The monetary marketplace made a fast restoration this week with one of the vital extra unstable names within the business main the way in which. Wenesday’s information that price lists (out of doors of China) could be not on time by means of 90 days led to a couple optimism or even susceptible financial information overdue within the week did not put a damper in the marketplace.

In line with information equipped by means of S&P Global Market Intelligence, stocks of SoFi Applied sciences (SOFI 1.66%) jumped up to 11.3% this week, KKR (KKR -0.46%) was once up 9.2% at its top, and Capital One Monetary (COF -0.74%) rose 7.4%. The shares are up 10.6%, 7.5%, and six%, respectively, as of two:30 p.m. ET.

Bouncing off a low

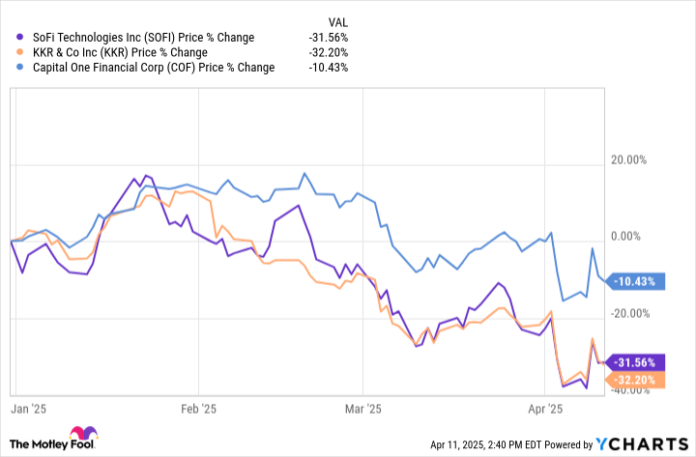

To be truthful, the strikes this week are in comparison to ultimate week’s marketplace cave in. Stocks are nonetheless down from the start of April, handiest 11 days in the past, and feature all fallen up to now in 2025.

SOFI information by means of YCharts

With that standpoint, it is exhausting to name this a sturdy rally. However buyers had been having a bet this week {that a} extend in some price lists and possible offers on others would scale back the chance of a recession and due to this fact defaults at the debt firms like SoFi and Capital One have on their steadiness sheets. KKR’s upward thrust was once obviously as a result of asset values are up, and that’s the reason a large a part of their rate construction.

Whilst the temporary possibility could also be observed as not up to a couple of days in the past, there are nonetheless extra dangers as of late than early this 12 months as economists ramp up their expectancies for a recession. And making issues worse is the upward push in rates of interest this week that might make it extra pricey for corporations, customers, or even the federal government to refinance debt. Oh, and the greenback is shedding, too.

Taking a step again

Lengthy-term buyers will need to take this chance to take a look at the long-term developments available in the market and financial system. To this point in 2025 shopper self belief is down, price lists and expectancies for inflation are up, and rates of interest are emerging.

The ones elements do not bode smartly for the financial system or monetary corporations, so it will be an issue of who will continue to exist and thrive thru upcoming marketplace turbulence. I don’t believe we are in for main losses on loans at this level, however the dangers for monetary firms are leveraged in comparison to maximum shares according to their trade fashions, so income and steerage shall be value staring at carefully.

Forget about the volatility

As those shares upward thrust and fall swiftly, it can be crucial for buyers to remember the long-term objective, which is to shop for opportunistically when the marketplace is pondering temporary. I believe those firms will be capable to organize dangers higher than what the marketplace noticed throughout the monetary disaster and whilst the restoration is probably not easy I am beginning to dollar-cost moderate at decrease costs. Lengthy-term, any giant dips are alternatives for buyers.