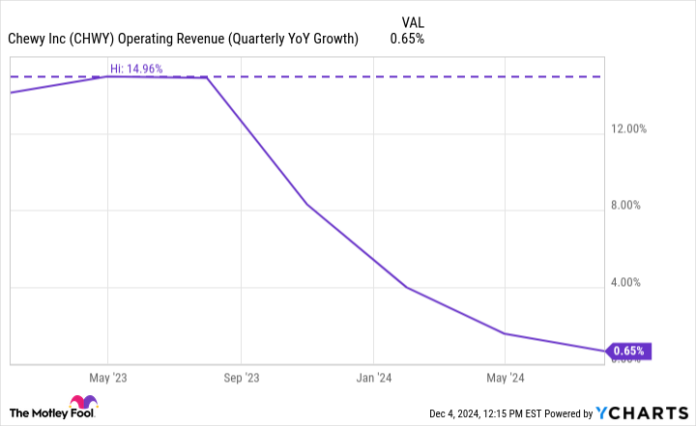

I believe buyers could be lacking the wooded area for the bushes with Chewy nowadays. Control simply gave steering for the fourth quarter of 2024, forecasting 13% year-over-year expansion. No longer best is that higher than its 4% expansion within the fourth quarter of 2023, this could be Chewy’s best possible expansion in just about two years.

CHWY Operating Revenue (Quarterly YoY Growth) information by way of YCharts. Chart does not mirror newest quarter.

There are lots of causes to love Chewy inventory however lackluster expansion has held the inventory again in recent times. However issues may well be turning round and I believe buyers are creating a mistake to promote Chewy nowadays. On the contrary, this looks as if a purchasing alternative to me.

Jon Quast has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Chewy. The Motley Idiot has a disclosure coverage.