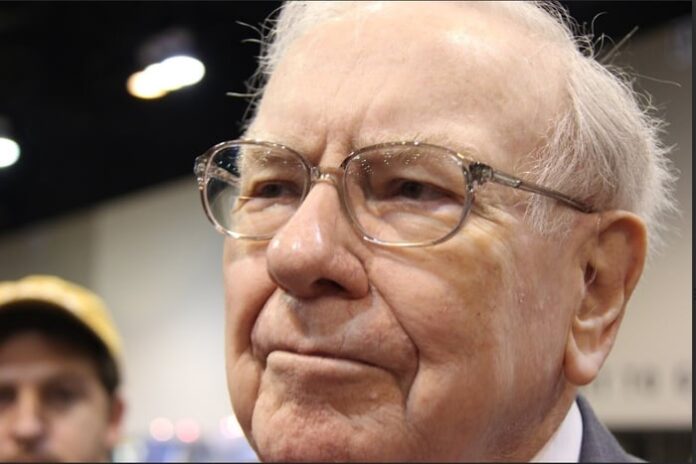

I may not lie. It used to be an emotional revel in to listen to that Warren Buffett plans to step down as CEO of Berkshire Hathaway. It really marks the tip of an generation.

The person has been rocking the inventory marketplace for a long time. In line with a work via CNN, Buffett created returns of five,500,000% throughout his funding occupation. Given all that point and revel in, there may be some funding knowledge lets all stand to be told from the Oracle of Omaha. Listed here are 5 items of his recommendation.

Symbol supply: The Motley Idiot.

1. Put money into The usa

In a New York Occasions op-ed, Buffett wrote about making an investment in The usa. While you have a look at Berkshire’s holdings, the majority of its shares (as a share of general capital in play) are American corporations. In spite of probably the most present woes over business wars and prime costs on shoppers, The usa stays the biggest financial system on this planet, and arguably probably the most leading edge. The place higher to speculate your bucks?

2. “A easy rule dictates my purchasing: Be worried when others are grasping, and be grasping when others are worried.”

This quote is amazingly significant, and makes best possible sense. Everybody needs that crystal ball telling them when to visit money, and when to be closely interested by shares. In some ways, it comes all the way down to seeing when the marketplace is getting forward of itself from a valuation viewpoint.

That, after all, is an oversimplification of an overly advanced dynamic. Then again, whilst you watch Buffett, a few of his greatest strikes have took place when he swoops in when issues are unhealthy. He purchased up shares within the 2008 monetary disaster, and is lately sitting on an enormous pile of money of just about $350 billion, indicating that the corporate is ready possibly for an tournament at some point.

3. Purchase superb corporations at truthful costs

He has in large part attributed it to studying from longtime spouse Charlie Munger, however Buffett advocates purchasing “superb corporations at truthful costs, relatively than truthful corporations at superb costs.” Every now and then, it is simple to get stuck up in a inventory this is buying and selling under ebook worth, however you even have to invite your self why is it buying and selling under ebook worth.

Buffett made an enormous wager on Apple that paid off handsomely, however it wasn’t essentially the most affordable inventory. He noticed the price within the energy of its logo, and what it used to be doing with the software of an iPhone.

4. Recall to mind shares as companies

I have in mind looking at Buffett on CNBC talking to the purpose that traders could be a lot in the event that they considered shares as companies, relatively than only a proportion worth. This could be his maximum necessary level in his discussions of the inventory marketplace.

Oftentimes, that is very true for investors. It is simple to get stuck up in the cost motion of an funding. Walmart is going down 10%, so we purchase. Walmart is going up 10%, so we promote. However why is the inventory shifting?

What we will have to be doing is learning what the industry itself is doing, and deciding whether or not it’ll continue to grow and generating income over the years. We will have to be having a look at what trade a industry is in, and whether or not that trade stands to develop. Value volatility will all the time be there. It is what the industry is doing that determines long-term traits on the finish of the day.

5. To that finish, play the lengthy sport

A tangent to this easy technique is that you just will have to most effective make investments cash that you just do not want, and will sit down on for some time. Buffett is infamous for containing shares for lengthy classes of time. He is owned Coca-Cola for many years.

The principle argument for long-term making an investment is that it will provide you with a a lot better image of ways the percentage worth goes to accomplish. Just right shares upward push via time, although they’re erratic brief time period. Seeking to gauge what a inventory will do in two weeks, and even a couple of months, can grow to be a idiot’s errand in no time. One unhealthy quarter can induce volatility. Should you consider in Buffett’s teachings, a just right investor does not get emotional about momentary strikes.

Having a look forward, we will be able to most effective hope that Greg Abel, Buffett’s introduced successor as CEO, will have the ability to put all this knowledge to just right use.

David Butler has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Apple, Berkshire Hathaway, and Walmart. The Motley Idiot has a disclosure coverage.