The S&P 500 has dropped 10% or extra 9 occasions since 2010, now not together with the present sell-off. Alternatively, the index has delivered a median go back of 18% within the yr following the beginning date of those corrections. In truth, the marketplace was once upper in 8 of the ultimate 9 circumstances.

Conserving those above-average returns in thoughts — and with many shares now buying and selling at newly reduced valuations — it looks as if an excellent time so as to add to shares. Listed below are 3 magnificent shares buying and selling at once-in-a-decade valuations that I would thankfully purchase presently.

1. Zoetis

Zoetis (ZTS 1.28%) is a number one animal healthcare corporate providing over 300 medications, vaccines, and different precision well being merchandise to maintain spouse animals and cattle globally.

Since its spin-off from Pfizer in 2013, Zoetis has delivered an annualized overall go back of 15%, demonstrating the market-beating attainable of what may seem like a steady-Eddie funding to start with look. Alternatively, after experiencing a pandemic-driven growth that noticed puppy adoptions and next vet sanatorium visits skyrocket, the corporate’s inventory has declined through 39% as issues normalized.

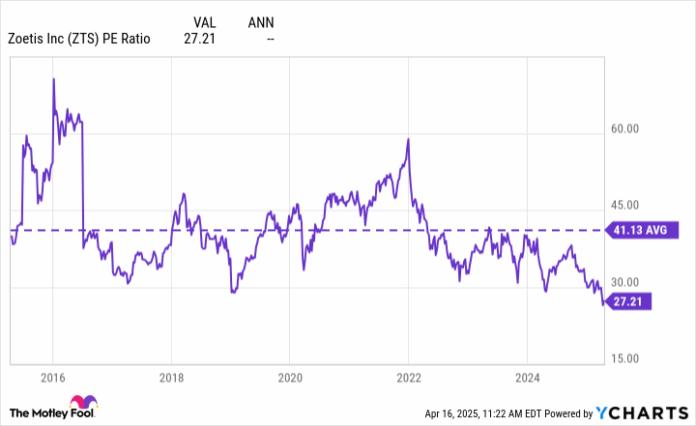

Following this decline, regardless that, Zoetis now trades at a price-to-earnings (P/E) ratio of 27 — its lowest mark in a decade.

ZTS PE Ratio information through YCharts. PE Ratio = price-to-earnings ratio.

Whilst the marketplace would possibly now be extra pessimistic towards Zoetis’s inventory than it has ever been, the corporate’s exact operations and outlook glance more potent than ever. Zoetis grew earnings and changed income in line with proportion through 11% and 17%, respectively, in 2024 and noticed explosive expansion in its latest expansion space: serving to osteoarthritis (OA) ache in canine and cats. Librela (for canine) and Solensia (for cats) grew gross sales through 80% and 20%, respectively, in 2024, as veterinarians proceed to select those merchandise for OA ache over conventional nonsteroidal anti inflammatory medicine that can have extra uncomfortable side effects.

With 40% of canine experiencing OA ache sooner or later of their lifestyles and cats and canine already residing two years longer than they had been as not too long ago as 2012, those medications may play a key function in protecting our growing older pals at ease.

One ultimate bit of excellent information for traders: Zoetis’s 1.2% dividend yield is at its highest-ever mark, and control has grown dividend bills through 18% during the last decade.

Secure expansion, promising expansion spaces, and a ballooning dividend at a decade-low valuation? I will thankfully stay including to certainly one of my most vital holdings.

2. Yeti

Yeti (YETI 3.42%) is an increasingly more common way of life emblem well-known for its top class out of doors merchandise and drinkware. Developing sturdy, top quality items, Yeti has advanced an immensely dependable buyer base of out of doors fanatics, whether or not they are surfers, fishermen, climbers, bull riders, or fish fry pit masters.

After the corporate’s inventory quintupled within the 3 years following its 2019 preliminary public providing, it seemed like Yeti will be the subsequent giant way of life emblem. Alternatively, Yeti’s inventory has plummeted 75% from its all-time highs following a significant recall of a few of its coolers in 2023 and the present tariff considerations with China.

Alternatively, whilst Yeti’s inventory has necessarily retraced to its place to begin in 2019, the corporate has greater than doubled its gross sales, internet source of revenue, and loose money glide (FCF) over that point.

Whilst the street to get right here was once bumpy, Yeti’s expansion possibilities nonetheless glance promising because it tries to develop in two key techniques: through advertising and marketing to adjoining verticals and increasing across the world. Increasing into new product classes, akin to cookware after obtaining Butter Pat, taking part with creators adjoining to its core out of doors area of interest, and sponsoring groups in Main League Football and Method 1, Yeti’s target audience succeed in grows through the day.

In the meantime, the corporate lately generates handiest 18% of its gross sales from out of doors the US, while a lot of its athletic emblem friends are nearer to 40% or 50%. Although this 18% determine is considerably upper than the two% in 2018, Yeti’s 30% world gross sales expansion in 2024 displays that the most efficient would possibly nonetheless be to come back.

Lately buying and selling at its lowest ever P/E ratio of 13, Yeti may end up to be a scouse borrow because it shifts its drinkware manufacturing out of China.

YETI PE Ratio information through YCharts. PE Ratio = price-to-earnings ratio.

YETI PE Ratio information through YCharts. PE Ratio = price-to-earnings ratio.

Set to make 80% of its drinkware merchandise out of doors the rustic through yr’s finish, traders should not view Yeti as broken items because of the price lists. As an alternative, it is likely one of the maximum loved manufacturers available in the market, with a cult-like following and a large $300 million internet money stability to be had to combat with.

3. Wingstop

Impulsively rising buffalo wing franchisor Wingstop (WING 0.35%) operates 2,154 places within the U.S. and 359 across the world. Whilst Wingstop delivered its twenty first consecutive yr of same-store gross sales (SSS) expansion and higher its shop depend, gross sales, and internet source of revenue through 16%, 36%, and 55%, respectively, in 2024, its inventory payment sits 49% underneath its 52-week highs.

Whilst this drop makes completely no sense to start with look, it’s a lot more affordable after we see that Wingstop traded above 150 occasions income at one level ultimate yr. Merely put, it was once priced for perfection and infrequently overlooked the mark with its most up-to-date effects. Now buying and selling at 59 occasions income — some distance underneath its common of 100 — Wingstop looks as if a once-in-a-decade alternative, for my part.

WING PE Ratio information through YCharts. PE Ratio = price-to-earnings ratio.

WING PE Ratio information through YCharts. PE Ratio = price-to-earnings ratio.

The primary explanation why I consider Wingstop will develop into this lofty valuation is that control expects to quadruple its shop depend over the longer term and has the observe document to again this perception. Whilst this expansion would possibly sound like a very formidable purpose, the corporate has a pipeline of over 2,000 eating place commitments beneath construction. This determine is the absolute best it’s been within the corporate’s historical past and just about equals its current shop depend.

This huge pipeline, paired with Wingstop’s lengthy historical past of SSS expansion, must lend a hand the corporate briefly outgrow this valuation.

And if Wingstop’s top class ticket has you cautious of an funding, believe that it has averaged a P/E ratio of 100 throughout its publicly traded historical past, but it has turn out to be a 10-bagger over that point.