Richard Drury

Via Aye Soe

At a Look

As geopolitical tensions, shifts in commerce insurance policies and inflationary pressures stay increased, buyers would possibly flip to less-correlated markets Selection asset categories like commodities and cryptocurrencies may just play a larger function in buyers’ portfolios

In 2025, portfolio diversification is changing into a key technique for managing chance. As buyers glance to derisk the burden of U.S. equities, 4 key spaces of hobby have emerged.

1. Diversification Inside of U.S. Equities

U.S. equities set document highs ultimate 12 months, and the burden of U.S. equities as a proportion of worldwide fairness comprised just about 67% through the top of 2024, up from 62.57% in 2023, in step with the MSCI All Nation Global Index (ACWI). Inside of U.S. equities, the blended weight of Apple, Nvidia, Microsoft, Amazon and Alphabet within the S&P 500 reached just about 29% on December 31, 2024.

The dominance of U.S. equities blended with the heavy concentration in the top five names is a reminder for buyers to proactively organize focus chance and diversify throughout the fairness asset elegance itself.

All the way through marketplace selloffs led through mega-cap names, the S&P 500 Equivalent Weight Index has a tendency to say no lower than the cap-weighted S&P 500. For example of its skill to scale back chance, on January 27, 2025 the S&P 500 declined -1.46% on a value go back foundation, led through Nvidia, when buyers discovered of the Chinese language AI corporate, DeepSeek. The S&P 500 Equivalent Weight Index posted +0.02% at the identical day.

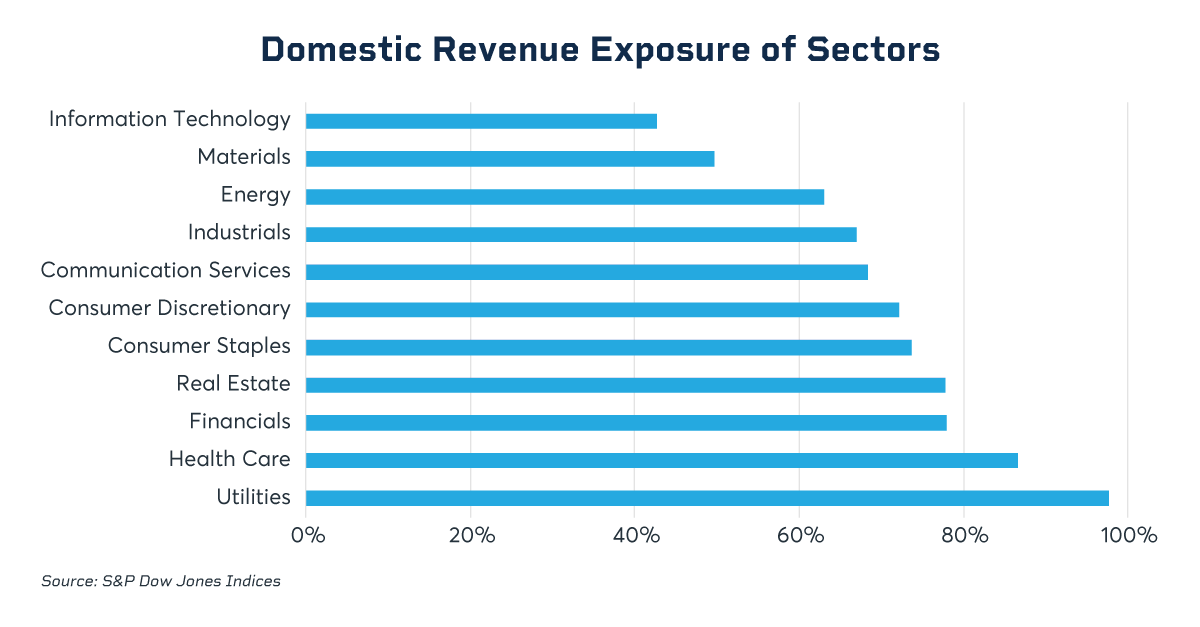

Efficiency too can range through sector. One solution to assess the possible implications of commerce coverage adjustments, as an example, can be to decide the proportion of overseas and home income won through firms in every World Trade Classification Same old (GICS) sector. An S&P World learn about presentations that sectors similar to financials, utilities, well being care and actual property have the perfect proportion of home income whilst sectors similar to industrials, power, fabrics and data generation have a better proportion of overseas income.

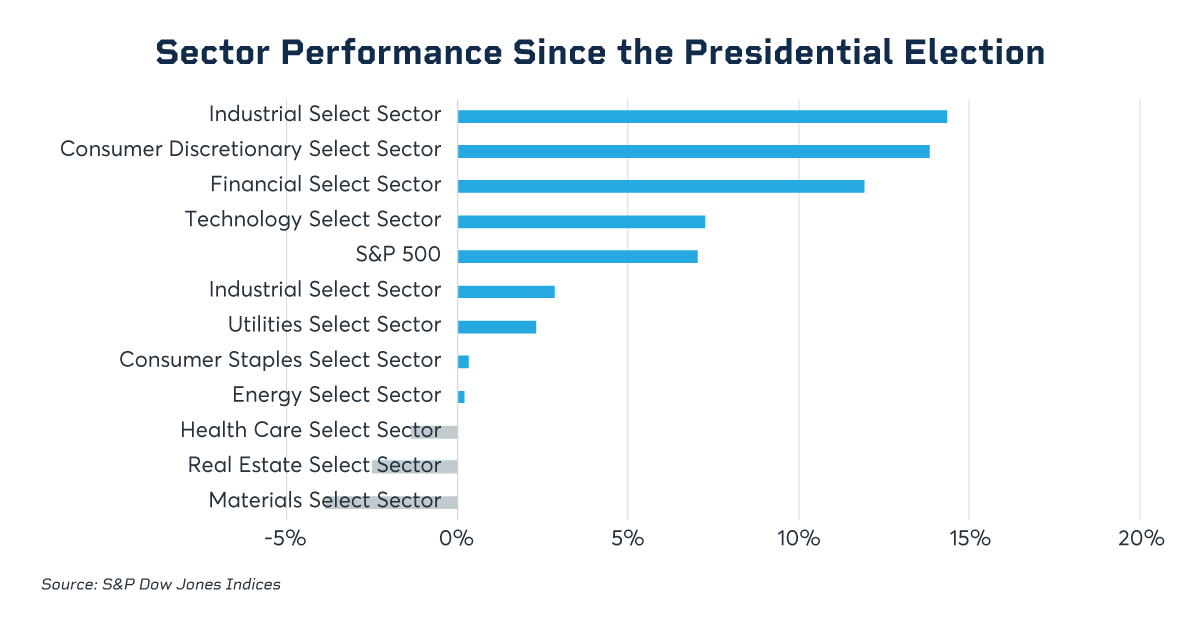

Sector efficiency for the reason that presidential election has been combined, with a large dispersion of returns seen a number of the sectors. Industrials, shopper discretionary and financials posted double-digit features whilst fabrics, well being care and actual property are within the adverse. The extensive dispersion of returns would possibly proceed for the rest of 2025 because the marketplace digests evolving commerce insurance policies and their doable have an effect on.

As trade-related occasions proceed to spread, Sector futures and options will also be necessary equipment throughout the U.S. fairness area to make tactical changes in addition to medium time period repositioning.

2. Diversification with Much less-Correlated Markets

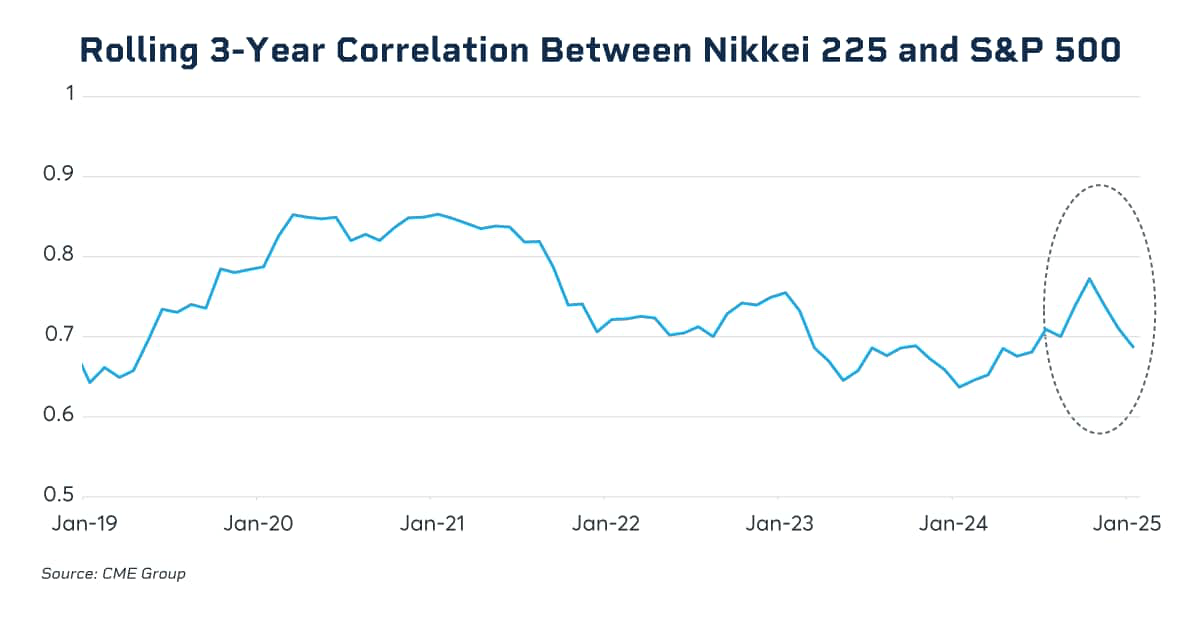

Traders are an increasing number of having a look to global fairness markets to diversify their U.S. fairness holdings. Eastern equities, specifically, are gaining extra consideration. The Nikkei 225 Index, measured in native forex yen, posted vital features in 2023 (28.24%) and 2024 (19.22%) because of an financial rebound and the go back of inflation. Moreover, the correlation between U.S. and Eastern equities has been lowering in fresh months.

3. Vast Publicity by means of Commodity Indices

2024 used to be one of the most turning issues for commodities, as each the S&P GSCI and Bloomberg Commodity Index (BCOM) posted certain returns. Commodity markets could continue to be active throughout 2025 as the consequences of geopolitical tensions, shifts in commerce insurance policies and inflationary pressures stay increased.

Commodity Indices – 2024 Returns

Spot Go back

General Go back

Extra Go back

S&P GSCI

2.61%

9.25%

3.79%

Bloomberg Commodity Index (BCOM)

6.27%

5.38%

0.12%

Click on to magnify Supply: Bloomberg, S&P Dow Jones Indices. Knowledge as of 12/31/2024. Returns in USD.

Click on to magnify

In the case of commodities despite the fact that, index selection issues. As an example the S&P GSCI is manufacturing weighted and does now not practice sector weight constraints. Because of this, the index tilts closely towards power. The BCOM index, on the other hand, is a mixture of manufacturing and liquidity weighting whilst keeping up equivalent weight throughout sectors. Because of this, the 2 indices could have other chance/go back profiles relying on which commodity sectors are riding the efficiency.

Adoption of the CME Group commodity complex, which contains S&P GSCI and BCOM futures, has greater considerably since 2020, with open hobby (OI) rising from just about $900M to just about $6B in notional foundation as of January 31, 2025.

4. Enlargement and Innovation in Crypto

Ultimate 12 months noticed many new trends within the cryptocurrency ecosystem, together with the release of spot bitcoin ETFs and bitcoin hitting $100,000 for the primary time. With the brand new management would possibly come new frameworks and rules round cryptocurrencies in 2025 and beyond, which might encourage additional innovation and expansion on this area.

By contrast background of doable regulatory exchange, institutional adoption of cryptocurrency is anticipated to upward thrust as crypto infrastructure improves and the product panorama evolves, with various kinds of funding automobiles coming to marketplace, in step with a PwC report.

Uncertainty Continues

Marketplace uncertainty has heightened in 2025 amid shifts in commerce coverage, inflation final stubbornly increased and buyers changing into wary of the oversized returns generated through mega-cap shares. Amid those adjustments, diversification as a chance control instrument is changing into central to making an investment for plenty of marketplace members.

Editor’s Observe: The abstract bullets for this newsletter have been selected through In quest of Alpha editors.