China pledged to retaliate in opposition to Donald Trump’s newest tariff risk and stepped up efforts to enhance the marketplace, elevating the chance of a protracted industry conflict between the arena’s two biggest economies.

“The U.S. risk to escalate price lists on China is a mistake on best of a mistake,” the Chinese language Ministry of Trade mentioned in a Tuesday remark. “If the U.S. insists by itself manner, China will struggle to the tip.”

The Chinese language reaction got here hours after Trump vowed to slap further 50% import taxes on China until it withdraws its tit-for-tat retaliation in opposition to his previous levies. The blunt response suggests Beijing intends to withstand the U.S. president’s power marketing campaign, dimming the chance of a deal within the quick time period.

“The rhetoric from China is powerful,” mentioned Michelle Lam, larger China economist at Societe Generale SA. “With out Trump backing down buyers might want to get ready for industry decoupling between each international locations.”

Chinese language government have signaled their resolution to enhance markets. The central financial institution has loosened its grip at the yuan to spice up the enchantment of its exports and a gaggle of state-linked finances referred to as the nationwide staff scooped up property. Officers additionally promised loans to lend a hand stabilize the marketplace and had been reported to have thought to be frontloading some stimulus.

The onshore yuan slid to the weakest stage since September 2023, whilst the offshore unit hit a two-month low Tuesday. The Grasp Seng China Enterprises Index jumped up to 3.7% after capping its worst loss for the reason that monetary disaster within the earlier consultation.

Trump’s newest fee would pile onto a 34% “reciprocal” responsibility set to kick in April 9, in addition to a 20% hike applied previous this yr, consistent with a White Area legit. That takes the cumulative tariff charge introduced this yr to 104%—successfully doubling the import value of any items shipped from China to the U.S.

The Chinese language Ministry of Trade also referred to as for discussion to unravel disputes in its remark, in spite of Trump’s caution that “all talks with China” a couple of assembly might be terminated if Beijing doesn’t take motion, with out specifying what could be required.

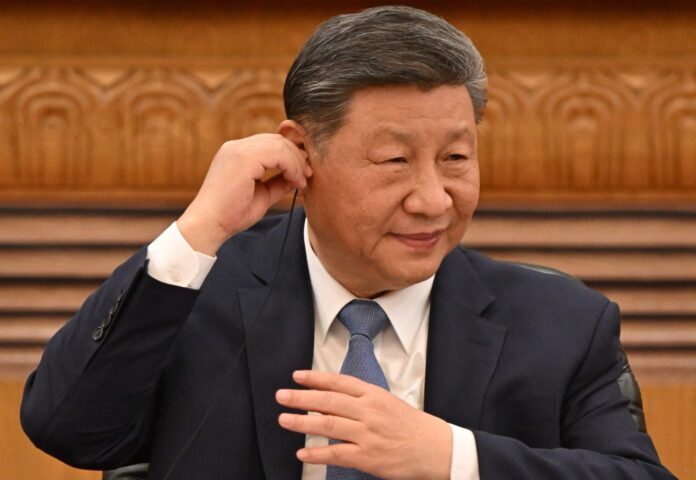

The escalation in tensions makes any approaching name between the 2 international leaders much less most probably. Trump hasn’t spoken with Chinese language President Xi Jinping since returning to the White Area, the longest a U.S. president has long gone with out chatting with his Chinese language counterpart post-inauguration in twenty years.

The Communist Celebration’s legit newspaper this week printed an article pointing out that Beijing is now not “clinging to illusions” of putting a deal. As a substitute, officers are that specialize in shielding the financial system. Xi has vowed to spice up home intake with price lists anticipated to harm exports, a sector liable for a 3rd of China’s financial enlargement ultimate yr.

Underscoring Beijing efforts to stem an equities rout, a basket of 8 exchange-traded finances liked through the so-called nationwide staff noticed report internet influx of 42 billion yuan ($5.7 billion) Monday.

A weaker yuan may just additionally offset the impact of upper price lists. The Chinese language central financial institution’s solving on Tuesday— previous the keenly-watched 7.20 in step with buck stage—indicators extra tolerance for depreciation. Bets on financial stimulus have supported call for for China bonds, as 10-year sovereign yield hovered with reference to a report low set in early February.

China will hit again at new U.S. price lists with similar measures as any contemporary U.S. levies will upload restricted ache to the Asian country, consistent with Ding Shuang, leader economist for Higher China & North Asia at Same old Chartered.

“The marginal impact of elevating price lists farther from the prevailing stage of about 65% will shrink,” he mentioned of extra U.S. price lists. “Maximum Chinese language exports to the U.S. have already been affected. For items that aren’t value delicate, price lists gained’t paintings regardless of how prime they cross.”

According to the most recent U.S. transfer, China’s embassy in Washington known as U.S. threats “no longer how you can have interaction” with China.

“The U.S. hegemonic transfer within the identify of reciprocity serves its egocentric pursuits on the expense of alternative international locations’ reputable pursuits and places ‘The usa first’ over world regulations,” embassy spokesman Liu Pengyu mentioned.

This tale was once in the beginning featured on Fortune.com