In spite of the fanfare, the unreal intelligence (AI) revolution has simply begun. With the AI marketplace valued at $189 billion in 2023, the United Countries believes it’ll transform a $4.8 trillion marketplace by means of 2033.

Firms like Nvidia have already taken good thing about this expansion, hovering to multitrillion-dollar marketplace caps. However the two AI companies under industry at simply fractions of that worth. Through the years, then again, lets see the sort of shares surpass Nvidia’s marketplace cap, main to very large good points for affected person shareholders.

That is what makes Nvidia so particular

At the moment, maximum estimates imagine that Nvidia instructions someplace between 70% and 95% of the AI graphics processing unit (GPU) marketplace. GPUs, or graphics processing gadgets, are essential elements essential for coaching and executing AI fashions, in addition to facilitating many different device finding out duties. With out GPUs, the AI revolution would no longer be starting up at just about the similar dimension or scale. And at this time, Nvidia dominates AI-specific GPU gross sales.

What makes Nvidia’s GPUs so particular? Two issues: early funding and seller lock-in via its developer suite referred to as CUDA.

Long ago in 2006, Nvidia’s management identified the significance of programmable infrastructure. This is, they understood that builders would wish to customise their chips to optimize for positive parameters, letting them procedure knowledge or run calculations sooner and extra successfully than a inventory GPU. To handle this, Nvidia launched Compute Unified Instrument Structure (CUDA). This unlocked the ability of parallel computing, making its chips extra sexy than the contest when it got here to efficiency optimization doable.

Lately, many Nvidia shoppers are the use of Nvidia merchandise because of CUDA. They have custom designed their setups from a device point of view round Nvidia’s {hardware} choices, developing what analysts name “seller lock-in.” This lock-in has granted Nvidia an 80% to 95% marketplace percentage for AI-related GPUs. It will be arduous to compete with this aggressive benefit. However sooner or later, some other chipmaker will wreck via. And the corporations under are my best bets on the subject of each possibility and doable upside doable.

Two shares that would sooner or later beat Nvidia

The street to toppling Nvidia shall be an extended one. However over the approaching years, I think both Intel (INTC 5.56%) or Complex Micro Gadgets (AMD 4.81%) may just wreck via.

AMD is arguably in the most efficient place to probably fit Nvidia’s AI dominance over the following 5 years. The corporate’s newest GPUs have carried out neatly towards Nvidia’s Blackwell chips on benchmark exams. Plus, Nvidia is having problem production sufficient chips to fulfill call for, resulting in multi-month delays on shipments, giving AMD a capability to extra all of a sudden meet emerging call for regardless of arguably inferior merchandise with much less seller lock-in.

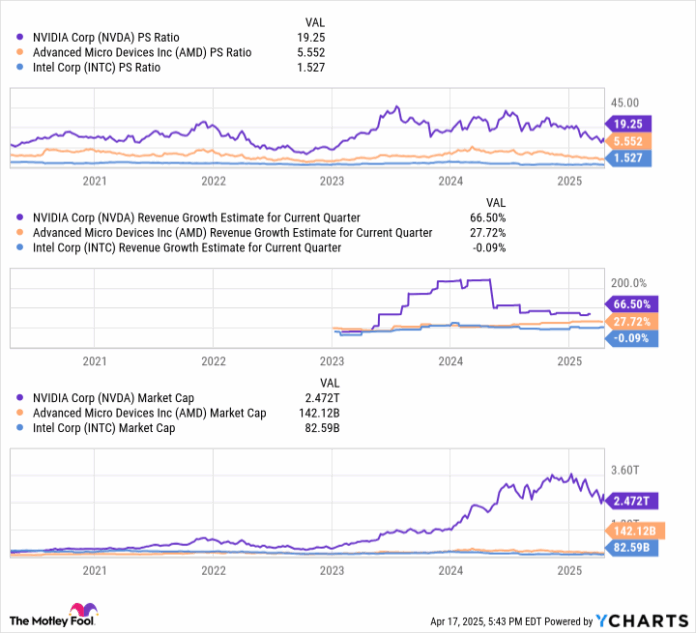

NVDA PS Ratio knowledge by means of YCharts

At the moment, Intel is a ways in the back of AMD relating to catching up with Nvidia. However its marketplace cap and valuation greater than mirror that truth. Intel is valued at simply $80 billion as opposed to a $140 billion valuation for AMD. In the meantime, Intel stocks industry at simply 1.5 instances gross sales as opposed to a 5.6 instances gross sales valuation for AMD. Making a bet on Intel attaining Nvidia’s valuation by means of 2030 is obviously an extended shot. However the corporate is making an investment closely to support its chips’ competitiveness, in addition to its general production capability. And overdue remaining yr it gained a multibillion-dollar contract from Amazon for AI chips and some other multibillion-dollar contract from the U.S. army.

Which corporate am I making a bet on lately to meet up with Nvidia? I am going with AMD. Its chip efficiency and production functions heftily outpace Intel’s for AI GPUs. And with 52% of income coming from knowledge facilities as opposed to simply 25% for Intel, AMD is obviously a lot more leveraged to the AI financial system than Intel. Nvidia’s CUDA structure will stay a powerful barrier to festival for future years. However each AMD and Intel have such affordable relative valuations that each are price a small, speculative funding, even though the percentages of overtaking Nvidia by means of 2030 stay narrow.

Ryan Vanzo has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Complex Micro Gadgets, Intel, and Nvidia. The Motley Idiot recommends the next choices: brief Would possibly 2025 $30 calls on Intel. The Motley Idiot has a disclosure coverage.