Whilst synthetic intelligence (AI) making an investment has been the using pattern available in the market during the last two years, it gave up that management position to price lists in early 2025. AI continues to be an enormous pattern and is not in point of fact slowing down, so the loss of center of attention in this vital house opens up an funding alternative to scoop up one of the vital leaders at hefty reductions.

I am planning to do that, and the highest 3 shares on my buying groceries listing are Nvidia (NVDA -3.01%), Taiwan Semiconductor (TSM 0.13%), and The Industry Table (TTD 3.71%). All 3 of those shares seem like screaming offers at this time, and buyers can be sensible to scoop them up ahead of the marketplace turns its center of attention again to AI.

Nvidia and Taiwan Semiconductor

Nvidia and Taiwan Semiconductor move hand-in-hand as an funding. Taiwan Semiconductor is a chip fabricator, and its foundries produce chips that move into just about all state of the art gadgets, comparable to Nvidia’s graphics processing gadgets (GPUs). GPUs were a best choice for somebody inquisitive about coaching and working AI fashions as a result of their awesome computing skill. They are able to procedure a couple of calculations in parallel, an impact that may be additional amplified by means of connecting 1000’s of them in combination in clusters. Knowledge facilities devoted to AI coaching may have greater than 100,000 GPUs, and just about all are most likely sourced from Nvidia because of its class-leading era.

Alternatively, buyers are frightened about how price lists will impact AI call for.

Presently, it is not in point of fact a subject as a result of semiconductors are in particular exempt from price lists. Alternatively, the Trump management indicated it’s investigating semiconductor-specific price lists which may be issued. Whilst it is not possible to understand the speed, President Donald Trump is aware of how essential those chips are to our tech-fueled society, and a top charge can be unwise. The aim of price lists is to get firms that experience taken their manufacturing capacities out of the country to go back them to the U.S., which is one thing that Nvidia and TSMC are already doing.

TSMC constructed a fabrication facility in Arizona and introduced plans for 3 further fabrication amenities — two packaging facilities and one analysis and design operation. This funding will overall $100 billion — on best of the $65 billion TSMC already spent within the U.S. However it is essential as a result of manufacturing at its present Arizona facility has already bought out thru 2027.

One of the chips being produced on the Arizona facility are the parts for Nvidia’s state of the art Blackwell GPU, and the remainder of the meeting may be being accomplished within the U.S. by means of quite a lot of Nvidia companions. This makes Nvidia’s best GPU utterly exempt from price lists, as it is already produced within the U.S.

In consequence, buyers want to put tariff fears behind their minds for firms like Nvidia and TSMC, as they are already transferring within the course to steer clear of them.

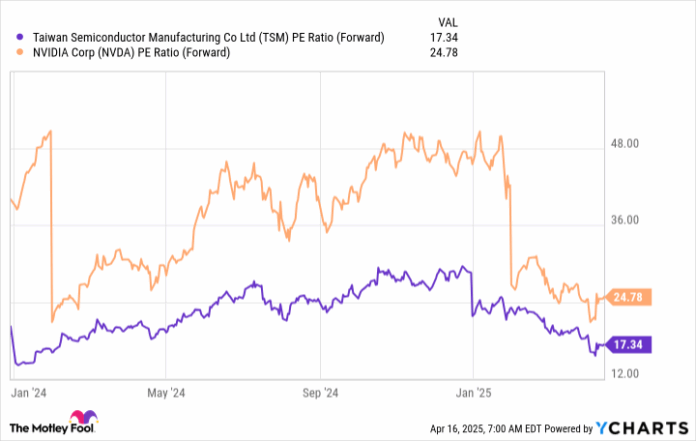

In spite of that, every inventory trades at a bargain to the degrees they have got traded at as not too long ago as previous this yr.

TSM PE Ratio (Forward) information by means of YCharts

Each shares glance attractively priced from a ahead P/E standpoint, and buyers must take this chance to shop for them. It is not continuously that those shares are priced this cost effectively.

The Industry Table

The Industry Table is not a play on AI {hardware}; it is a play on instrument. The Industry Table is an promoting corporate that specializes in connecting advert consumers with probably the most opportune promoting places. It is a best utility for AI, as it could analyze patterns of the way present advert campaigns are appearing and tweak them as essential to be sure that advert greenbacks are being spent successfully.

The Industry Table is in the course of migrating its buyer base from its outdated Solimar platform to Kokai, which is pushed by means of AI. Alternatively, The Industry Table skilled a stumble in This autumn all through this migration, and it neglected out on some income that it will have captured if it had simplest fascinated with non permanent good fortune. As a result of The Industry Table desires to deal with those long-term relationships, it took the income loss, however that got here on the expense of lacking inside steering for the primary time in corporate historical past.

This led to the inventory to unload greater than 30% at the day following profits, however that drop was once amplified by means of the wider marketplace sell-off that passed off within the weeks following The Industry Table’s This autumn announcement. Now, the inventory is down round 65% from its all-time top, however it looks as if a perfect cut price right here.

At 28 instances ahead profits, it is dearer than Nvidia or TSMC.

TTD PE Ratio (Forward) information by means of YCharts

Alternatively, the marketplace alternative that The Industry Table is focused on is very large and rising, and The Industry Table nonetheless has quite a lot of room for margin enlargement, which is able to power the denominator of the profits ratio up, which in flip decreases its valuation. This is a wonderful value to pay for the inventory, and buyers want to scoop up stocks of this long-term winner ahead of it is too past due.

Keithen Drury has positions in Nvidia, Taiwan Semiconductor Production, and The Industry Table. The Motley Idiot has positions in and recommends Nvidia, Taiwan Semiconductor Production, and The Industry Table. The Motley Idiot has a disclosure coverage.