Warren Buffett is frequently thought to be the best investor of all time. His perspectives in this subject (and similar ones) lift important weight on Wall Boulevard, with traders and analysts alike frequently putting on his each and every phrase right through Berkshire Hathaway’s (NYSE: BRK.A) (NYSE: BRK.B) mythical annual conferences.

In the newest installment of this much-anticipated tournament, the Oracle of Omaha stated certain issues about Tim Cook dinner, the CEO of Apple (AAPL 0.49%), an organization whose stocks his conglomerate has owned for some time. Let’s have a look at what Buffett needed to say and what it method for traders.

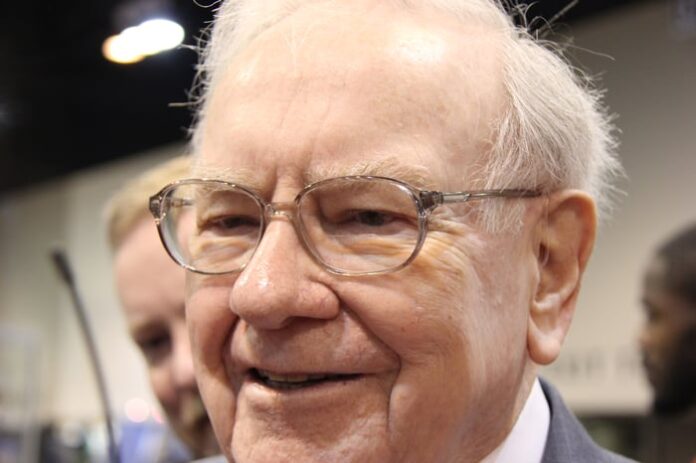

Symbol supply: The Motley Idiot.

Apple has been an ideal funding for Buffett

Berkshire Hathaway first bought Apple stocks within the first quarter of 2016. On the time, the tech corporate used to be flying excessive, nonetheless driving the wave of its a success try to revolutionize the smartphone business. Buffett and his group obviously did not suppose it used to be too past due to get in at the act, despite the fact that, and their choice to invest in Apple paid wealthy dividends, actually and figuratively. Since early 2016, Apple’s inventory has delivered market-crushing returns.

AAPL Total Return Level information through YCharts.

That brings us to what Buffett lately stated about Tim Cook dinner, who has been the CEO of Apple since 2011. To cite the person himself:

Tim Cook dinner has made Berkshire much more cash than I have ever made [for] Berkshire Hathaway.

Now, let’s understand that Warren Buffett has been on the helm of his corporate for the reason that 60s, and in that point, the industry has carried out exceptionally smartly. Is that this commentary about Tim Cook dinner intended to be taken actually? Possibly no longer, however the factor to notice this is that Buffett, a very good CEO in his personal proper, thinks very extremely of Tim Cook dinner.

This is one thing else the Oracle of Omaha stated some years in the past concerning the tech corporate. He referred to as Apple “most certainly” the most efficient industry on the earth. This is why those feedback will have to topic to traders, particularly at the moment.

Apple can triumph over its present stumbling blocks

Apple has confronted a barrage of headwinds. Listed below are 3 of them. First, the corporate’s gross sales enlargement has slowed significantly for the reason that iPhone now not generates the thrill it as soon as did. 2nd, Apple has been the objective of antitrust court cases because of alleged anticompetitive practices. 3rd, the tech chief will really feel the impact of Trump’s price lists greater than maximum different corporations because it does important production in China.

The query for long-term traders is whether or not Apple can triumph over those demanding situations and nonetheless ship sturdy performances in the end. This is the relationship with Buffett’s fresh feedback: One of the most perfect predictors of an organization’s luck is the group main it. And obviously, Apple has superb stewardship. Since Tim Cook dinner turned into the CEO, the corporate has carried out extremely smartly. That does not ensure it could possibly proceed doing so. So much has modified since 2011.

However something hasn’t. Tim Cook dinner continues to be CEO. A pace-setter of this caliber can to find tactics to navigate the problems the corporate has encountered. And when taking a look on the industry, we will see indicators of a brilliant long run. For one, Apple stays a surprisingly widespread corporate with arguably the arena’s most precious emblem title. The corporate’s emblem permits it a point of pricing energy, even with stiff pageant throughout all instrument classes, just because shoppers, a minimum of a lot of them, need to personal probably the most tech large’s units and are prepared to pay a top rate for it.

Apple’s put in base of greater than 2.35 billion units lately reached all-time highs throughout all classes and geographical areas. Additional, the corporate’s services and products phase continues to make development. This high-margin unit has grown quicker than the remainder of Apple’s industry lately and boasts over one billion paid subscriptions. Apple’s massive put in base will permit it to create extra monetization schemes.

Finally, Apple generates important quantities of money. Its trailing-12-month unfastened money glide is $98.5 billion. The corporate has the monetary method to conform to converting financial scenarios. It lately introduced a $500 billion U.S. funding initiative, partially to shore up its native production capability, which is able to assist mitigate the have an effect on of price lists.

Apple would possibly not triumph over all its problems in a single day, however because of the sturdy industry it has already constructed and with a very good chief on the helm, the inventory nonetheless appears sexy to long-term traders.