Eli Lilly (LLY -0.14%) is essentially the most treasured healthcare inventory on the earth, with a marketplace capitalization of just about $700 billion. However in contemporary weeks, its proportion payment has been falling. And now the inventory is down over 20% from its 52-week excessive of $972.53. May this be a good time so as to add the high-powered healthcare inventory in your portfolio?

Why is Eli Lilly inventory suffering of past due?

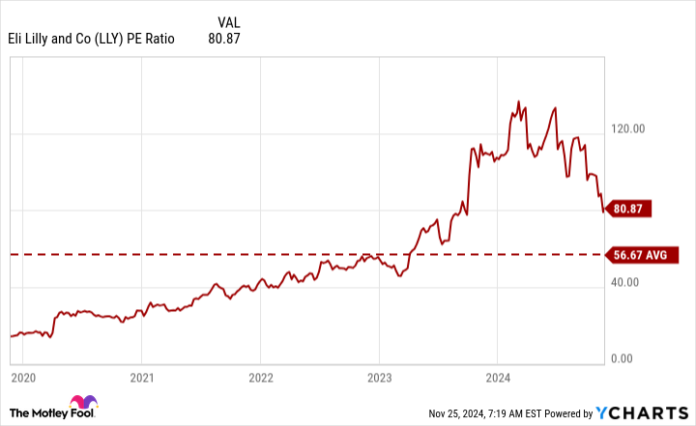

Eli Lilly has been an out of this world expansion inventory to possess in recent times. Getting into buying and selling this week, its five-year returns have totaled greater than 550%. And that suggests a excessive valuation can have so much to do with hesitancy from traders as there could also be numerous worry that the inventory has change into too dear — stocks of Eli Lilly are buying and selling at a price-to-earnings (P/E) more than one of greater than 80.

Even with the inventory’s contemporary drop in price, it’s buying and selling at an increased valuation in comparison with what it has averaged in recent times.

LLY PE Ratio knowledge by way of YCharts

Buyers can also be involved that below a brand new presidential management, there might be other insurance policies installed position that can affect drug pricing. Final week, the inventory closed at $748.01, which is a 7% decline from the $804.73 it closed at at the day of the election, on Nov. 5.

Will have to traders be interested by Eli Lilly?

Eli Lilly is a most sensible healthcare corporate with an especially promising drug in tirzepatide in its portfolio, which has the prospective to very best the best-selling drug ever, with analysts estimating that its height annual gross sales may just most sensible greater than $50 billion. The drug has already received approval from regulators for diabetes (Mounjaro) and weight reduction (Zepbound).

It may additionally download approval to regard sleep apnea within the close to long term, which might be a recreation changer for the industry, irrespective of who’s within the White Area. The drug is in extraordinarily excessive call for and generally is a expansion catalyst for Eli Lilly for future years.

Within the trailing three hundred and sixty five days, Eli Lilly has generated $40.9 billion in earnings and $8.4 billion in benefit. It was once simply a few years in the past the place the industry was once reporting gross sales of round $28 billion and appearing minimum expansion. However now, the corporate is rising at a a lot more spectacular tempo, and it is nonetheless at the cusp of much more superb expansion within the not-too-distant long term.

Whilst Eli Lilly’s valuation does glance excessive, over the years its endured expansion must permit that hefty P/E more than one to come back down. And should you imagine, as I do, that the inventory might doubtlessly most sensible a $1 trillion valuation someday, there may be excellent reason why to stay bullish on Eli Lilly in spite of its contemporary struggles.

Buyers must take the chance to load up on Eli Lilly inventory

Eli Lilly has monumental expansion doable, which is why you most likely would possibly not see the inventory buying and selling at 20 or 30 occasions income anytime quickly. Buyers are paying a top class for the industry, in large part because of tirzepatide and the exceptional expansion doable it possesses.

It is a forged industry to put money into, and if you’ll get it at any more or less bargain, it generally is a no-brainer value purchasing. Eli Lilly is likely one of the most sensible healthcare shares you’ll personal for the lengthy haul, and now will also be an optimum time so as to add it in your portfolio.

David Jagielski has no place in any of the shares discussed. The Motley Idiot has no place in any of the shares discussed. The Motley Idiot has a disclosure coverage.