Lifestyles comes at us speedy. All of us have milestone occasions we need to pay for and targets we need to achieve. For many of us, retirement is an purpose they’re at all times chipping away at. Others could also be laser-focused on saving to shop for a house, tucking away cash for holiday or padding their children’ school price range. For some, it’s merely rising wealth to reach monetary freedom. And possibly you’re juggling all the above abruptly.

Fortuitously, there’s an app for that.

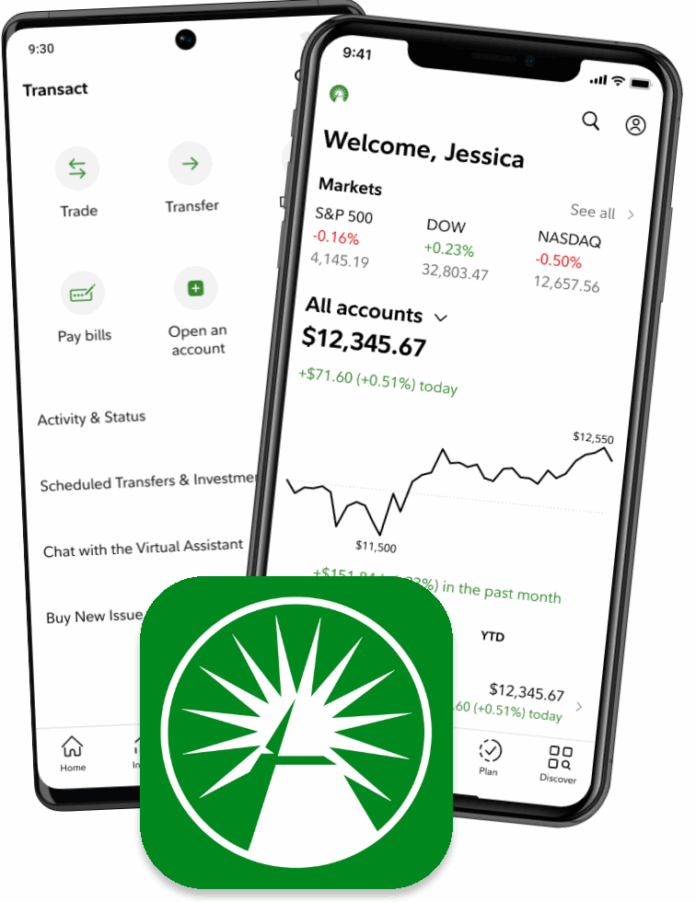

The Fidelity mobile app is a number one finance app and a complete funding platform. The tough but easy-to-use interface lets in customers to construct and observe their funding portfolio and industry shares, mutual price range and ETFs (exchange-traded price range) with the assistance of analysis and marketplace research equipment. Then again, the app dips even additional into non-public finance with its money control, monetary target surroundings and money-saving features.

On this article, we’ll dive deeper into the lengthy checklist of options and advantages the Constancy cellular app supplies to a wide variety of buyers, together with its integrated safety and academic components. Plus, we’ll have a look at how Constancy compares to different funding platforms like Robinhood or E*TRADE.

Screenshot of Constancy.com/cellular/assessment

Key Options of the Constancy Cell App

Constancy permits you to purchase, promote, industry, organize and save all below one roof. You’ll make investments at the cross with robust buying and selling equipment and faucet into assets that assist you to make smarter selections along with your cash. And that’s just the beginning of it. Listed here are the core options introduced by means of the Constancy finance app:

Funding Options

The app has quite a lot of wealth-building options:

Funding control: Construct and organize your funding portfolio. The app permits you to purchase, promote and industry shares, mutual price range, ETFs and choices. Maximum U.S. shares and ETFs are traded commission-free and you’ll put money into fractional stocks for as low as $1. From there, you’ll observe your portfolio efficiency, together with positive aspects and losses. You’ll additionally arrange routine investments, switch cash and use industry-leading marketplace research equipment to industry smarter.

Mutual price range and ETF buying and selling: Buying and selling mutual price range, shares and ETFs is straightforward with Constancy. Industry tickets simplify the method and real-time quotes permit for immediate worth assessments. The ETF Screener is helping you examine ETFs in keeping with your funding targets, and basket portfolios assist you to organize quite a lot of shares and ETFs as one funding.

Inventory marketplace capability: Constancy additionally purposes as an all-in-one inventory marketplace app. The platform’s algorithms proactively scan for inventory costs and anomalies out there. You’ll obtain funding information and marketplace indicators for temporary and long-term alternatives. You’ll additionally create customized watchlists to trace and observe positive securities.

Screenshot of Constancy cellular app

Different Monetary Gear

Further monetary equipment assist you to organize your cash neatly:

Constancy Move: Fidelity Go units you up with a robo-adviser that mechanically rebalances your portfolio in keeping with your targets and chance tolerance for a extra hands-off making an investment enjoy. There is not any advisory commission for balances below $25,000 and a zero.35% advisory commission for balances of $25,000 or extra. Customers over $25,000 even have get entry to to limitless one-on-one monetary training calls.

Private finance equipment: Goal-setting modules assist you to paintings towards goals together with retirement, house purchasing, holidays, schooling or beginning a trade. 401(okay)s, IRAs, HSAs and 529 plans may also be controlled via Constancy and monetary calculators assist you to estimate long run wishes whilst optimizing your contributions.

Cash-saving options: Constancy additionally works as a money-saving app. Budgeting worksheets, spend monitoring and debt control, together with bank card guidelines and mortgage evaluate, assist you to see the place your cash goes and the place there are alternatives to reduce. The app additionally helps money control being able to deposit assessments, pay expenses and automate transfers and investments.

Screenshot of Constancy cellular app

Advantages of the Constancy App

There’s greater than what meets the attention in relation to the Constancy app. Its core funding control and monetary features are what deliver other folks to the platform. Nevertheless it additionally has further advantages that make it stand out to customers.

Sensible, Easy and Customized Options

Advantages of the app come with options that make it smooth to make use of and adapted to each and every person:

Complete funding choices: A complete suite of funding choices is to be had together with shares, ETFs, mutual price range, choices, fractional stocks and even cryptocurrencies like Bitcoin or Ethereum to enhance all funding methods.

Consumer-friendly interface: The app’s design is intuitive and blank in order that newbies and seasoned buyers alike can navigate and entire duties with out feeling beaten. The primary dashboard provides an simply digestible snapshot of marketplace process, portfolio efficiency and accounts. Industry processes are streamlined for minimum faucets, analysis equipment are smooth to search out and suggestions and tutorials pop up right through the platform.

Customizable enjoy: You’ll select between two navigation choices to fit your making an investment wishes. Along with “House,” “Transact” and “Uncover,” the usual navigation choice provides “Making an investment” and “Making plans” buttons to the ground app navigation. The vintage navigation, however, makes a speciality of “Markets” and “Watchlists.” You’ll additionally choose between more than one structure choices when viewing your accounts.

Screenshot of Constancy cellular app

Actual-time marketplace knowledge: The inventory marketplace is continuously converting, this means that real-time knowledge is very important in an effort to make knowledgeable selections, capitalize on alternatives and decrease chance. With real-time quotes, real-time analytics and marketplace indicators, the Constancy app is designed that can assist you do exactly that.

Rewards and Improve

As well as, the app additionally has rewards methods and robust enhance for purchasers:

Rewards program: Connected to the no-annual-fee Constancy Rewards Visa Signature card, the Fidelity Rewards program lets in customers to earn issues for on a regular basis purchases. Issues may also be mechanically redeemed for a deposit into certainly one of your eligible Constancy accounts (HSA, IRA, and so forth.) or for such things as trip and present playing cards.

Monetary making plans enhance: With investments, cash accounts and financial savings accounts multi function position, customers could make smarter cash strikes. Knowledgeable assets and recommendation assist them higher perceive what to prioritize, observe their overall web value and align investments with long-term targets.

24/7 buyer enhance: The Constancy app comes with 24/7 get entry to to a digital assistant that may assist to control requests and resolution questions. For extra specialised enhance, reside chat with the group may be to be had Monday to Friday from 8 a.m.–10 p.m. (EST) and Saturday and Sunday from 9 a.m.–4 p.m. (EST).

Screenshot of Constancy cellular app

Safety and Privateness At the Constancy App

Some of the vital questions you will have is, “Is it protected to make use of the Constancy app?” or “Is Constancy protected to place cash in?”

Constancy takes multiple steps and precautions to offer protection to your cash and private knowledge. The next security measures are all constructed into the app:

Multi-factor authentication when logging in or making vital adjustments.

Biometric choices akin to Face ID or Contact ID also are to be had instead of passwords.

Financial institution-grade end-to-end encryption with SSL/TLS protocols secures delicate knowledge.

Fraud coverage algorithms scan for suspicious process and Constancy would possibly ask for verification for bizarre transactions.

Account restoration calls for a multi-step procedure that comes to e mail, telephone quantity and safety inquiries to log again in.

SIPC insurance coverage protects your property, and FDIC insurance coverage may be supplied for money balances to your Constancy Money Control account.

The Fidelity Customer Protection Guarantee guarantees that the corporate will reimburse you for any monetary losses that consequence from unauthorized process to your accounts.

The Constancy privateness coverage additional emphasizes the corporate’s dedication to protective person knowledge. It outlines precisely what non-public and monetary knowledge is accumulated and the way it’s used. It additionally mentions the community safety features in position, together with firewalls, intrusion detection methods, proxy servers and complex anti-malware.

Particular person customers would possibly take further steps to offer protection to their accounts from unauthorized get entry to. You’ll set indicators for any more or less account process, from logins to transactions. Customers can deny the app permission to their location, footage, contacts, and so forth., and in addition replace their knowledge sharing personal tastes to choose out of sharing knowledge with 3rd events. Disguise vital account knowledge at the app’s major dashboard for additonal safety. Accounts may also be locked in an instant to forestall withdrawals.

The Constancy app may be a monetary content material library. It’s no longer only a position to retailer your price range however a spot the place you’ll learn to make that cash be just right for you. The app is full of assets and monetary equipment like those indexed beneath which are designed to lead you to your monetary adventure.

Tutorial content material: There’s a whole “Uncover” phase within the Constancy app stocked with articles, movies, webinars and tutorials on making an investment methods and private finance guidelines. Right here, you are going to additionally in finding marketplace information and traits, shares to look at and personalised funding ideas.

Interactive equipment: Constancy’s interactive equipment do the arduous be just right for you. The monetary target planner software and retirement calculator assist you to type other eventualities and estimate how much cash it is important to save to your targets in keeping with quite a lot of standards. Funding screeners and the chance profiling software assist you to to filter out inventory choices and get personalised funding suggestions. You’ll even benefit from the tax making plans software to estimate the tax implications of movements like promoting securities or retreating price range.

Finding out for newbies: For brand new buyers, Constancy supplies a wealth of tutorial content material targeting monetary and making an investment fundamentals. Those assets destroy down several types of securities, portfolio diversification and different advanced monetary ideas so newbies could make extra knowledgeable selections from the get-go. Beginner customers may additionally make a choice to choose into Constancy Move so they may be able to ease into making an investment with somewhat little bit of enhance.

Comparability With Different Finance Apps

The Constancy cellular app joins a lot of different programs available in the market constructed for making an investment and your different monetary wishes. Constancy was once named the best overall app for investing and stock trading by NerdWallet in 2025. However, see for your self how the platform compares to different large names within the house like Robinhood, E*TRADE and Forefront.

FidelityRobinhoodE*TRADEVanguardInitial CostsFree obtain, no account minimal, possible charges for Constancy Move.Loose obtain, no account minimal, per 30 days charges just for Robinhood Gold.Loose obtain, no account minimal, no repairs charges.Loose obtain, some mutual price range and ETFs require account minimums, annual charges for some accounts.Fee Charges$0 for many U.S. inventory, ETF and choices buying and selling.$0 for U.S. inventory, ETF and choices buying and selling.$0 for U.S. inventory, ETF and choices buying and selling.$0 for U.S. inventory and ETF buying and selling. $1 according to contract for choices buying and selling.Funding SecuritiesStocks, ETFs, mutual price range, choices, fractional stocks, bonds, CDs, cryptocurrencies.Shares, choices, ETFs and cryptocurrency. No mutual price range or person bonds.Shares, ETFs, mutual price range, choices, futures, bonds, CDs, cryptocurrencies.Shares, ETFs, mutual price range, choices, bonds, CDs.Funding FeaturesReal-time quotes, marketplace indicators, inline suggestions, Constancy Move.24/5 buying and selling, real-time marketplace costs, much less tough buying and selling and analysis equipment. Complicated and interactive buying and selling equipment, real-time marketplace knowledge, In the back of the Transfer inventory worth motion function. No real-time knowledge streaming, no worth indicators, no longer supplied for advanced trades. Different Monetary FeaturesEducational content material, money control, budgeting, rewards program and goal-setting equipment. HSA, 529, IRA, and 401(okay) plans. Novice instructional content material, Money Card and 1% fit IRA accounts. Does no longer come with money control, budgeting or making plans equipment. Tutorial content material, money control, IRA and 401(okay) accounts. Does no longer come with budgeting or making plans equipment.Tutorial content material, money control, IRA, 401(okay), and 529 plans. Does no longer come with in-app budgeting or making plans equipment. SecurityMulti-factor authentication, biometrics, encryption, FDIC and SIPC insurance coverage.Two-factor authentication, biometrics, encryption, FDIC and SIPC insurance coverage.Two-factor authentication, biometrics, encryption, FDIC and SIPC insurance coverage.Multi-factor authentication, biometrics, encryption, FDIC and SIPC insurance coverage.Buyer Service24/7 chat enhance, reside chat telephone enhance to be had.24/7 chat enhance, telephone enhance to be had.Chat and contact enhance to be had.No chat enhance, restricted telephone enhance.RatingsApple: 4.8Google Play: 4.6Apple: 4.3Google Play: 4.2Apple: 4.7 Google Play: 4.7Apple: 4.7Google Play: 3.4

Examine and Imagine What’s Proper for You

Whilst all 4 funding apps are similar in some spaces, they each and every have their very own distinctive variations. The Forefront app is handy for monitoring funding efficiency and making easy trades, however its restricted marketplace knowledge, enhance and total features obstruct it. The Robinhood app is beginner-friendly, however, like Forefront, its analysis equipment are restricted. With complex marketplace analytics and real-time insights, E*TRADE is a smart choice for extra lively buyers. Then again, it doesn’t be offering the non-public finance and making plans options that some customers would possibly need.

Constancy supplies all the above, matching E*TRADE when it comes to funding choices and marketplace knowledge and in addition coming to the desk with a complete suite of money control and monetary making plans equipment. Buyer enhance and safety also are a best precedence for the applying and lines like Constancy Move and Constancy Rewards make it a robust all-around select.

Who Is Constancy For?

One of the crucial absolute best issues concerning the Constancy app is that it caters to a wide variety of buyers. Whether or not you’re utterly new to the arena of bears and bulls otherwise you’re a practiced dealer, there are equipment to be had to fulfill your wishes. The app is at all times loose to obtain and there aren’t any account minimums for any investor to open a retail brokerage account.

Novice buyers: Without a account minimums, a lot of beginner-friendly assets and an easy platform, the Constancy funding app is a great choice for the ones other folks simply getting their toes rainy.

Skilled buyers: Buyers with some enjoy below their belts can benefit from complex marketplace analysis equipment like scanners and real-time insights and diversify their portfolio with a variety of funding sorts in a single position.

Lengthy-term savers: The retirement calculator and goal-setting equipment make it smooth for long-term savers to devise for the longer term, arrange emergency price range and a lot more. They are able to arrange automated bills, in finding tactics to save cash, observe account efficiency or even put money into cheap mutual price range and ETFs, which are perfect for long-term making an investment.

Energetic buyers: Those that need to be closely concerned within the buying and selling procedure will admire real-time quotes and will use the Constancy app to trace inventory traits. Watchlists and customized indicators may even stay them up-to-the-minute on main shifts or related information, even if they’re no longer actively the usage of the platform.

Constancy consumers: The cellular app is a to hand extension of Constancy’s different current products and services. Established consumers can seamlessly combine their different Constancy merchandise like Constancy Money Control, so they may be able to get entry to all their accounts and make funding strikes at the cross.

Constancy: A Tough Making an investment and Finance App

The Constancy cellular app’s 4.8 megastar score within the Apple App Retailer and four.6 megastar score in Google Play discuss for themselves, and it’s transparent why buyers believe the platform. The all-in-one finance and inventory marketplace app gives a unbroken mix of funding control, money control and monetary making plans equipment that cater to newbies and skilled buyers alike. Its real-time marketplace knowledge, probably the greatest security measures, easy-to-use interface and academic assets additional solidify its worth.

Whether or not you’re having a look to leap into the inventory buying and selling recreation for the primary time, plan for retirement or simply save for the longer term, the Constancy app can give you the monetary equipment you wish to have to prevail. And with a low barrier to access and no account minimums, it’s worthwhile to get started nowadays.

Photograph by means of Delmaine Donson/iStock.com