Semiconductor shares are promoting off as Trump’s tariff time table sparks ongoing tensions amongst industry companions. Is that this a possibility to shop for Taiwan Semi?

Normally talking, inventory costs transfer in response to reactions to quarterly profits or financial signs corresponding to inflation or unemployment charges. These days, the ones variables have taken a again seat to any other gigantic subject: swaying investor sentiment.

In fact, I am referencing President Trump’s tariff insurance policies. With profits season temporarily coming near, buyers are for sure going to be dialing in to profits calls to listen to what company executives have to mention about how price lists are impacting their companies.

Let’s discover how the narrative round Trump’s price lists have already impacted the inventory marketplace — and particularly, the era sector. From there, I’m going to hone in on semiconductor shares and discover if Taiwan Semiconductor Production (TSM 1.03%) looks as if a just right purchase at this time as the corporate’s profits come into center of attention on April 17.

Trump’s tariff insurance policies are rocking the inventory marketplace, and massive tech is in reality feeling the force

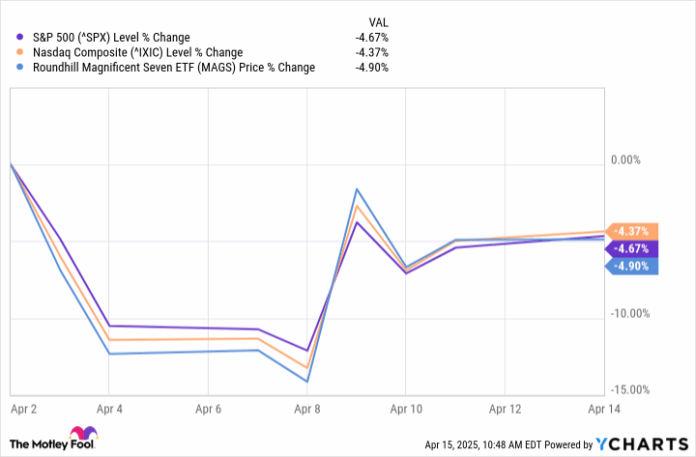

President Trump introduced his new tariff time table on April 2, calling the high-profile tournament “Liberation Day.” Since then, the S&P 500 (^GSPC -0.17%) and Nasdaq Composite (^IXIC -0.05%) have each and every fallen by way of greater than 10% on the lowest ranges. As well as, megacap enlargement shares within the era sector had been feeling reasonably somewhat of force.

These days, the attract of man-made intelligence (AI) is not sufficient to trap cautious buyers. Because the chart illustrates, the Roundhill Magnificent Seven ETF, which tracks the actions of “Magnificent Seven” shares Nvidia, Microsoft, Apple, Tesla, Meta Platforms, Alphabet, and Amazon, is down about 5% since April 2.

^SPX knowledge by way of YCharts

Chip shares had been specifically prone

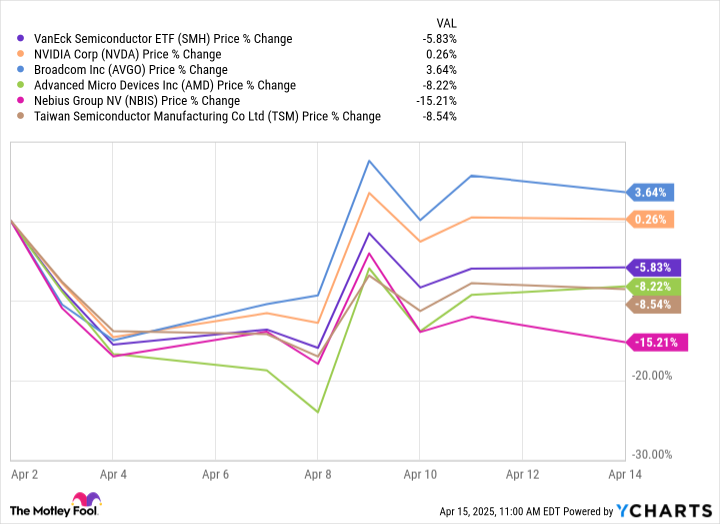

Whilst this research sheds mild on how the tariff narrative is impacting main era shares, it does not do a lot to lend a hand us know how Trump’s new insurance policies are affecting the semiconductor business.

The rationale I’m involved in semiconductors is twofold. First, chips play an integral function within the building of generative AI. As well as, chip firms corresponding to Nvidia, Complex Micro Gadgets, and plenty of extra outsource a lot in their production to Taiwan Semiconductor.

Those price lists have already sparked reasonably somewhat of anxiety amongst global industry companions with the U.S. For the reason that many American era firms depend at the subtle fabrication services and products from Taiwan Semi, ongoing negotiations round what particular items are topic to price lists may take a toll on near-term industry possibilities.

SMH knowledge by way of YCharts

Because the graph signifies, chip shares have not fared so neatly during the last couple of weeks. A number of the shares I have defined, TSMC is the second-worst appearing inventory on this peer set, with a drop of 8.5% since April 2.

![]()

Symbol supply: Taiwan Semiconductor Production.

Must you purchase the dip in TSMC inventory at this time?

I will be able to perceive if the sell-off within the inventory marketplace at this time is disorienting to buyers. That mentioned, there are some things on my thoughts as a long-term investor.

In contrast to different varieties of regulation and regulatory affairs, tariff insurance policies do not at all times want middleman approvals from Congress. Because of this, price lists can usually be imposed or reversed lovely temporarily. This dynamic could be a sure or a unfavourable, relying at the scenario.

As an example, the Trump management may select to impose very particular kinds of price lists round sure sides of semiconductor merchandise or sure international locations that manufacture and export them to the U.S. Given how briskly those insurance policies can alternate, it is herbal for buyers to turn into slowed down by way of all of the uncertainty.

With that mentioned, I see a silver lining hiding amongst all of this hoopla. In keeping with the Nationwide Financial Council management, the Trump management is lately in negotiations with 130 international locations across the price lists. I am cautiously positive that those industry talks are a just right sign for what is to return down the street.

Stated otherwise, I see the price lists as a bargaining chip to renegotiate industry members of the family. As such, the near-term uncertainty has led to in style panic within the capital markets. Alternatively, the long-term effects may well be a lot more sure if the U.S. is in a position to hammer out some new industry offers.

Whilst the daily talks and negotiations will most probably dominate information headlines, I would not center of attention an excessive amount of on that at this time. As a substitute, I would inspire buyers to concentrate on the strikes giant tech is making.

Thus far this 12 months, there were plenty of large-scale AI infrastructure initiatives introduced, together with over $300 billion from Microsoft, Meta, Amazon, and Alphabet, in addition to a $500 billion dedication from Apple. Funding in AI does not seem to be going away, and I see ongoing spending from giant tech as a catalyst for TSMC’s services and products within the long-run.

Whilst I believe the markets will proceed to witness volatility because the tariff scenario unfolds within the close to time period, I feel the present dip in Taiwan Semi inventory is simply too just right to move up at this time. Subsequently, I’d inspire buyers to imagine purchasing Taiwan Semi stocks as profits season rapid approaches.

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of marketplace building and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Marketplace, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Idiot has positions in and recommends Complex Micro Gadgets, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nebius Staff, Nvidia, Taiwan Semiconductor Production, and Tesla. The Motley Idiot recommends Broadcom and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.