Fund Main points

Inception Date

09/26/1980

Benchmark

Mixed 70% MSCI Global Price-NR + 30% Bloomberg US Company Prime Yield Index, MSCI Global Price Index-NR, Bloomberg US Company Prime

Yield Index

Click on to amplify

Fund Description

The fund seeks capital appreciation with source of revenue as a secondary purpose. Its technique is eager about undervalued mid- to large-cap fairness securities with a good portion of its belongings in international securities. The fund additionally invests in merger arbitrage securities and securities of distressed corporations.

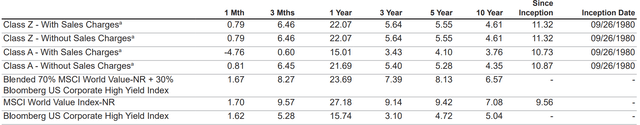

Efficiency Knowledge[1]

Moderate Annual General Returns[2](%)

Efficiency information quoted represents previous efficiency, which doesn’t ensure long run effects. Present efficiency could also be decrease or upper than the figures proven. Main worth and funding returns will vary, and buyers’ stocks, when redeemed, could also be price roughly than the unique price. Efficiency would had been decrease if charges had no longer been waived in quite a lot of classes. General returns suppose the reinvestment of all distributions and the deduction of all fund bills. Returns with gross sales price replicate a deduction of the said most gross sales price. Returns for classes of not up to 12 months don’t seem to be annualized. All categories of stocks might not be to be had to all buyers or via all distribution channels. For present month-end efficiency, please name Franklin Templeton at (800) DIAL BEN/(800) 342-5236 or talk over with www.franklintempleton.com.

An investor can not make investments immediately in an index, and unmanaged index returns don’t replicate any charges, bills or gross sales fees.

Click on to amplify

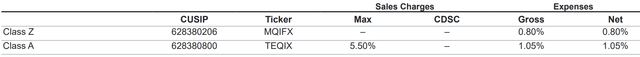

Proportion Elegance Main points

Web Returns come with source of revenue web of tax withholding when dividends are paid. The Mixed Benchmark (70% MSCI Global Price Index-NR (USD) + 30% Bloomberg U.S. Company Prime Yield Bond Index) is a mix of main world inventory and U.S. high-yield bond indexes. The MSCI Global Price Index-NR (USD) is a marketplace capitalization-weighted index of shares showing general worth taste traits in world advanced markets. The Bloomberg U.S. Company Prime Yield Bond Index measures the efficiency of the U.S. dollar-denominated, high-yield, fixed-rate company bond marketplace. Supply: MSCI makes no warranties and shall haven’t any legal responsibility with admire to any MSCI information reproduced herein. No additional redistribution or use is allowed. This record isn’t ready or counseled through MSCI. Bloomberg Indices.

Web Returns come with source of revenue web of tax withholding when dividends are paid. The MSCI Global Price Index is a marketplace capitalization-weighted index designed to measure the efficiency of shares showing general worth taste traits in advanced markets. Supply: MSCI makes no warranties and shall haven’t any legal responsibility with admire to any MSCI information reproduced herein. No additional redistribution or use is allowed. This record isn’t ready or counseled through MSCI.

The Bloomberg U.S. Company Prime Yield Bond Index measures the efficiency of the U.S. dollar-denominated, high-yield, fixed-rate company bond marketplace. Supply: Bloomberg Indices.

Click on to amplify

Portfolio Diversification

Most sensible Holdings

% of General

Most sensible Holdings

%

SORENSON COMMUNICATIONS LLC

6.88

EVEREST GROUP LTD

2.10

ELEVANCE HEALTH INC

1.95

RECKITT BENCKISER GROUP PLC

1.86

GLOBAL PAYMENTS INC

1.84

BRITISH AMERICAN TOBACCO PLC

1.82

RIO TINTO PLC

1.72

WALT DISNEY CO/THE

1.70

NEPTUNE BIDCO US INC (NIELSEN FINANCE)

1.69

MEDTRONIC PLC

1.66

Click on to amplify

Efficient December 1, 2021, Mixed 70% MSCI Global Price-NR+30% Bloomberg US Company Prime Yield Index used to be added as a number one benchmark. MSCI Global Price Index-NR used to be modified to a 2nd benchmark and Bloomberg U.S. Company Prime Yield Index changed into the 3rd benchmark. Sessions shorter than 12 months are proven as cumulative general returns.

What Are The Dangers?

All investments contain dangers, together with imaginable lack of important. The funding taste would possibly grow to be out of fashion, which will have a damaging affect on efficiency. Global investments are topic to important dangers, together with foreign money fluctuations and social, financial and political uncertainties, which might building up volatility. Those dangers are magnified in rising markets. To the level the fund invests in corporations in a particular nation or area, the fund would possibly revel in larger volatility than a fund this is extra widely diverse geographically. Small- and mid-cap shares contain larger dangers and volatility than large-cap shares. Investments in corporations engaged in mergers, reorganizations or liquidations additionally contain particular dangers as pending offers might not be finished on time or on favorable phrases. Low-rated, high-yield bonds are topic to larger worth volatility, illiquidity and chance of default. The chief would possibly believe environmental, social and governance standards within the analysis or funding procedure; then again, ESG issues might not be a determinative consider safety variety. As well as, the executive would possibly not assess each and every funding for ESG standards, and no longer each and every ESG issue could also be recognized or evaluated. Those and different dangers are mentioned within the fund’s prospectus.

Essential Data

The guidelines supplied isn’t a whole research of each and every subject matter reality referring to any nation, marketplace, business, safety or fund. As a result of marketplace and financial prerequisites are topic to switch, feedback, reviews and analyses are rendered as of the date of this subject matter and would possibly trade with out understand. A portfolio supervisor’s evaluate of a specific safety, funding or technique isn’t meant as person funding recommendation or a advice or solicitation to shop for, promote or hang any safety or to undertake any funding technique; it’s meant handiest to offer perception into the fund’s portfolio variety procedure. Holdings are topic to switch.

Sooner than making an investment, in moderation believe a fund’s funding targets, dangers, fees and bills. You’ll in finding this and different data in every prospectus, or abstract prospectus, if to be had, at www.franklintempleton.com. Please learn it in moderation.

Franklin Vendors, LLC. Member FINRA/SIPC.

CFA® and Chartered Monetary Analyst® are logos owned through CFA Institute.

Supply: FactSet. Essential information supplier notices and phrases to be had at www.franklintempletondatasources.com.

a. The entire annual working bills are as of the fund’s prospectus to be had on the time of newsletter. Exact bills could also be upper and would possibly affect portfolio returns.