Klaus Vedfelt/DigitalVision by the use of Getty Pictures

Q1 2025

YTD

1-Yr

3-Yr

5-Yr

Inception†

Leaven Companions, LP

14.2%

14.2%

9.8%

35.0%

101.2%

65.4%

S&P 500 (SPXTR)

-4.2%

-4.2%

8.2%

27.7%

130.8%

128.3%

MSCI EAFE (EFA)

8.0%

8.0%

5.5%

19.2%

75.1%

42.9%

Leading edge General Global (VT)

-0.9%

-0.9%

6.9%

20.2%

102.4%

77.8%

Click on to amplify

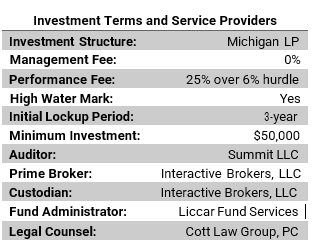

Leaven Companions, LP are time-weighted gross cumulative returns (unaudited) equipped by means of our top dealer, Interactive Agents. Efficiency knowledge, (internet of all charges and bills), for every spouse, is supplied by means of Liccar Fund Products and services.

†Buying and selling started on March 16, 2018.

Click on to amplify

Pricey Companions,

Within the first quarter of 2025, overall fund property liked by means of 14.2%. For the three-year length, the fund is up 35.0p.c1 in comparison to the S&P 500 go back of 27.7%.

I wish to thank everybody for spending a Saturday morning in combination remaining month for our annual assembly. It was once in reality a pleasure for me to host, and it’s an honor to be part of such glorious folks!

As mentioned within the assembly, 2025 has began off smartly, with the fund completing the quarter up over 14% gross. We reviewed one of the crucial key participants to fund returns, together with a vital achieve in Nakayo, Inc. (6715:TSE).

Based in 1944, Nakayo is a Jap corporate with round 750 workers. They manufacture verbal exchange apparatus utilized in conventional voice verbal exchange along with IP phone era. Like such a lot of small-cap firms in Japan, it is a sleepy corporate with an extended historical past of profitability. Being excited about basic momentum, I purchased stocks of the corporate after it all started appearing noticeable enhancements in its profitability and capital potency. On the time of acquire, the corporate had round $22 million in money, $130 million in property with out a debt, and was once buying and selling at the inventory marketplace for $35 million.2 My conversative estimate of the liquidation worth was once $58 million. I made it a subject matter place within the fund. As success would have it, now not lengthy after proudly owning the inventory, Ai Holdings (3027:TSE), which owned about 8% of the inventory on the time, made a young be offering for the rest stocks of the corporate at ¥2,550 in step with proportion. We bought our whole preserving at round ¥2,535 in step with proportion, for a achieve of about 130%. There are lots of extra undervalued firms like Nakayo in Japan, presenting ripe alternatives.

What a distinction a couple of weeks could make! Since our annual assembly a temporary time in the past, markets have ramped up the volatility to dizzying heights. The usually used gauge for marketplace volatility is the Cboe Volatility Index (VIX). You may bring to mind it as Wall Boulevard’s “worry gauge.” The VIX has reached disaster stage, peaking at 60 – a degree typically most effective observed all over main marketplace sell-offs just like the COVID-19 length and the 2008 monetary disaster.

Markets hate perceived uncertainty. President Trump’s geopolitical battle on an financial entrance has driven the limits on POTUS’s talent to wield tariffs3 as Thor’s hammer. It stays undetermined if the President’s movements are merely a negotiating tactic or whether or not those exhausting price lists will dangle. Regardless of the case could also be, it has presented an excessive amount of perceived uncertainty. And uncertainty begets volatility. On April ninth, the marketplace surged 9.5% — the most important single-day achieve since 2008 — following President Trump’s announcement of a 90-day tariff pause, most effective to fall sharply by means of 3.5% day after today. We would possibly revel in extra volatility within the days to return.

Even supposing volatility within the inventory marketplace is worrisome, volatility within the bond marketplace could also be extra troubling. Briefly, each the bond marketplace and the inventory marketplace are in decline, suggesting that there could also be a liquidity disaster within the monetary sector. For instance, there lately are some rumblings about fear of the instability of “the foundation business.” In case you have now not heard of the foundation business, don’t worry, you don’t seem to be by myself! The foundation business is a normal software utilized by asset managers to get momentary Treasury-like returns with no need to position up the entire cash to possess the T-Invoice outright. As an alternative of borrowing cash the standard method, asset managers can use monetary markets to “borrow” cash by means of purchasing Treasury futures as an alternative. Hedge budget have risen in contemporary times4 to take in the other aspect of that business by means of borrowing vital sums of cash, promoting the futures (that the asset managers are purchasing) and proudly owning the underlying T-Invoice. This motion of being brief futures and lengthy the underlying supplies the hedge budget with a small unfold for his or her products and services. In go back, asset managers pay just a little of top rate however get Treasury-like returns. The scale of the foundation business is big, with estimates suggesting it accounts for round $800 billion to $1 trillion in notional worth, making it a significant factor of the monetary gadget. When the water is calm, everybody is excited, and every player is getting adequately compensated. The issue in fact is when volatility spikes and the fast place isn’t adequately ‘hedged’ by means of the underlying holdings—which creates margin calls, forcing hedge budget to promote T-Expenses to pay down their brief positions. If volatility is going haywire, that could be a downside—simply ask Lengthy-Time period Capital Control.

Call to mind our monetary gadget as a finely tuned Ferrari. The entirety is structured with positive precision right down to the remaining rivet; when the elements is just right, efficiency is flawless. However get started tinkering with an element within the automotive and you’ll have secondary and tertiary results that might motive malfunctions in different spaces of the auto which might be problematic, even fatal. POTUS is tinkering.

In all, higher ranges of uncertainty coupled with an puffed up inventory marketplace and requires an “approaching”5 recession make for fascinating instances to mention the least; a in a position provide of Dramamine could also be so as.

Remember that, I do not know what’s going to occur subsequent. Without reference to the end result, executing our technique with persistence with an eye fixed against mitigating possibility is the trail ahead.

As all the time, my very own capital is closely invested along yours, aligning my incentives with yours.

In Last

I’m thankful to your participation in Leaven Companions, and that you’ve got entrusted me with managing your property. I look ahead to reporting to you at our subsequent quarter-end.

Within the intervening time, if there’s the rest I will do for you, please don’t hesitate to touch me.

Sincerely,

Brent Jackson, CFA

Footnotes

1 This equates to an approximate 10.5% annualized gross go back for the 3-year length.

2 Please word those estimates are according to conversion from Jap yen to US greenback.

3 Technically, the Space of Representatives has Constitutional authority on issuing price lists, now not POTUS.

4 It was essentially funding banks.

5 https://www.hussmanfunds.com/remark/mc250404/

DISCLAIMER

The guidelines contained herein relating to Leaven Companions, LP (the “Fund”) is confidential and proprietary and is meant most effective to be used by means of the recipient. The guidelines and reviews expressed herein are as of the date showing on this subject matter most effective, don’t seem to be whole, are matter to modify with out prior understand, and don’t comprise subject matter data in regards to the Fund, together with particular data in the case of an funding within the Fund and similar essential possibility disclosures. This file isn’t supposed to be, nor will have to or not it’s construed or used as an be offering to promote, or a solicitation of any be offering to shop for any pursuits within the Fund. If any be offering is made, it will likely be pursuant to a definitive Personal Providing Memorandum ready by means of or on behalf of the Fund which comprises detailed data regarding the funding phrases and the dangers, charges and bills related to an funding within the Fund.

An funding within the Fund is speculative and would possibly contain considerable funding and different dangers. Such dangers would possibly come with, with out limitation, possibility of inauspicious or unanticipated marketplace tendencies, possibility of counterparty or issuer default, and possibility of illiquidity. The efficiency result of the Fund will also be risky. No illustration is made that the Basic Spouse’s or the Fund’s possibility control procedure or funding goals will or usually are accomplished or a success or that the Fund or any funding will make any benefit or won’t maintain losses.

As with every hedge fund, the previous efficiency of the Fund isn’t any indication of long run effects. Exact returns for every investor within the Fund would possibly range because of the timing of investments. Efficiency data contained herein has now not but been independently audited or verified. Whilst the knowledge contained herein has been ready from data that Jackson Capital Control GP, LLC, the overall spouse of the Fund (the “Basic Spouse”), believes to be dependable, the Basic Spouse does now not warrant the accuracy or completeness of such data.

Click on to amplify

Editor’s Word: The abstract bullets for this newsletter had been selected by means of In search of Alpha editors.