The final time Broadcom’s inventory dropped this a lot was once in 2020. Since then, it has risen over 800%.

It is commonplace when the inventory marketplace is going down, however it may be frightening when it occurs temporarily. Glance no additional than the previous couple of weeks. The Trump Management’s tariff announcement and ongoing posturing with different nations has despatched shares tumbling to a couple dramatic declines.

Broadcom (AVGO -2.19%) slid just about 40% off its late-2024 highs, its sharpest decline up to now 10 years out of doors the time the marketplace crashed on the onset of COVID-19 in early 2020. Now, the inventory has bounced off its fresh low. Will have to traders purchase Broadcom now?

Here’s what you want to grasp.

Purchasing Broadcom’s final dramatic decline labored out neatly

Historical past has proven that after the inventory marketplace panics, it has a tendency to be a just right purchasing alternative. The cause of panic has a tendency to switch, however traders are people with feelings, and from time to time, the pendulum can swing too some distance in a single path. Tariff fears could have brought about a panic this time, nevertheless it was once COVID-19 again in 2020.

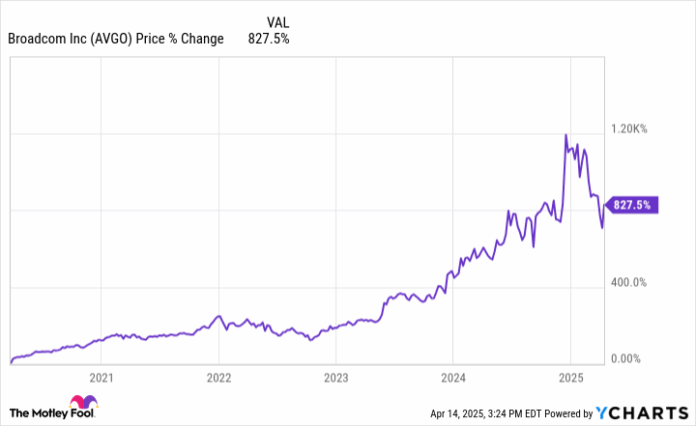

The inventory marketplace plummeted. Broadcom’s inventory payment fell virtually 50%. It isn’t a laugh purchasing shares in those moments. But, those that held their nostril and invested within the semiconductor and instrument massive made some huge cash. Broadcom has risen over 800% from March 2020 to lately:

AVGO knowledge by means of YCharts

It’s a must to understand that this is not the case with each inventory in a marketplace downturn. A endure marketplace can flush out low-quality corporations and motive everlasting losses for traders. Broadcom, an trade chief in semiconductors for networking and communications, is a superb trade and bounced again after the pandemic.

The corporate’s enlargement outlook has advanced with AI

Broadcom has thrived over the last decade, basically because of enlargement in its core semiconductor trade, which focuses on chips for networking and different communications packages. It then varied its trade with acquisitions, setting up infrastructure answers as about 40% of its trade. This section sells services like cybersecurity, instrument for undertaking mainframes, and personal cloud computing.

The coming of man-made intelligence (AI) has ignited enlargement within the semiconductor trade. AI fashions require immense computing energy to coach and serve as. Broadcom is carving out its proportion of this marketplace. It’s creating customized accelerator chips (XPUs) for a number of massive corporations making an investment in construction AI infrastructure, referred to as AI hyperscalers.

Control estimates that offers with 3 hyperscalers by myself will constitute a $60 billion to $90 billion earnings alternative in 2027. Broadcom’s AI-related chip earnings was once $12.2 billion in 2024, so figuring out anyplace close to that chance will force vital enlargement over the following a number of years. Analysts estimate the corporate will develop revenue by means of a median of just about 21% yearly over the following 3 to 5 years.

Will have to you purchase the inventory? Why Broadcom would possibly battle to copy historical past

Broadcom’s robust enlargement outlook and up to date decline would reputedly sign traders to shop for, however now not so speedy.

Keep in mind how I mentioned the pendulum can swing too some distance? Neatly, it took place once more, however within the different path. The marketplace has rallied exhausting on AI enthusiasm for the previous two years. As inventory valuations upward thrust, costs get started reflecting extra long term enlargement. Broadcom’s price-to-earnings (P/E) ratio has larger from 32 in March 2020 to 86 lately. The inventory payment larger over 800%, however revenue didn’t.

At a PEG ratio of four, Broadcom’s payment is just too top, even for a trade rising revenue by means of 21% yearly. I most often purchase fine quality shares at PEG ratios as much as 2 to two.5. As you move upper, the dangers build up that issues will move unsuitable. In all probability Broadcom would possibly not develop as speedy as was hoping, or the marketplace and inventory valuations will widely decline.

Broadcom continues to be a very good trade, however overpaying for shares, even nice corporations, in most cases backfires extra continuously than it really works out.