Palantir Applied sciences (PLTR -0.22%) went public in September 2020, and stocks of the tool platforms and knowledge analytics supplier have jumped an outstanding 714% since then as of this writing, even though it’s price noting that virtually the entire inventory’s positive factors have arrived previously couple of years following the release of its synthetic intelligence (AI) tool platform in April 2023.

On the other hand, Palantir inventory has dropped significantly previously month or so. The inventory shot up remarkably when 2025 started, however it has dropped 38% from the 52-week top it hit on Feb. 18. Palantir’s contemporary slide is on account of elements outdoor of the corporate’s keep watch over. The wider inventory marketplace negativity induced by way of the tariff-induced international industry conflict has led traders to press the panic button.

The tech-laden Nasdaq Composite index has dropped greater than 20% in 2025 (as of this writing). Fears of an financial slowdown and a possible recession have led traders to ebook earnings in shares that delivered exceptional positive factors previously couple of years, and Palantir is one among them.

On the other hand, the tool specialist’s sharp pullback of overdue may trap growth-oriented traders into purchasing the inventory, making an allowance for the prospective upside it might ship over the following decade. Let’s take a better have a look at the catalysts that are supposed to act as tailwinds for Palantir over the following 10 years.

Booming call for for AI tool can assist Palantir zoom upper

Palantir’s development trajectory has began bettering because the release of its Synthetic Intelligence Platform (AIP) a few years in the past. The corporate introduced AIP for each industrial and govt shoppers with the purpose of serving to them construct and deploy AI programs adapted to their operations. This platform has received immense traction because of the productiveness positive factors that AIP shoppers were attaining, resulting in exceptional development in Palantir’s buyer base, in addition to spending by way of present shoppers.

In particular, Palantir registered a 43% year-over-year build up in its buyer rely within the fourth quarter of 2024. Even higher, it witnessed an build up within the selection of shoppers signing larger offers with the corporate. As an example, the selection of offers price $1 million or extra signed by way of Palantir final quarter larger by way of 25% from the year-ago duration. In the meantime, the rise within the selection of $5 million-plus offers was once larger at 57% on a year-over-year foundation.

Those numbers make it transparent that Palantir is profitable giant from the fast adoption of AI tool, a marketplace that is anticipated to develop at an out of this world tempo over the following decade. Marketplace analysis supplier Roots Research expects the AI tool marketplace to generate a whopping $5.2 trillion in annual income in 2035, suggesting that Palantir is scratching the skin of an enormous end-market alternative that might assist it maintain terrific development ranges over the following decade.

It’s price noting that Palantir has been ranked as the highest seller of AI tool platforms by way of more than one third-party marketplace analysis companies reminiscent of IDC, Forrester, and others. This explains why shoppers were flocking to Palantir’s AIP, because the platform has been in a position to ship price and potency positive factors. The corporate reported a cast year-over-year build up of 56% in its general contract worth in This autumn 2024 to $1.8 billion.

This ended in a large bounce in Palantir’s income pipeline. The corporate posted a 40% year-over-year build up in its closing deal worth (RDV) in This autumn to an outstanding $5.4 billion. The metric refers back to the general closing worth of contracts that Palantir has to meet on the finish of a duration. The expansion in Palantir’s RDV was once upper than the 36% income development the corporate clocked all the way through the quarter.

So, Palantir is surroundings itself up for a lot more potent development someday. The corporate will have to have the benefit of the addition of extra shoppers, in addition to the larger spending by way of present shoppers on its choices. Those elements are contributing towards certain unit economics for Palantir, permitting the corporate to report a lot sooner development in profits as in comparison to income.

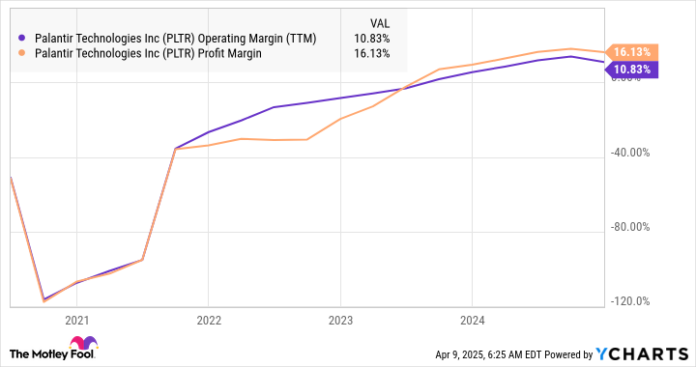

Unit economics is a measure of an organization’s profitability, serving to us perceive how much cash it’s making from each and every buyer. For the reason that Palantir has been in a position to signal expanded offers with present shoppers, a pattern that might proceed someday because of the proliferation of AI, its margin profile may proceed bettering.

The next chart obviously signifies that Palantir’s margins have progressed significantly previously couple of years, and there may be nonetheless more space for development in this entrance.

PLTR Operating Margin (TTM) information by way of YCharts

Will have to valuation be a priority presently?

Palantir’s pricey valuation is a key reason traders were reserving earnings on this inventory. In the end, shares buying and selling at a top class valuation are at the next possibility all the way through sell-offs since they’re deemed riskier when in comparison to worth shares. The unhealthy information is that Palantir remains to be buying and selling at 66 instances gross sales and 145 instances ahead profits in spite of pulling again considerably of overdue.

So, it would possibly not be unexpected to peer this AI inventory pulling again additional because of the destructive sentiment that is affecting international inventory markets presently. On the other hand, if Palantir inventory continues to slip additional and turns into to be had at a far inexpensive valuation, it might be price purchasing, making an allowance for the large addressable alternative to be had within the AI tool marketplace over the following 10 years.

What is price noting is that Palantir has began rising at a sooner tempo than the speed at which the worldwide AI tool marketplace is predicted to develop over the following decade. Roots Research is forecasting a compound annual development charge of just about 31% for the generative AI tool marketplace via 2035. Palantir’s income development of 36% was once a lot sooner than that, whilst the development in its RPO was once even higher.

There’s a excellent probability that Palantir will have the ability to maintain wholesome development ranges over the following decade in mild of the productiveness positive factors that AIP is turning in to shoppers. So, savvy traders would do neatly to regulate Palantir inventory and imagine collecting it if it falls additional since it might transform a cast funding over the following decade.