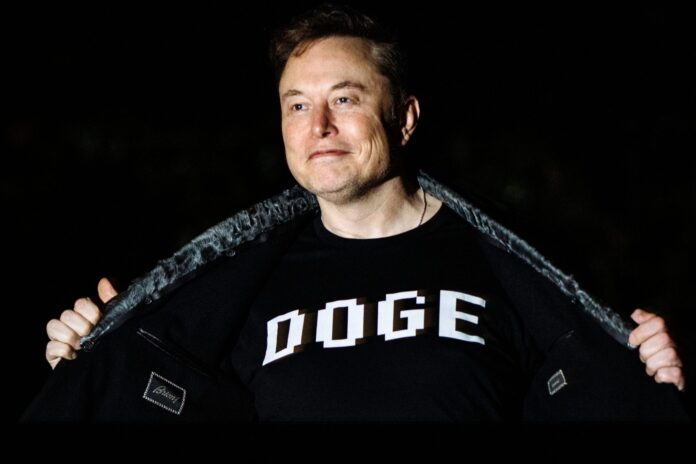

Elon Musk’s Division of Executive Potency raced to intestine the country’s best client monetary watchdog in a frenzied, 36-hour scramble this week, sending out red slips to 1000’s of federal workers whilst lambasting “incompetent” company staffers, consistent with court docket filings via affected workers on Friday.

The filings supply an ordinary glimpse into the efforts to upend the Shopper Monetary Coverage Bureau, the company created within the wake of the 2008 monetary disaster that has turn out to be a chief goal of Trump supporters.

On Wednesday, consistent with contemporary court docket filings, the CFPB’s leader prison officer issued a memo to body of workers outlining the company’s supervision and enforcement priorities, saying a focal point on fraud whilst deprioritizing spaces akin to loans, virtual bills, and clinical debt. Day after today, CFPB appearing director Russell Vought despatched out a so-called “discount in drive” memo, informing 1000’s of workers that they have been being fired.

Whilst an appeals court docket had dominated that any layoffs would wish a “particularized review,” that means that any affected workers have been deemed pointless for the company to meet its statutory necessities, an company staffer testified in a court docket submitting launched on Friday that the CFPB’s leader working officer pushed aside any considerations that the course used to be now not being adopted, as an alternative announcing that “all that mattered used to be the numbers.”

The staffer, who submitted a pseudonymous declaration as a result of worry of retaliation, mentioned they have been a part of the reduction-in-force workforce. In line with the record, DOGE member Gavin Kliger controlled the RIF, preserving the workforce up for 36 hours immediately to be sure that notices would move out on Thursday. “Gavin used to be screaming at other folks he didn’t consider have been operating rapid sufficient to make sure they might move out in this compressed timeline, calling them incompetent,” wrote the staffer.

Kliger didn’t reply to a request for remark.

Jason Brown, the top of the CFPB’s 57-person place of business of study, testified that each one however 3 senior workers have been fired on Thursday, with nobody consulted about whether or not the place of business would have the ability to satisfy its statutory tasks after the layoffs. “The remainder workers lack sure technical experience to meet those purposes on their very own,” he wrote.

Josh Friedman, an Air Power veteran operating within the CFPB’s Administrative center of Servicemember Affairs, wrote in a declaration that he used to be issued an RIF understand whilst serving on energetic accountability on the Pentagon. He testified that each one or just about all the place of business body of workers have been fired, regardless of Dodd-Frank requiring the company to have the place of business.

Within the crosshairs

The CFPB, established greater than a decade in the past via the landmark Dodd-Frank legislative reforms, has lengthy been within the crosshairs of conservatives, who take care of that its client coverage mandate is redundant with different regulatory companies and now not topic to right kind oversight. After years of unsuccessful conservative prison demanding situations to get rid of the company, the CFPB turned into a chief goal of a lot of Trump’s supporters right through his most up-to-date presidential marketing campaign, with Musk tweeting “Delete CFPB” after Trump’s victory in November.

The Trump management temporarily tried to halt the company’s process and to behavior in style firings after taking place of business, however used to be met with prison hindrances, together with a lawsuit via one of the most centered workers. Even with the CFPB’s paintings in large part stalled and Congress repealing the company’s contemporary rulemaking, staffers have fought in court docket to be reinstated to their positions, arguing that makes an attempt to “delete” the company are unconstitutional.

Whilst the pass judgement on overseeing the case halted the CFPB from firing employees or shutting down the company, an appeals court docket ultimate week scaled back the freeze, permitting the management to partially proceed with its marketing campaign. The CFPB’s choice this week to fireplace roughly 90% of its 1,700 workers, on the other hand, induced a prison showdown.

At a initial listening to on Friday, the pass judgement on overseeing the case issued a short lived block at the layoffs, although she’s going to proceed to make a decision whether or not they violate her earlier order, with a follow-up listening to scheduled for April 28. In a submitting on Friday, the CFPB’s leader prison officer argued that it’s taking the bureau in a “new course.”

“I applaud the federal pass judgement on for blockading Donald Trump and Elon Musk’s try to hearth just about all the body of workers on the Shopper Monetary Coverage Bureau, and for spotting this newest transfer for what it’s: but any other unlawful effort to intestine the company altogether,” mentioned Area Monetary Products and services Committee Score Member Maxine Waters (D-Calif.) in a remark shared with Fortune.

A spokesperson for the CFPB didn’t instantly reply to a request for remark.

Do you’re employed on the CFPB? Have additional information? Achieve out by the use of Sign to Leo Schwartz at 856-872-2064

This tale used to be at first featured on Fortune.com