Palantir (PLTR -0.22%) has controlled to be moderately resilient amid the hot turmoil within the inventory marketplace. As of this writing, the inventory is up 17% 12 months thus far in spite of pulling again 27% from the all time prime it reached in February.

That is nonetheless a premium-priced inventory, although. Palantir trades at 158 instances this 12 months’s anticipated revenue and 55 instances anticipated gross sales. That is a particularly bullish valuation — and one that appears even pricier taking into account macroeconomic headwinds may gradual the corporate’s contemporary momentum.

Whilst there is no doubt Palantir is a pricey inventory via those typical valuation metrics, there’s some other indicator that places the inventory’s ticket in a extra cheap mild.

Palantir is producing a large number of money

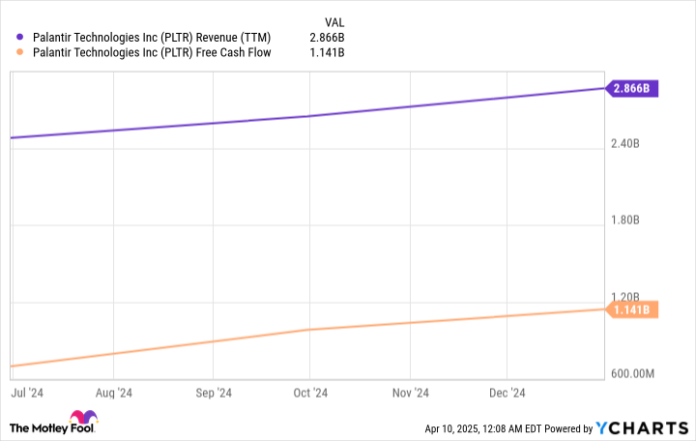

Although Palantir inventory appears rather dear on a price-to-earnings foundation, there are some excellent the explanation why buyers had been keen to pay a top class to possess the inventory. As an example, simply check out the chart beneath, which tracks the corporate’s gross sales and loose money glide (FCF) during the last 12 months.

Knowledge via YCharts.

For 2024, Palantir generated FCF of $1.14 billion on income of $2.86 billion. In different phrases, the corporate is producing $0.40 in loose money glide for each and every $1 in gross sales recorded. That is an improbable margin — and one that appears even higher within the context of Palantir’s best line momentum.

Final 12 months, income higher 29%, and control initiatives expansion will building up to 31% this 12 months (on the midpoint of the steering vary). The bogus intelligence instrument supplier is posting a FCF margin that will be enviable for a winning however slow-growing, mature industry, however its income expansion has speeded up for 6 instantly quarters.

With Palantir having established itself as a go-to supplier of robust analytics gear for each business and executive shoppers, the corporate seems poised to deal with its sturdy expansion trajectory. In the meantime, its sturdy FCF margin will assist Palantir climate any business battle and different macroeconomic dangers. In that mild, the inventory’s ticket is not as unreasonable as standard valuation metrics may counsel.

Keith Noonan has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Palantir Applied sciences. The Motley Idiot has a disclosure coverage.