The inventory marketplace was once having a robust day on Tuesday, with the Dow Jones Commercial Moderate (^DJI 0.47%), S&P 500 (^GSPC 0.10%), and Nasdaq Composite (^IXIC -0.37%) all upper by means of about 2% as of 12:15 p.m. ET.

Then again, the monetary sector was once one of the crucial best-performing spaces of the inventory marketplace. Megabank JPMorgan Chase (JPM 2.29%) was once up by means of 4.2%, whilst each Citigroup (C 0.94%) and Wells Fargo (WFC 1.06%) have been each upper by means of about 3% for the day.

Why are the large banks hiking?

The large explanation why the inventory marketplace typically is upper is that traders appear positive tariff offers can be reached. President Trump posted on social media that he had a “nice name” with South Korea, and that China needs to make a deal. This follows Treasury Secretary Scott Bessent reporting that 70 nations are ready to start out tariff negotiations.

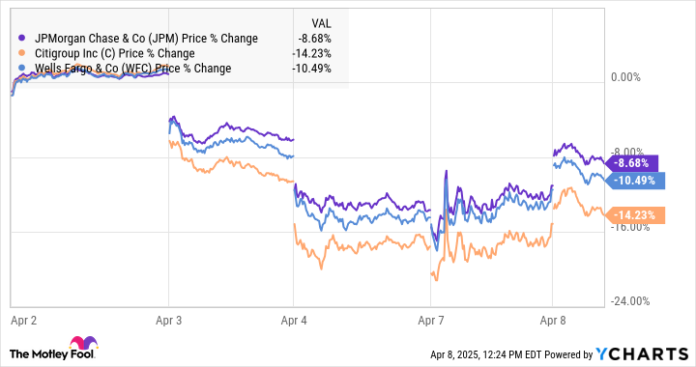

Additionally it is essential to say that financial institution shares have been one of the toughest hit available in the market downturn after Trump’s preliminary tariff announcement final week. Even after these days’s rebound, all 3 financial institution shares are down between 8.5% and 14% during the last week.

JPM information by means of YCharts

Whilst banks are not without delay impacted by means of price lists, they do rely at the well being of the U.S. economic system. If the price lists result in inflation and/or a U.S. recession, they might motive mortgage call for to fall and shopper default charges to spike upper, either one of which might be unhealthy for financial institution earnings.

To be transparent, no primary tariff offers were reached on the time of this writing, and the extra price lists Trump introduced are nonetheless set to take impact at nighttime on April 9.

Financial institution income are on deck

JPMorgan Chase and Wells Fargo are set to file their first-quarter income on Friday, April 11, with Citigroup and maximum different primary monetary establishments to apply early subsequent week.

There are some things particularly to control. For something, traders can be gazing delinquency charges and charge-offs for clues about shopper well being. After all, the tariff announcement and next marketplace plunge came about after the primary quarter ended, however there were issues that defaults may just tick upper for some time.

As well as, it’s going to be attention-grabbing to peer how financial institution internet pastime margins are acting. The newest Federal Reserve rate of interest reduce happened in December 2024, so the primary quarter would be the first three-month length the place the decrease federal finances fee is mirrored within the numbers.

In a nutshell, whilst those 3 financial institution shares had been extraordinarily risky not too long ago, we are about to get a better take a look at how their companies are in reality acting.

Wells Fargo is an promoting spouse of Motley Idiot Cash. Citigroup is an promoting spouse of Motley Idiot Cash. JPMorgan Chase is an promoting spouse of Motley Idiot Cash. Matt Frankel has no place in any of the shares discussed. The Motley Idiot has positions in and recommends JPMorgan Chase. The Motley Idiot has a disclosure coverage.