Guido Mieth/DigitalVision by means of Getty Pictures

Funding Means

Constancy® Massive Cap Inventory Fund is a various home fairness technique with a large-cap core orientation. Our funding manner is to search out corporations that we imagine have horny profits and dividend yield prospective over the following two to 3 years, and the place our view isn’t like marketplace consensus. We imagine securities can develop into mispriced relative to their true long-term worth when traders develop into more and more targeted at the brief time period, and our procedure seeks to milk those discrepancies to power efficiency. We try to discover those corporations via in-depth bottom-up, basic research, running in live performance with Constancy’s international analysis crew.

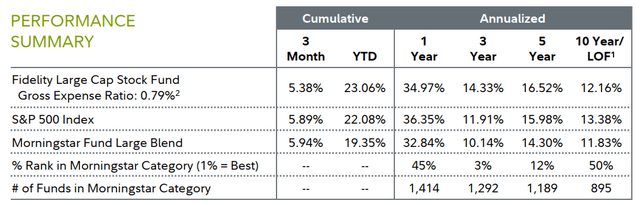

1 Lifetime of Fund (LOF) if efficiency is lower than 10 years. Fund inception date: 06/22/1995.

2 This expense ratio is from the latest prospectus and most often is in line with quantities incurred all through the latest fiscal yr, or estimated quantities for the present fiscal yr when it comes to a newly introduced fund. It does no longer come with any charge waivers or reimbursements, which might be mirrored within the fund’s internet expense ratio.

Previous efficiency isn’t any ensure of long term effects. Funding go back and predominant worth of an funding will range; due to this fact, you might have a acquire or loss while you promote your stocks. Present efficiency is also increased or less than the efficiency said. Efficiency proven is that of the fund’s Retail Elegance stocks (if multiclass). It’s possible you’ll personal any other proportion category of the fund with a special expense construction and, thus, have other returns. To be informed extra or to acquire the latest month-end or different share-class efficiency, consult with Fidelity Funds | Mutual Funds from Fidelity Investments, Financial Professionals | Fidelity Institutional, or Fidelity NetBenefits | Employee Benefits. General returns are ancient and come with exchange in proportion worth and reinvestment of dividends and capital beneficial properties, if any.

Cumulative whole returns are reported as of the length indicated.

For definitions and different essential knowledge, please see the Definitions and Vital Knowledge segment of this Fund Assessment.

Click on to magnify

Efficiency Assessment

For the quarter, the fund received 5.38%, lagging the 5.89% advance of the benchmark S&P 500® index.

Massive-cap shares had been pushed by means of resilient company income, the promise of synthetic intelligence and the Federal Reserve’s long- expected pivot to chopping rates of interest. Amid this favorable backdrop for higher-risk belongings, the index endured its late-2023 momentum and ended September at its all-time ultimate excessive.

Nearly all asset classes received sharply in Q3. The shift towards international financial easing received steam when the Fed diminished its benchmark federal price range charge after a historical climbing cycle that started in March 2022 to fight consistently excessive inflation. On September 18, the central financial institution lower charges by means of 0.50 share issues, choosing a bolder get started in making its first charge relief since March 2020. The Fed’s said objective is to reach a cushy touchdown for the financial system.

The S&P 500® rose 1.22% in July, with the top-heavy index marking a contemporary all-time excessive sooner than a pointy three-week reversal as traders turned around into small-cap, worth and cyclical stocks because of fear a few recession within the U.S. Volatility spiked, however the index rallied as August (+2.43%) spread out. In September, shares rose sooner than and after the Fed’s mid-month assembly. The two.14% advance for the month bumped the index’s year-to-date acquire to 22.08% – its easiest outcome at September’s finish since 1997.

For the quarter, worth stocks (+9%) inside the S&P 500® crowned progress (+4%). Through sector, management significantly shifted amid a cooling in stocks of businesses which have been fanned by means of fervor for generative AI heralding transformative exchange. However AI’s affect was once mirrored within the 19% advance for the utilities sector, which benefited from offering the electrical energy had to energy information facilities used for AI.

Handiest 3 sectors lagged the S&P 500® in Q3. The rotation out of mega-cap progress shares stunted knowledge generation and verbal exchange services and products (+2% each and every), compounded by means of questions concerning the sturdiness of AI-related spending, particularly after vulnerable showings in September for production job and activity openings. Finally, power (-2%) struggled as a result of oil costs dipped on worries concerning the outlook for international call for.

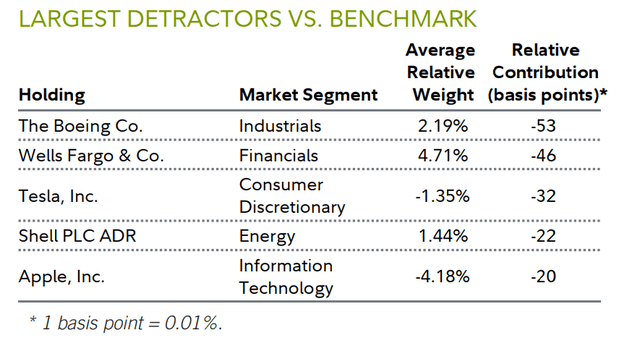

Safety variety within the financials sector was once the biggest detractor from the fund’s efficiency as opposed to the benchmark the previous 3 months. An obese within the lagging power sector additionally harm.

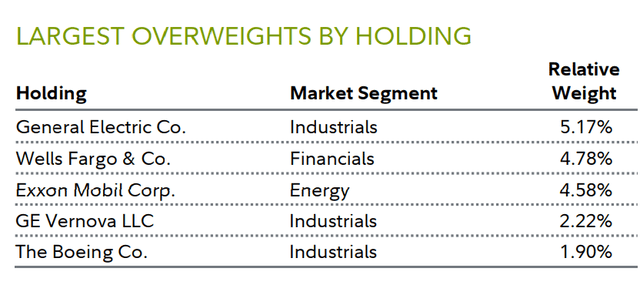

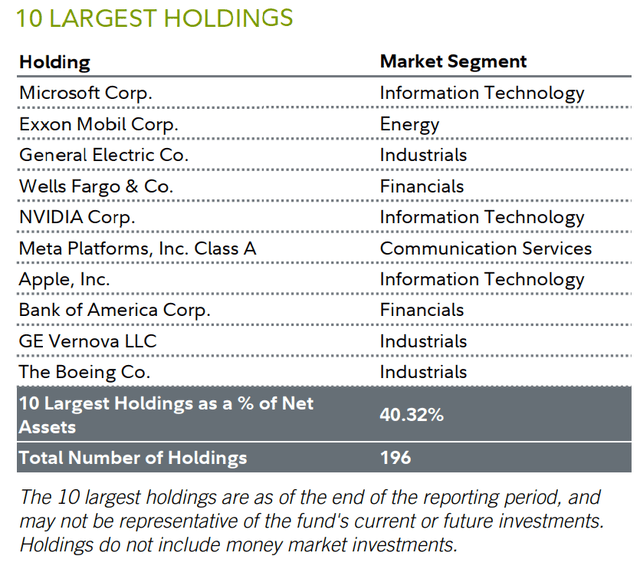

The most important person detractor in Q3 was once an oversized stake in aerospace corporate Boeing (BA) (-16%), which has continued more than one crises associated with the security of its plane. Then again, we expect it has important upside prospective, merely if the corporate can execute its turnaround technique. We will most likely see more than one ups and downs within the coming years. However we see super alternative if the turnaround succeeds, which is why Boeing completed September because the No. 10 keeping and fifth-largest obese.

In financials, it harm to carry an oversized stake in Wells Fargo (-4%). In July, the monetary services and products company reported Q2 effects that modestly outperformed consensus expectancies however confirmed a marked decline in internet hobby source of revenue. In its steering, Wells Fargo (WFC) projected that hobby source of revenue can be hampered for the rest of 2024, given expected easing of economic coverage by means of the Fed. In our view, the business endured to get well from the regional financial institution disaster closing spring, main to larger investor self belief within the safety of financial institution deposits. Moreover, worries about credit-related losses in business actual property have lowered, whilst fear about the potential for heightened capital necessities affecting lending requirements have lessened.

According to this, we added to Wells Fargo in Q3, and it was once a peak keeping and obese on September 30.

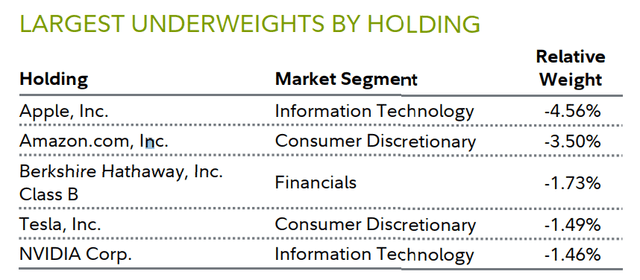

We will additionally word that warding off electric-vehicle maker and benchmark part Tesla (TSLA) (+32%) detracted from relative efficiency, as we preferred shares we thought to be a greater are compatible for the fund.

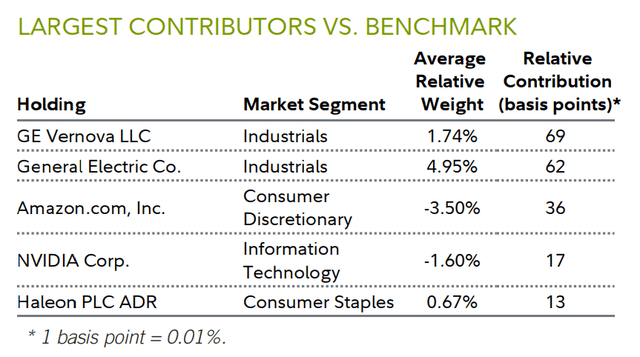

Conversely, positioning within the capital items business contributed as opposed to the benchmark in Q3, led by means of overweights in GE Vernova (GEV) (+49%) and Common Aerospace (GEV) (+19%, previously Common Electrical). The marketplace endured to be inspired with Common Aerospace’s industry turnaround and balance-sheet growth, that have equipped an enormous tailwind to its profits and proportion worth. After more than one years of robust progress in income, benefit margin, profits and loose coins movement, Common Aerospace has horny alternative forward of it, in our opinion, because of the tailwind coming from the economic aerospace business. We see GE Vernova, GE’s energy and renewables industry unit that the corporate spun off in early April, as any other high-potential keeping, in a position to have the benefit of rising call for for sustainable power. Each had been peak holdings and overweights as of quarter finish.

Outlook and Positioning

Our funding philosophy and procedure is in line with the concept inventory costs apply adjustments in long-term profits estimates.

As a result of long-term profits are inherently much less predictable than non permanent profits, the marketplace is susceptible to overreact to adjustments within the latter, main securities to develop into mispriced relative to their intrinsic, or true, worth.

We imagine that by means of combining exhaustive funding analysis with persistence and self-discipline, an investor has the chance to profit from this marketplace inefficiency. A inventory with a decrease valuation would possibly outperform or underperform at other issues in each and every marketplace cycle, however this feature has traditionally resulted in outperformance over longer stretches. This shut consideration to valuation is a technique we set up portfolio threat.

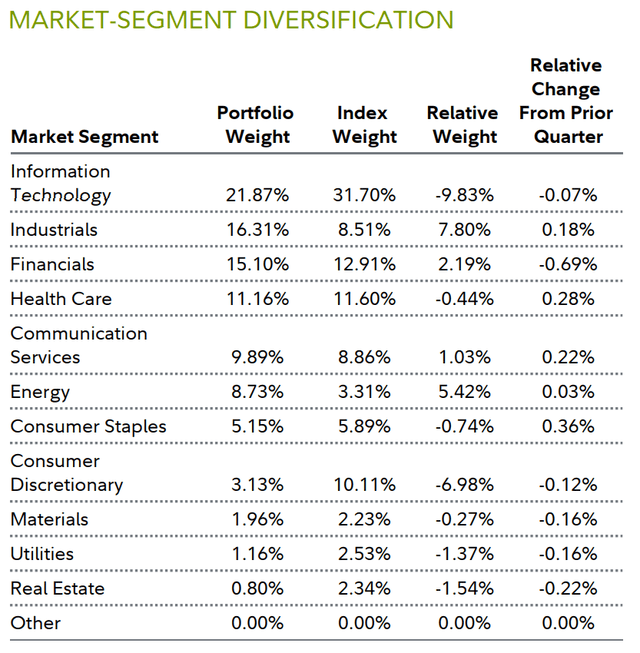

As the general quarter of 2024 starts, the biggest sector obese was once industrials, representing about 16% of belongings, and particularly the economic aerospace business. We imagine the continuing restoration of spending on commute may spice up corporations pushed by means of the aerospace industry.

The following-largest obese was once power, more or less 9% of internet belongings. For a number of years, we have preferred power as a result of we imagine the marketplace has began to comprehend that the transition to inexperienced power goes to take longer than anticipated. Call for has remained sturdy, whilst provide is constrained. On this atmosphere, we have been focusing the fund’s power investments at the most powerful competition within the business, led by means of Exxon Mobil (XOM), a enormous keeping and obese at quarter finish.

The fund ended September with an obese in financials, which represented 15% of belongings. We have now emphasised the biggest monetary establishments whilst warding off maximum small- and mid-cap banks, in line with our trust that scale issues on this business.

For a while, the fund has been underweight progress shares, as we have discovered them unfavorably valued relative to their longer-term profits alternative. Not too long ago, on the other hand, we have steadily narrowed that underweight. A part of our funding thesis is that funding in generative AI, already large, is not likely to forestall. So, we have selectively added to sure progress shares of companies which might be in some type hooked up to AI.

The generative AI phenomenon is, if no longer but producing sooner profits progress to strengthen sure corporations’ increased valuations, no less than offering hope that the profits spice up is across the nook. So, numerous progress shares have rallied on that prospect.

Once we see growth-related funding alternatives at a valuation that moves us as horny, we attempt to take benefit by means of making an investment in companies we imagine can generate just right profits progress, have a forged stability sheet and will generate coins movement.

In the meantime, we have have shyed away from or underweighted corporations we expect aren’t cash-flow generative or which might be much more likely to stand aggressive force.

Prior to now one year, the S&P 500 has received more or less 36%, whilst profits progress was once within the mid-single digits. This means that more than one enlargement has performed an oversized position. We predict that additional more than one progress shape here’s not likely, and it’s much more essential to concentrate on sustainable profits progress from corporations in place to regulate their very own future, whilst additionally minimizing publicity to valuation threat.

The underlying degree of inflation that the corporations we put money into face has abated from the 2023 height, however stays increased as opposed to fresh historical past. We stay interested in corporations with pricing energy and systems to include prices and power operational potency.

Definitions and Vital Knowledge

Knowledge equipped in, and presentation of, this file are for informational and academic functions simplest and aren’t a advice to take any explicit motion, or any motion in any respect, nor an be offering or solicitation to shop for or promote any securities or services and products introduced. It’s not funding recommendation. Constancy does no longer supply felony or tax recommendation.

Earlier than making any funding selections, you must visit your personal skilled advisers and take note all the explicit information and instances of your own state of affairs. Constancy and its representatives could have a warfare of hobby within the merchandise or services and products discussed in those fabrics as a result of they have got a monetary hobby in them, and obtain repayment, without delay or not directly, in reference to the control, distribution, and/or servicing of those merchandise or services and products, together with Constancy price range, sure third-party price range and merchandise, and likely funding services and products.

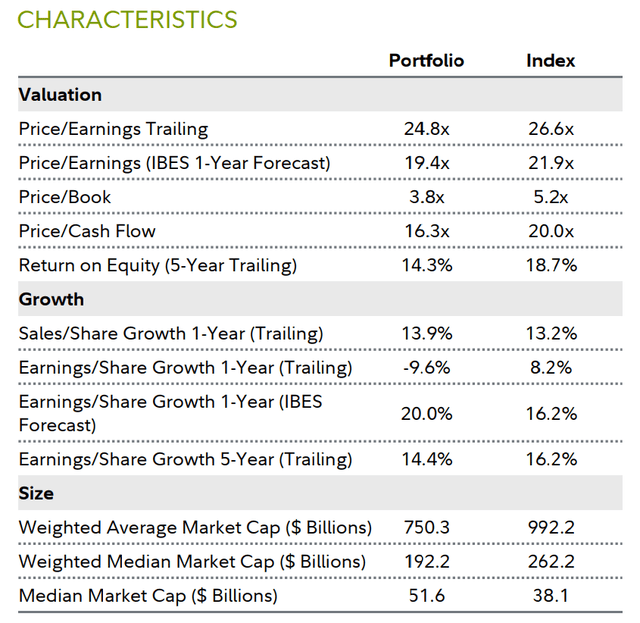

Traits

Profits-According to-Proportion Expansion Trailing measures the expansion in reported profits in line with proportion over trailing one- and five-year sessions.

Profits-According to-Proportion Expansion ((IBES) 1-Yr Forecast) measures the expansion in reported profits in line with proportion as estimated by means of Wall Side road analysts.

Median Marketplace Cap identifies the median marketplace capitalization of the portfolio or benchmark as made up our minds by means of the underlying safety marketplace caps.

Worth-to-Ebook (P/B) Ratio is the ratio of an organization’s present proportion worth to reported accrued income and capital.

Worth/Money Float is the ratio of an organization’s present proportion worth to its trailing 12-months coins movement in line with proportion.

Worth-to-Profits (P/E) Ratio ((IBES) 1-Yr Forecast) is the ratio of an organization’s present proportion worth to Wall Side road analysts’ estimates of profits.

Worth-to-Profits (P/E) Ratio Trailing is the ratio of an organization’s present proportion worth to its trailing 12-months profits in line with proportion.

Go back on Fairness (ROE) 5-Yr Trailing is the ratio of an organization’s closing 5 years ancient profitability to its shareholders’ fairness.

Most well-liked inventory is incorporated as a part of each and every corporate’s internet value.

Gross sales-According to-Proportion Expansion measures the expansion in reported gross sales over the desired previous period of time.

Weighted Moderate Marketplace Cap identifies the marketplace capitalization of the typical fairness keeping as made up our minds by means of the bucks invested within the portfolio or benchmark.

Weighted MedianMarketCapidentifies the marketplace capitalization of the median fairness keeping as made up our minds by means of the bucks invested within the portfolio or benchmark.

Vital Fund Knowledge

Relative positioning information introduced on this statement is in line with the fund’s number one benchmark (INDEX) except a secondary benchmark is supplied to evaluate efficiency.

Indices

It’s not imaginable to speculate without delay in an index. All indices represented are unmanaged. All indices come with reinvestment of dividends and hobby source of revenue except in a different way famous.

S&P 500 Index is a marketplace capitalization-weighted index of 500 not unusual shares selected for marketplace measurement, liquidity, and business workforce illustration to constitute U.S. fairness efficiency.

Marketplace-Weight Segments

Marketplace-segment weights illustrate examples of sectors or industries through which the fund would possibly make investments, and will not be consultant of the fund’s present or long term investments. They must no longer be construed or used as a advice for any sector or business.

Score Knowledge

© 2024 Morningstar, Inc. All rights reserved. The Morningstar knowledge contained herein: (1) is proprietary to Morningstar and/or its content material suppliers; (2) will not be copied or redistributed; and (3) isn’t warranted to be correct, whole or well timed. Neither Morningstar nor its content material suppliers are answerable for any damages or losses bobbing up from any use of this knowledge. Constancy does no longer assessment the Morningstar information and, for mutual fund efficiency, you must test the fund’s present prospectus for probably the most up-to-date knowledge regarding acceptable so much, charges and bills.

% Rank in Morningstar Class is the fund’s total-return percentile rank relative to all price range that experience the similar Morningstar Class. The absolute best (or maximum favorable) percentile rank is 1 and the bottom (or least favorable) percentile rank is 100. The highest- appearing fund in a class will at all times obtain a rank of one%. % Rank in Morningstar Class is in line with whole returns which come with reinvested dividends and capital beneficial properties, if any, and exclude gross sales fees. More than one proportion categories of a fund have a not unusual portfolio however impose other expense buildings.

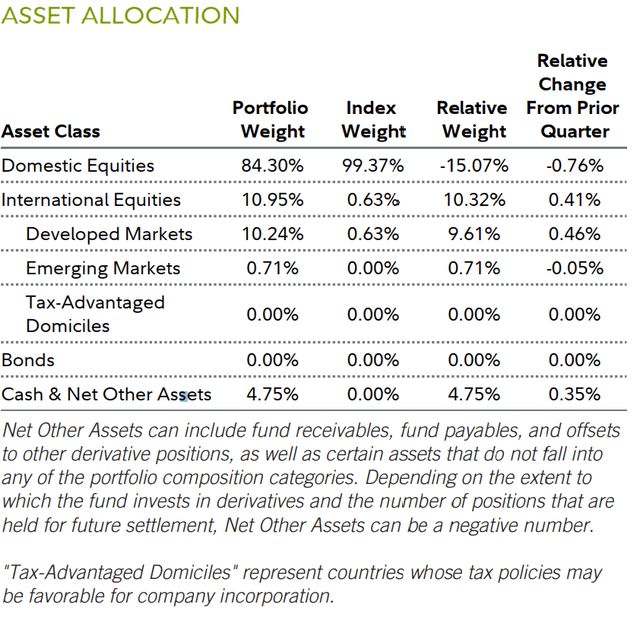

Relative Weights

Relative weights represents the % of fund belongings in a selected marketplace phase, asset category or credits high quality relative to the benchmark. A favorable quantity represents an obese, and a detrimental quantity is an underweight. The fund’s benchmark is indexed in an instant beneath the fund identify within the Efficiency Abstract.

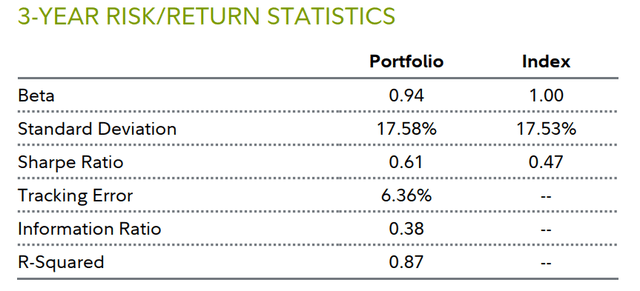

3-Yr Possibility/Go back Statistics

Beta is a measure of the volatility of a fund relative to its benchmark index. A beta better (much less) than 1 is extra (much less) risky than the index.

Knowledge Ratio measures a fund’s lively go back (fund’s reasonable per 30 days go back minus the benchmark’s reasonable per 30 days go back) in terms of the volatility of its lively returns.

R-Squared measures how a fund’s efficiency correlates with a benchmark index’s efficiency and displays what portion of it may be defined by means of the efficiency of the whole marketplace/index. R- Squared levels from 0, which means no correlation, to at least one, which means highest correlation. An R-Squared worth of lower than 0.5 signifies that annualized alpha and beta aren’t dependable efficiency statistics.

Sharpe Ratio is a measure of ancient risk-adjusted efficiency. It’s calculated by means of dividing the fund’s extra returns (the fund’s reasonable annual go back for the length minus the 3-month “threat loose” go back charge) and dividing it by means of the usual deviation of the fund’s returns. The upper the ratio, the simpler the fund’s go back in line with unit of threat. The 3 month “threat loose” charge used is the 90-day Treasury Invoice charge.

Usual Deviation is a statistical dimension of the dispersion of a fund’s go back over a specified period of time. Constancy calculates usual deviations by means of evaluating a fund’s per 30 days returns to its reasonable per 30 days go back over a 36-month length, after which annualizes the quantity. Buyers would possibly read about ancient usual deviation along with ancient returns to make a decision whether or not a fund’s volatility would had been appropriate given the returns it will have produced. The next usual deviation signifies a much broader dispersion of previous returns and thus better ancient volatility. Usual deviation does no longer point out how the fund in reality carried out, however simply signifies the volatility of its returns through the years.

Monitoring Error is the divergence between the cost conduct of a place or a portfolio and the cost conduct of a benchmark, developing an sudden benefit or loss.

Click on to magnify

Editor’s Notice: The abstract bullets for this newsletter had been selected by means of Searching for Alpha editors.