In as of late’s CEO Day by day: Shawn Tully at the U.S.’s use of non-tariff boundaries.

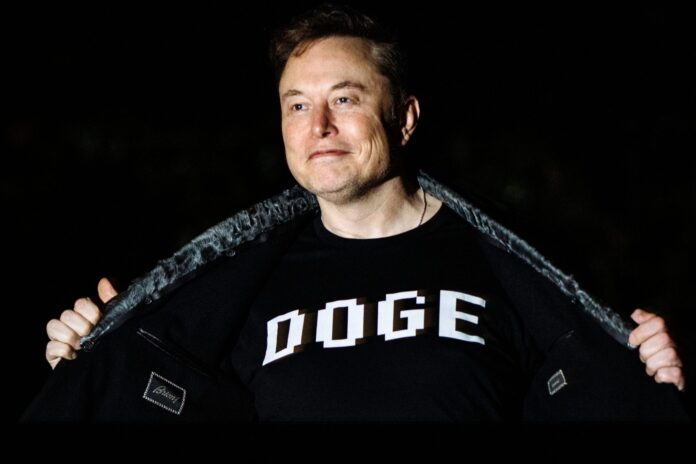

The large tale: Musk underneath force to go away DOGE as Tesla turns into tainted with politics.

The markets: The greenback and the S&P 500 are down however Asia appears to be like OK.

Analyst notes from Apollo on recession, Oxford Economics on price lists, and Goldman Sachs on shares.

Plus: All of the information and watercooler chat from Fortune.

Excellent morning. For weeks I’ve been digging into the tariff warfare reverberating all over the world and affecting just about each trade there may be. To me, a significant thriller of the Trump tariff campaign is that this: The “Liberation Day” reciprocal tasks he’s threatening are utterly disconnected from what different international locations are charging the U.S. on our exports. In just about all instances, Trump’s price lists are more than one occasions higher. How does he justify this massive gulf? The president claims we’re getting “ripped off” no longer by means of over the top price lists however blatant “non-tariff boundaries” (NTBs), equivalent to quotas and technical requirements that systematically block our items from overseas markets, whilst we naively open The usa to the “cheaters” who lock us out. However the knowledge display a distinct tale. After I dug in, it was transparent that the U.S. is using lots of the methods that we’ve slammed buying and selling companions for implementing. Right here’s what leaders must know concerning the insurance policies underlying this chaotic debate:

A extremely revered information to the place other nations’ industry insurance policies stand at the spectrum from open to restrictive is the Global Business Barrier Index compiled by means of the Tholos Basis, a Washington, D.C., suppose tank specializing in tax reform and coverage analysis. For 2024, the Tholos knowledge positioned the U.S. because the twenty fourth maximum protectionist financial system on the earth from a listing of 88 nations, in accordance with the choice of restraints on industry every country imposes. General, we’re about 10% above moderate in general restrictions—on a roster that includes a variety of dangerous actors.

NTBs are available in all kinds of bureaucracy. They surround such practices as quotas, technical requirements, and packaging, labeling, licensing, and protection necessities. In a 2024 find out about, the St. Louis Federal Reserve reported that throughout 15 production sectors, NTBs lined neatly over two-thirds of the imports of elements, commodities, and completed merchandise.

The U.S. is an avid consumer of a protectionist instrument known as the “tariff-rate quota.” In spite of its identify, the TRQ is in point of fact a non-tariff barrier as it doesn’t in reality impose tasks. TRQs usually permit merchandise or commodities to go into the rustic duty-free to a undeniable degree, and as soon as the imports hit that bogey, cause prohibitively top price lists, successfully halting the flows of rival merchandise and commodities from out of the country, and implementing a hard and fast quota to defend home manufacturers. A most sensible instance: the sugar marketplace, the place, by means of legislation, the USDA laws limit manufacturing to stay minimal costs in most cases upper than at the world markets. “The U.S. govt is the chief of a national sugar cartel,” a Cato Institute find out about declared.You’ll learn the overall tale about how NTBs paintings and which industries are probably the most secure right here. — Shawn Tully

Extra information underneath.Touch CEO Day by day by way of Diane Brady at diane.brady@fortune.com

This tale used to be firstly featured on Fortune.com