Apple (AAPL 1.36%) hasn’t been ready to flee the marketwide sell-off, and is down round 20% from its all-time highs. There was once substantial worry about how the corporate would fare as a result of a lot of its electronics are manufactured in China. Apple has struggled to develop gross sales just lately, and any value building up in its base product would have made that state of affairs even worse.

Alternatively, Apple were given some just right information over the weekend: Smartphones and different electronics are exempt from the reciprocal price lists. That implies the iPhone may not be going up in value by means of 145%, which is the present tariff fee on China (even if that is topic to switch, as we have now discovered).

Is that this a large sufficient announcement to show the inventory round? Or is there one thing else that buyers want to be careful for?

iPhones are nonetheless getting hit with a tariff, however now not on the 145% stage

Like maximum bulletins about U.S. tariff insurance policies, now not all knowledge is to be had directly. Trade Secretary Howard Lutnick famous that the exceptions for digital gadgets had been most effective transient. In the end, they’d be incorporated in a semiconductor-specific tariff that might be introduced inside a month or two. Whilst this provides Apple some respiring room for now, any other type of tariff is coming down the pipeline in the end.

So Apple’s inventory is not roaring upper, as a result of we are in any other spherical of “wait and spot” with price lists.

President Donald Trump is eager about all tech production being achieved out of doors of U.S. borders, which his management says is a countrywide safety chance. Apple is taking steps to transport extra of its production again to the U.S., and introduced a $500 billion funding over the following 4 years to construct amenities around the U.S. that can produce its merchandise.

We’re going to see if this buys Apple some grace from the Trump management, however according to Trump’s language surrounding its state of affairs, exemptions may not be passed out in any respect. So there may nonetheless be some problems with Apple’s merchandise emerging in value to offset the consequences of price lists, which might now not assist gross sales.

Apple nonetheless has a top rate valuation in spite of its gradual gross sales expansion

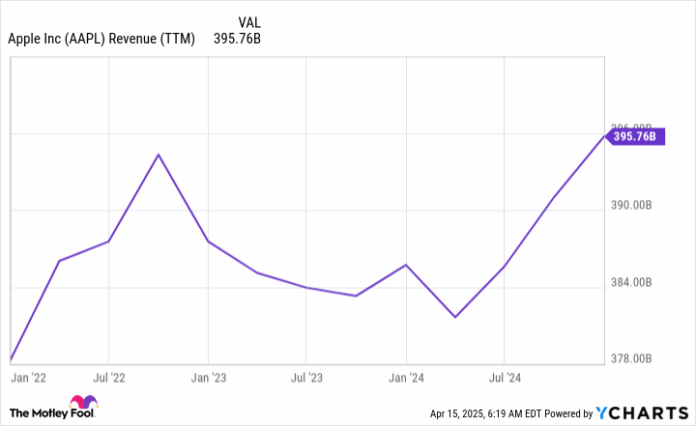

Apple’s gross sales expansion has been just about nonexistent over the last 3 years:

AAPL Revenue (TTM) knowledge by means of YCharts.

With Apple simply now attaining its COVID-era gross sales height, it is going to need to struggle price lists to go back to this threshold. We do not know a lot about how the corporate believes price lists will have an effect on its gross sales, however we will in finding out extra on Might 1 when it stories fiscal second-quarter gross sales (for the quarter finishing in March 2025).

Even with the inventory falling 20% and gross sales being flat over the last 3 years, Apple’s inventory nonetheless fetches a top rate valuation according to value to income:

AAPL PE Ratio (Forward) knowledge by means of YCharts.

At 28 instances ahead income, Apple’s inventory is a long way from affordable, even if it is a lot more sexy than it’s been for lots of the previous yr. It additionally has a vital top rate to the wider marketplace, which trades at 20.1 instances ahead income (as measured by means of the S&P 500).

Till we listen extra from control following Q2 income, or get readability on upcoming semiconductor price lists, I believe it is best to keep away from the inventory. There are not any new merchandise or options using Apple’s expansion, and customers are already stretched skinny, which makes value will increase problematic. Alternatively, Apple would possibly want to hike costs anyway to offset the consequences of price lists, or consume into its margins.

Both means, Apple’s inventory will endure, so buyers will have to be affected person ahead of buying stocks.

Keithen Drury has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Apple. The Motley Idiot has a disclosure coverage.