sankai

Through Elisa Mazen, Michael Testorf, CFA, & Pawel Wroblewski, CFA

U.S. Exceptionalism Offsets In another country Weak point Marketplace Review

After powerful efficiency within the first 9 months of the 12 months, world equities struggled within the fourth quarter because of a go back to slender management within the U.S. and marketplace issues about tariff wars and doubtlessly different punitive measures that may be levied via the second one Trump management. The more potent U.S. buck (USDOLLAR,DXY) and damaging sentiment over the present state of political opinions in Europe additionally weighed at the biggest advanced markets out of doors the U.S. The benchmark MSCI All Nation International Index declined 0.99% within the quarter however completed the 12 months up 17.49% on energy amongst U.S. shares.

From a regional point of view, the U.S. outperformed the index for the quarter and was once the one main advanced marketplace to generate positive aspects. Japan suffered the narrowest losses amongst different areas whilst the UK, rising markets, Asia Ex Japan and Europe Ex-U.Ok. had been the best laggards.

In spite of inklings of a U.S. marketplace broadening within the fourth quarter sparked via Trump’s election victory and extra rate of interest cuts from the Federal Reserve, the post-election rally proved short-lived and momentum-led with quite slender management. Fee cuts got here amid sturdy financial information that started to make stronger the case for a slower easing cycle from the Federal Reserve than were anticipated. This, in conjunction with doubtlessly reflationary coverage from the Trump management, similar to price lists, in addition to slight upticks in inflation, put some upward force on rates of interest, inflicting some weak spot in economically touchy and rate-sensitive sectors. Within the wide marketplace S&P 500 Index, mega cap tech management helped the shopper discretionary, communique services and products and knowledge generation sectors proceed their 2024 dominance within the fourth quarter, in conjunction with financials. Tariff and inflation issues, in the meantime weighed on cyclical, rate-sensitive and defensive sectors, with fabrics, well being care, actual property and utilities the ground performers.

In contrast to within the U.S., the place moderating inflation has been accompanied via resilient GDP development, Europe and the U.Ok. proceed to stand recession dangers. Whilst the Ecu Central Financial institution (in conjunction with Switzerland) took the lead amongst world central banks in chopping charges and endured to ease coverage aggressively within the fourth quarter, inflation stays above goals. Political turmoil in Europe’s two biggest economies – Germany and France – in addition to endured weak spot in its key export marketplace of China had been exacerbated via Trump’s danger of price lists. In the meantime, hopes for answer of the Russia-Ukraine conflict, and the reconstruction spending that may practice, appear some distance off.

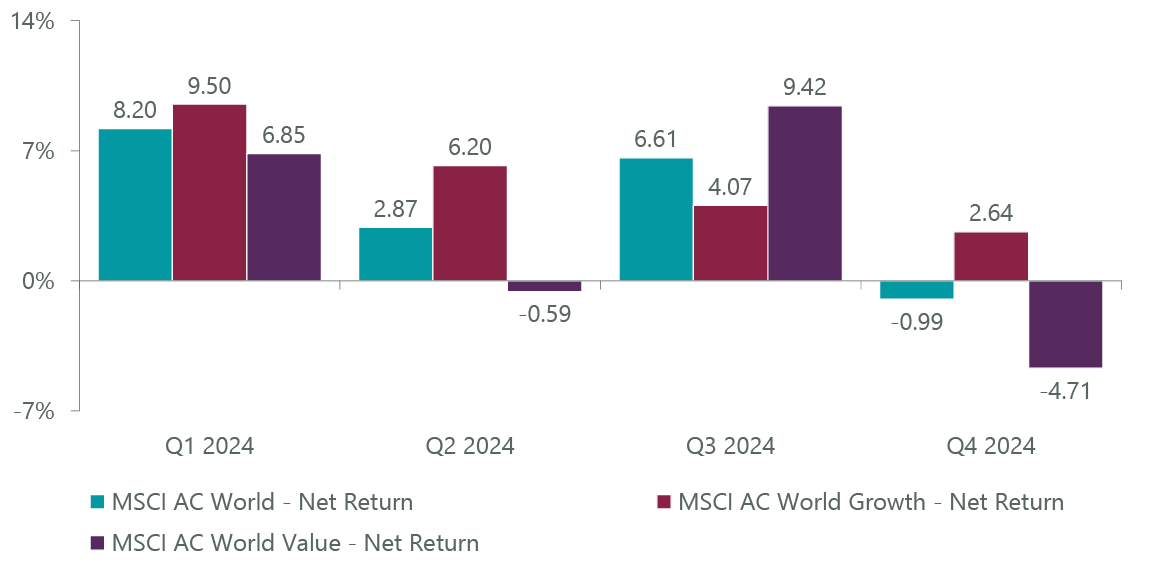

Lifted via the dominant weighting of U.S. shares within the index, world development shares complex 2.64% for the quarter and outperformed their price opposite numbers via 695 foundation issues. For the 12 months, development shares rose 24.23% and outperformed price via 1,347 bps.

Showcase 1: MSCI Expansion vs. Worth Efficiency

As of Dec. 31, 2024. Supply: FactSet.

On this growth-dominant atmosphere, the ClearBridge International Expansion Technique outperformed the benchmark for the fourth quarter and the total 12 months on a gross foundation. Within the fourth quarter, inventory variety and sector allocation each contributed to effects as our portfolio firms had been in a position to ship certain returns that belied the vulnerable macro backdrop throughout Europe and a transitional duration in Japan. The Technique’s obese to the extra growth-oriented IT and communique services and products sectors additionally proved advisable.

Contributions for the quarter had been various throughout holdings in our rising, solid and structural development buckets, firms together with U.S. AI-indexed chipmaker Marvell Era (MRVL), mega cap e-commerce and cloud supplier Amazon.com (AMZN), U.S. social media platform Reddit (RDDT), Canadian e-commerce enablement supplier Shopify (SHOP) and Singapore-based e-commerce and gaming platform Sea Restricted (SE). The ones names had been supported via U.S. communications chipmaker Broadcom (AVGO), Taiwan Semiconductor (TSM) and mega caps Apple (AAPL) and Alphabet (GOOG,GOOGL) .

Those various effects offset weak spot within the portfolio’s pharmaceutical holdings. Diabetes and weight problems drug maker Novo Nordisk (NVO), the portfolio’s 2d biggest place, declined following a disappointing medical trial relative to company-set expectancies for a next-generation weight reduction molecule. We imagine buyers overreacted to the slight pass over of its efficacy goals and imagine a detailed analysis of the knowledge displays efficacy within the molecule. Importantly, the trial was once now not a failure and we think the drug mixture would be the absolute best weight reduction drug available on the market. Fellow GLP-1 drug maker Eli Lilly (LLY) additionally declined on provide constraint issues whilst U.S. existence science equipment maker Thermo Fisher Medical (TMO) was once down on weaker biopharmaceutical R&D spending.

Portfolio Positioning

We added 11 new positions all through the quarter whilst exiting 12 others. A repurchase of Luxembourg-based audio streaming and podcast carrier Spotify (SPOT) marked the biggest new addition. Since we bought the inventory in the second one quarter of 2021, control has made two key adjustments to pressure subject material benefit upgrades: the corporate carried out two rounds of worth will increase throughout all subscription services and products and sharply reduce prices to improve income. The previous resulted in development in reasonable income in line with consumer after years of decline, whilst the latter led to significant working margin growth. Within the period in-between, Spotify has maintained a robust marketplace place, increasing pockets percentage whilst expanding the entire addressable marketplace for its services and products.

Rising development firms like Spotify and fellow new buys Reddit and Roblox (RBLX) are discovering their long ago into the portfolio as development is normalizing and financing prices easing for corporations that make investments closely in development and innovation. Reddit, in communique services and products, is a novel vacation spot for group and dialog on the net. The corporate’s newest quarterly effects confirmed sturdy positive aspects in day by day reasonable customers whilst promoting and knowledge licensing revenues additionally ramped aggressively. Reddit operates an excessively high-margin industry and we imagine the corporate remains to be early in its engagement, monetization and profitability adventure.

Roblox operates a web-based gaming and sport building platform. Expansion is pushed via expanding consumer engagement, bettering monetization thru top rate subscriptions and in-experience commercials, and efficient value control main to better margins. Roblox lately issued sturdy upward fiscal 2026 income revisions and an important growth in working income.

Luxurious items has represented our number one shopper discretionary publicity during the last a number of years, and we swapped exposures via changing OTCPK:LVMHF and Puig Manufacturers (OTCPK:PUIGF) with the acquisition of French equipment maker Hermes (OTCPK:HESAY). The corporate limits the availability of its ultra-premium, hand made leather-based items regardless of massive shopper call for. Whilst this has resulted in waitlists and decrease doable development, it has additionally underpinned the emblem’s desirability and exclusivity. We see alternatives for Hermes thru higher quantity, pricing energy and product classes similar to able to put on, jewellery, watches and attractiveness nonetheless in early phases of development.

We exited renewable power manufacturer NextEra (NEE) as we think the incoming Trump management to extend uncertainty round renewables call for and subsidies, which might pressure much less upside over the following couple of years. The most important gross sales all through the quarter additionally incorporated aerospace portions maker Transdigm (TDG), Eastern clinical tool maker Olympus (OTCPK:OCPNF), cosmetics marketer COTY and communications apparatus maker Amphenol (APH).

Outlook

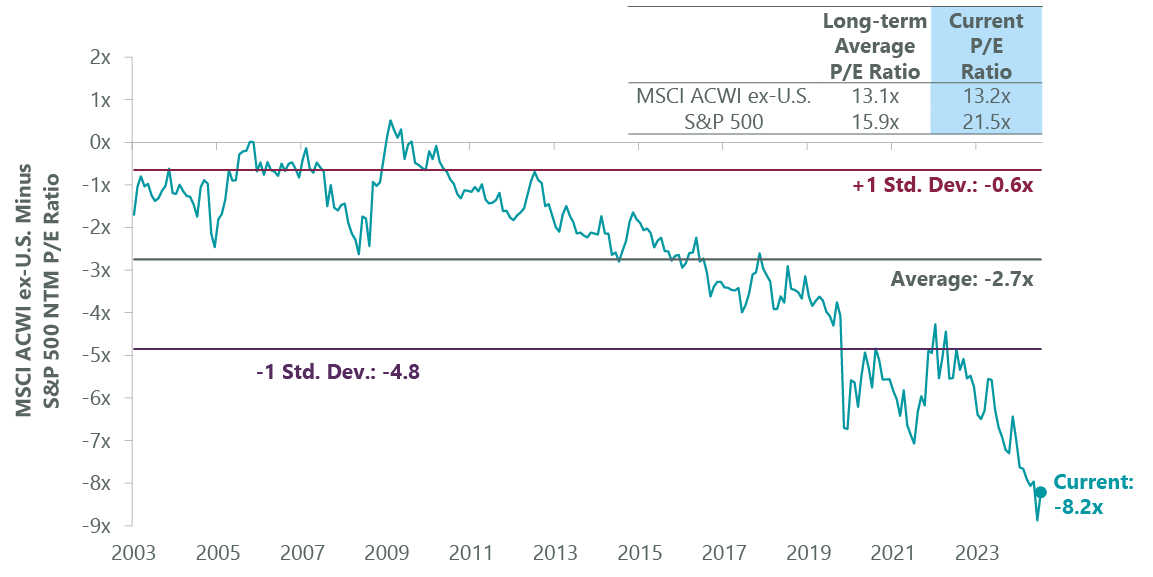

The theory of U.S. exceptionalism will have reached its zenith in 2024 because the U.S. economic system endured to ship cast development with inflation coming most commonly underneath regulate, resulting in outsize fairness returns. We imagine the second one Trump management introduces a wild card into that momentum and, with U.S. fairness valuations nicely above reasonable, leaves little room for error will have to tariff or comparable geopolitical insurance policies create volatility. World markets, alternatively, are priced for little development, which we imagine creates an overpassed alternative for lively development buyers like ourselves.

Showcase 2: International Valuations Sexy

As of Dec. 31, 2024. Assets: FactSet, MSCI, S&P.

We see a number of catalysts that might assist global equities shut the efficiency hole within the 12 months forward, which would provide a long-awaited supplement to our majority publicity in U.S. equities, which can be anticipated to ship certain however extra muted efficiency going ahead. The primary is price lists. In his first time period, Trump ended up imposing much less stringent and extra restricted price lists then were instructed at the marketing campaign path. Will have to his endured difficult communicate on price lists finally end up being extra of a negotiating instrument than precise business coverage, this is able to be a boon to the export-driven Ecu and Eastern economies. 2nd can be an finish to the Russia-Ukraine battle, which might generate vital stimulus for Europe total as Ukraine will require one of those Marshall Plan to restore its economic system. The International Financial institution estimates $480 billion relating to reconstruction prices, growing vital call for for spaces just like the fabrics sector in supplying cement and metal.

The 3rd doable driving force is that two of the biggest global economies, Germany and Japan, are nicely at the back of the U.S. relating to fiscal stimulus measures. Political upheaval in Germany may just take away previous impediments to bigger spending. With elections scheduled for the primary quarter, accommodative measures might be carried out in Germany as early as the second one quarter, doubtlessly boosting spending on infrastructure and spaces like semiconductors. Japan, in the meantime, lately introduced large stimulus of ¥1.8 trillion that will likely be used to fund its power transition.

Taken in combination, in conjunction with advanced marketplace valuations that experience slightly budged within the remaining two decades (in comparison to a 40% upward thrust in U.S. multiples), we see scope for a reversion to begin in world fairness management. We imagine the Technique’s various solution to development is well-suited to take part on this development over the approaching 12 months.

Portfolio Highlights

All the way through the fourth quarter, the ClearBridge International Expansion Technique outperformed its MSCI ACWI benchmark. On an absolute foundation, the Technique delivered positive aspects throughout 4 of the ten sectors by which it was once invested (out of eleven overall), with the IT and communique services and products sectors the principle individuals whilst the well being care, industrials and shopper staples sectors had been the main detractors.

On a relative foundation, total inventory variety and sector allocation contributed to efficiency. Particularly, inventory variety within the IT, communique services and products, well being care and fabrics sectors, overweights to communique services and products and IT in addition to an underweight to fabrics drove effects. Conversely, inventory variety within the financials, shopper discretionary, shopper staples and industrials sectors and an obese to well being care detracted from efficiency.

On a regional foundation, inventory variety in North The us, Europe Ex U.Ok., rising markets and Asia Ex Japan and an underweight to rising markets supported efficiency whilst inventory variety in Japan and an obese to Europe Ex U.Ok. proved unfavourable.

On a person inventory foundation, the biggest individuals to absolute returns within the quarter incorporated Marvell Era, Shopify and Nvidia (NVDA) within the IT sector, Amazon.com within the shopper discretionary sector and Reddit within the communique services and products sector. The best detractors from absolute returns incorporated positions in Novo Nordisk, Eli Lilly and Thermo Fisher Medical in well being care, Goal (TGT) in shopper staples and UBER in industrials.

Along with the transactions discussed above, the Technique bought stocks of Financial institution of The us (BAC) in financials, Test Level Device (CHKP) and DocuSign (DOCU) in IT, and Chewy (CHWY), Airbnb (ABNB) and Nike (NKE) in shopper discretionary and L’Oreal (OTCPK:LRLCF) in shopper staples. We additionally exited Monolithic Energy Techniques (MPWR) and ASML in IT, Pinterest (PINS) in communique services and products, Loblaw (OTCPK:LBLCF) in shopper staples and DexCom (DXCM) in well being care.

Elisa Mazen, Managing Director, Head of Global Growth, Portfolio Manager

Michael Testorf, CFA, Managing Director, Portfolio Manager

Pawel Wroblewski, CFA, Managing Director, Portfolio Manager

Previous efficiency isn’t any ensure of long term effects. Copyright © 2024 ClearBridge Investments. All reviews and knowledge incorporated on this statement are as of the newsletter date and are matter to modify. The reviews and perspectives expressed herein are of the writer and would possibly vary from different portfolio managers or the company as an entire, and don’t seem to be meant to be a forecast of long term occasions, a ensure of long term effects or funding recommendation. This data will have to now not be used as the only real foundation to make any funding resolution. The statistics had been acquired from assets believed to be dependable, however the accuracy and completeness of this data can’t be assured. Neither ClearBridge Investments, LLC nor its knowledge suppliers are answerable for any damages or losses coming up from any use of this data.

Efficiency supply: Interior. Benchmark supply: Morgan Stanley Capital World. Neither ClearBridge Investments, LLC nor its knowledge suppliers are answerable for any damages or losses coming up from any use of this data. Efficiency is initial and matter to modify. Neither MSCI nor another birthday party thinking about or associated with compiling, computing or growing the MSCI information makes any categorical or implied warranties or representations with appreciate to such information (or the effects to be acquired via the use thereof), and all such events hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or health for a specific function with appreciate to any of such information. With out restricting any of the foregoing, in no match shall MSCI, any of its associates or any 3rd birthday party thinking about or associated with compiling, computing or growing the knowledge have any legal responsibility for any direct, oblique, particular, punitive, consequential or another damages (together with misplaced income) although notified of the opportunity of such damages. No additional distribution or dissemination of the MSCI information is authorized with out MSCI’s categorical written consent. Additional distribution is unlawful.

Efficiency supply: Interior. Benchmark supply: Same old & Deficient’s.

Click on to amplify

Editor’s Observe: The abstract bullets for this text had been selected via In search of Alpha editors.

Editor’s Observe: This newsletter discusses a number of securities that don’t business on a significant U.S. trade. Please pay attention to the dangers related to those shares.