Price lists will likely be the focal point, however Apple’s problems predate the surprising tariff announcement on April 2.

The surprising and sharp inventory marketplace sell-off following the Trump management’s tariff bulletins on April 2 is hitting the sector’s biggest era firms. Apple (AAPL -3.05%), Microsoft, Amazon, Alphabet (Google), Meta Platforms (Fb), Nvidia, and Tesla — a gaggle referred to as the “Magnificent Seven” shares — have plunged from their highs.

Of those seven tech giants, Apple has suffered the sharpest decline so far in accordance with the Trump price lists.

Is the inventory’s decline warranted? How may price lists affect Apple and its cherished iOS merchandise? Most significantly, will have to buyers purchase the dip or wait this out?

Here is what you want to grasp.

Apple faces vital tariff dangers

The Trump management’s introduced tariff plan, barring adjustments, could have far-reaching results at the global’s economic system and production panorama. President Donald Trump’s plan applies a ten% unilateral tariff on U.S. imports, which started on April 5. Moreover, the federal government will, beginning April 9, observe incremental “reciprocal price lists” on imports from international locations the management deems to have mistreated the USA in business.

The us imports excess of it exports, so those plans sign an enormous alternate to the rustic’s present business insurance policies and may build up costs for U.S. customers.

If the introduced reciprocal charges cross into impact, they are going to dramatically have an effect on Apple, whose provide chain is nearly fully out of doors the USA; its production happens in China, India, Japan, South Korea, Taiwan, and Vietnam. Listed here are the introduced reciprocal tariff charges for the ones international locations:

China: 34%

India: 26%

Japan: 24%

South Korea: 25%

Taiwan: 32%

Vietnam: 46%

Past that, Apple assets maximum of its {hardware} elements from overseas international locations as smartly. Because of price lists, an iPhone may value up to 43% extra. Apple will both need to devour some or all of the ones prices, or move them directly to U.S. customers, most likely hurting gross sales.

It does not assist that Apple was once already due for a drop

The price lists are a transparent downward catalyst for Apple inventory, however they are no longer the one one. There’s a sturdy argument that Apple has bungled its first crack at synthetic intelligence (AI) so far. It built-in AI options into Siri and iOS past due ultimate 12 months, dubbing them Apple Intelligence. Alternatively, that hasn’t ignited iPhone gross sales as was hoping, and the lukewarm reception led the corporate to shuffle its interior AI management.

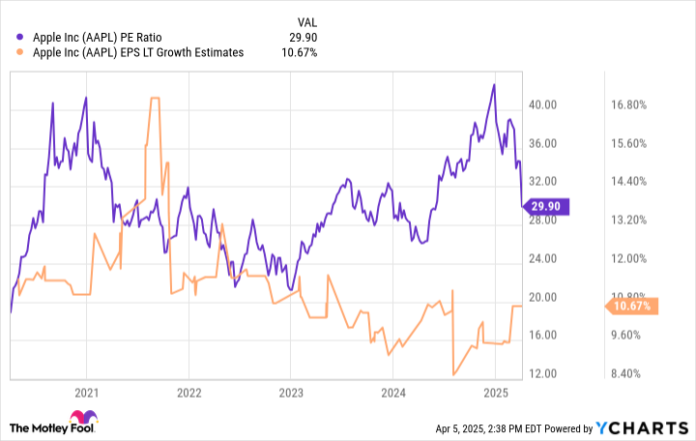

The placement does not precisely encourage self belief. Plus, Apple inventory entered the 12 months buying and selling at a price-to-earnings (P/E) ratio of greater than 40, even supposing analysts have been regularly decreasing their estimates of long-term revenue expansion since early 2022:

AAPL PE Ratio knowledge through YCharts.

Multibillionaire Warren Buffett, CEO of Berkshire Hathaway, spent many of the previous 12 months promoting down his corporate’s huge stake in Apple. It stays Berkshire’s biggest place, however Buffett, well-known for his eye for valuations, obviously noticed bother that lengthy preceded the hot tariff surprise.

Price lists had been the fit that ignited Apple’s decline, however the kindling was once dry, and a decline was once more than likely impending.

Is it time to imagine purchasing Apple?

Apple is extensively considered one of the most global’s maximum preeminent firms and is a welcome boost to any long-term portfolio. Sadly, it is more than likely method too quickly to shop for stocks at this time. The inventory nonetheless trades at 30 occasions revenue, and the corporate’s long run expansion may implode if price lists squeeze income or sink call for for brand new iPhones.

I feel Apple will determine one thing out right here. Simply weeks in the past, it introduced a plan to take a position $500 billion in the USA, which might assist it negotiate some aid from the introduced tariff charges.

Nonetheless, Apple is arguably too pricey for its lackluster expansion, and that is the reason earlier than factoring in any tariff affects. It’s possible you’ll need to reevaluate as soon as the tariff mud settles and the inventory trades at a P/E nearer to twenty, which might extra correctly replicate its expansion. Till then, Apple continues to be no longer able to chunk into.

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of marketplace construction and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Marketplace, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Justin Pope has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.