The sector is awash in inventory marketplace fever. Smartly, a minimum of a fever targeted on synthetic intelligence (AI), semiconductors, and cryptocurrency-related investments. In case your portfolio is keen on those classes, possibly it’s time to consider diversification.

Whilst making a bet on dangerous shares can appear simple in a bull marketplace, the ones dazzling returns can glance unsightly when the marketplace inevitably is going via a down cycle. The time is now — no longer later — to construct a strong portfolio that can cling up via all marketplace environments.

What inventory will have to an investor purchase for diversification? My guess is Philip Morris World (PM 2.48%). The worldwide nicotine large has a dividend yield above 4%, a blank stability sheet, and new segments that are supposed to lend a hand the corporate develop profits according to percentage (EPS) at a double-digit charge for future years. This is why the inventory is a smart purchase as the corporate tackles the transition from cigarettes and wins the marketplace for new nicotine-cessation merchandise.

Philip Morris: A one-time alternative to change from cigarettes

Philip Morris World owns many cigarette manufacturers, together with Marlboro, Chesterfield, and Parliment, and sells them in nearly each and every nation aside from China and the USA (Altria Team has the fitting to promote those manufacturers in the United States). With publicity to extra solid cigarette smoking markets, Philip Morris World is likely one of the few tobacco corporations going through drastic quantity declines for its legacy merchandise. In reality, its cigarette volumes grew 1.3% yr over yr remaining quarter.

In comparison to its American brethren, Altria Team, which had an 8.6% cigarette quantity decline remaining quarter, Philip Morris World’s legacy tobacco income will have to be sturdy and most likely develop within the future years because of worth will increase on packs of cigarettes. Then again, the corporate isn’t sitting tight.

Control has spent billions of greenbacks and made a big acquisition to take on the new-age nicotine marketplace, which is taking the class through typhoon. It has the main heat-not-burn instrument, IQOS, and owns Zyn, the dominant nicotine pouch emblem in the USA.

Those new merchandise don’t seem to be simplest much less damaging than conventional cigarettes from a well being standpoint however actually have a massive expansion runway forward of them. Remaining quarter, Philip Morris World’s smoke-free earnings grew 16.8% yr over yr at the again of quantity expansion from IQOS and Zyn. Smoke-free classes now account for 38% of the corporate’s general earnings and can turn into a rising piece of the pie for future years.

Unlocking nicotine pouch provide to boost up expansion

Philip Morris World’s earnings grew 11% yr over yr remaining quarter. What makes this quantity glance even higher is the availability scarcity of its well-liked Zyn nicotine pouches. With apparently insatiable buyer call for, Philip Morris has been not able to check provide with call for in the USA. Zyn volumes nonetheless grew aggressively remaining quarter, however its marketplace percentage fell from 75% to 65% because of the product being out of inventory at shops.

As soon as the Zyn scarcity ends — which control expects will happen in a while — this will have to result in an acceleration of Zyn’s quantity expansion and Philip Morris World’s topline earnings expansion. The combo of Zyn and IQOS quantity expansion has me assured that this corporate can develop earnings and profits at a double-digit charge for a few years into the longer term.

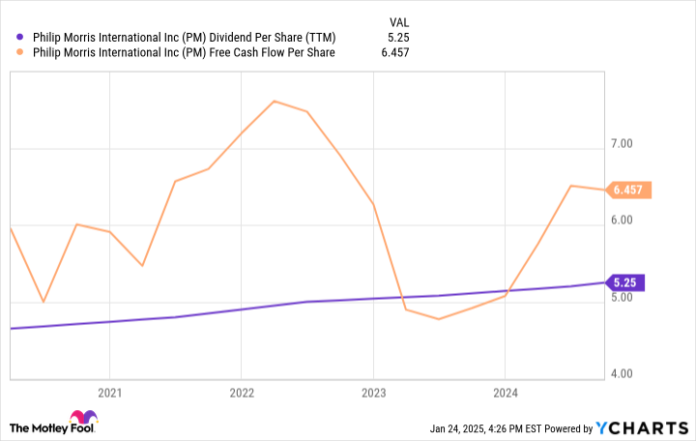

PM Dividend Per Share (TTM) knowledge through YCharts. TTM = trailing twelve months.

Stable dividend expansion and wealth appreciation

Philip Morris inventory has a dividend that these days yields round 4.2%. The corporate is investment those dividend payouts with income from legacy cigarettes and rising profits from Zyn and IQOS. Its dividend according to percentage is these days $5.25, which is sustainably funded with its $6.46 in unfastened money drift according to percentage.

Over the approaching years, I be expecting the corporate’s unfastened money drift according to percentage to stay mountaineering upper because of the abovementioned expansion elements. When this occurs, the corporate may have an increasing number of room to lift its dividend according to percentage, which is able to build up the source of revenue you earn from the funding every yr.

With a beginning dividend yield of four.2% and a dominant place in nicotine pouches and heat-not-burn units, I believe Philip Morris World is a rock-solid select all the way through this one-time transition from cigarettes to more secure nicotine merchandise. Purchase this inventory in your portfolio and not promote.

Brett Schafer has no place in any of the shares discussed. The Motley Idiot recommends Philip Morris World. The Motley Idiot has a disclosure coverage.