Hedge price range controlled through Invoice Ackman and Jeff Yass not too long ago purchased stocks of Nike inventory.

Portfolio managers Invoice Ackman and Jeff Yass proportion little or no in not unusual. Ackman is an activist investor who takes massive positions in a small cohort of shares. His fund, Pershing Sq. Capital Control, manages over $10 billion throughout simply 9 positions. By contrast, Yass is helping set up Susquehanna World Workforce (SIG) — a $57 billion fund with greater than 5,500 positions.

Whilst having a look thru the latest 13F filings for Pershing Sq. and SIG, I spotted one thing fascinating. Remaining quarter, Ackman’s fund initiated a brand new place in shoe and attire corporate Nike (NKE -1.15%). In the meantime, SIG — which already had a stake in Nike — larger its place within the inventory through 943%, purchasing just about 5.5 million stocks.

At the floor, those purchases glance questionable. Nike inventory has cratered through 27% up to now in 2024, making it some of the worst-performing firms within the Dow Jones Business Moderate.

Let’s dig into what is going on at Nike, and assess why Ackman and Yass could also be within the inventory. After an intensive research, buyers might come to look that Nike has the makings of an enchanting and probably profitable alternative at the moment.

What is going on with Nike?

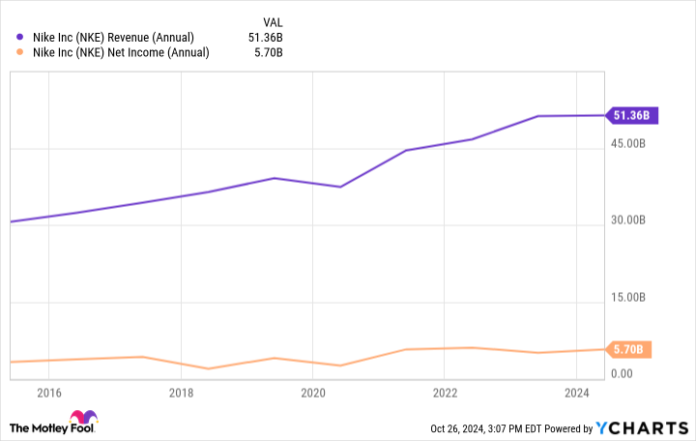

The chart under paints a horny fascinating image for Nike. Over the past decade, the corporate controlled to develop earnings and benefit significantly. On the other hand, in newer years, Nike’s gross sales and profitability have gone through a noticeable deceleration. Whilst buying groceries patterns amongst shopper discretionary items have surely been suffering from inflation and a high-interest-rate setting over the past couple of years, Nike’s issues are a lot more nuanced.

NKE Revenue (Annual) knowledge through YCharts.

Over the previous couple of years, Nike followed a brand new distribution technique through which it got rid of its merchandise from a number of brick-and-mortar retail shops and opted to double down on a digital-first way. In concept, this choice makes numerous sense. Via disposing of 3rd events from the equation and advertising and marketing at once to consumers thru its personal site and app, Nike was hoping to decrease its expense profile whilst producing extra margin amongst its consumers — thereby using extra environment friendly unit economics.

Sadly, this technique didn’t pan out as control had was hoping. In some way, Nike by accident allowed its emblem to turn out to be overshadowed through different shoe and attire makers after disposing of its merchandise from a number of primary retail vendors. This has brought about Nike to lose contact with customers, specifically more youthful demographics that experience proven some favorability towards different shoe firms reminiscent of Crocs, Birkenstock, On Keeping, and Allbirds.

Given the hiccups in Nike’s technique and the headwinds it is delivered to the corporate financially, I used to be now not shocked to look the corporate phase tactics with CEO John Donahoe remaining month.

Symbol supply: Getty Photographs.

A take a look at Nike’s valuation

For my part, valuing Nike inventory accurately is a specifically difficult workout. A brand new CEO coming in nearly surely method adjustments are coming — be it within the core industry, organizational construction, or advertising and marketing campaigns, I feel it is truthful to suppose that Nike goes thru a little bit of a turnaround these days. Most of these parameters make it onerous to correctly forecast Nike’s enlargement over the following couple of years, as I think most of the adjustments introduced through new control will take a little time to endure fruit.

NKE PE Ratio (Forward) knowledge through YCharts.

The chart above presentations tendencies in Nike’s ahead price-to-earnings (P/E) a couple of over the past 12 months. Whilst there were some pronounced ebbs and flows in Nike’s valuation, I might like to show that Nike’s present ahead P/E ratio is basically again to the place it used to be twelve months in the past.

May making an investment in Nike inventory now be a profitable transfer in the end?

Since Nike’s industry is at a crossroads and lots of query marks encompass the corporate’s long run, I in finding the rebound within the corporate’s valuation as proven above to be a bit convoluted. To me, it sort of feels that buyers are bullish at the CEO transition, however could also be pricing probably the most upside from Nike’s turnaround into the inventory already.

However, I do assume Ackman and Yass might be directly to one thing. In spite of its lackluster efficiency and emerging festival, Nike nonetheless stays one of the crucial identified and treasured manufacturers on the earth.

I feel Nike may just emerge as a winner in the end, and I’m cautiously constructive that its turnaround efforts might be well-executed. On the other hand, buyers must have abundant alternatives to spend money on Nike inventory at extra cheap valuations whilst the turnaround efforts take form. Because of this, I feel prudent buyers are tracking the inventory in the intervening time.

Adam Spatacco has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Nike. The Motley Idiot recommends Crocs and On Keeping. The Motley Idiot has a disclosure coverage.