President Donald Trump’s broad-based price lists despatched surprise waves during the inventory marketplace. The Dow Jones Business Moderate fell just about 1,680 issues on April 3, marking the worst day for the inventory marketplace since 2020. Following Trump’s announcement, buyers appeared blindsided by way of the magnitude of the price lists and the best way they had been calculated, leaving them at a loss for words about their attainable affect at the broader economic system.

The utter chaos would possibly depart buyers questioning if it is merely absolute best to stay with money all over this tumultuous time. Whilst that is probably not the worst concept, there’s one protected inventory that I believe buyers can purchase amid the uncertainty — and not anything else compares.

A flight to protection

Trump’s price lists are so vast and so heavy that almost each and every sector is prone to really feel some affect, in large part since the price lists may just hit U.S. gross home product (GDP). Carl Weinberg, leader economist at Top Frequency Economics, mentioned in a analysis be aware that U.S. GDP may just contract by way of 10% within the present quarter. Weinberg initiatives that the price lists may just take a $741 billion chunk out of U.S. family actual earning or company profits. Economists at JPMorgan Chase say the price lists quantity to the most important tax build up at the shopper since 1968.

So, the place are you able to put cash when it seems like the shopper would possibly combat and no sector can be immune? Easy, give your cash to Warren Buffett by way of making an investment in his corporate Berkshire Hathaway (BRK.A -6.74%) (BRK.B -6.89%). Berkshire is likely one of the greatest conglomerates on the earth and it is run by way of arguably the most efficient investor on the earth, Buffett, who has additionally skilled an excessively succesful crew of making an investment lieutenants. Berkshire has transform a protected haven for the marketplace this 12 months.

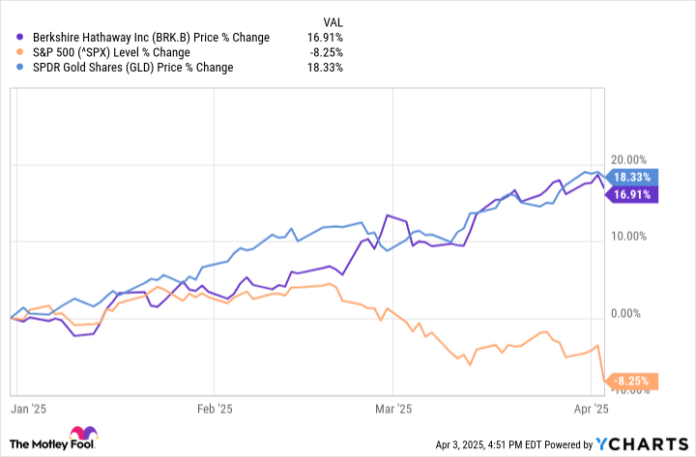

Knowledge by way of YCharts.

Berkshire has now not best overwhelmed the wider marketplace however has even hung in with gold (as represented by way of the SPDR Gold Stocks ETF (NYSEMKT: GLD)), which is seen as a more secure funding car in instances of uncertainty and has additionally been on an remarkable run. There are lots of causes to spend money on Berkshire Hathaway. For one, the corporate is amazingly protected and has constructed an epic money place of greater than $330 billion between money, money equivalents, and temporary U.S. Treasury expenses.

Berkshire additionally runs a number of other companies in many various sectors. In 2024, about 48% of its income got here from insurance coverage premiums or insurance coverage funding source of revenue, by which Berkshire takes the go with the flow from premiums and invests it into money, shares, and different monetary tools. Berkshire is famously identified for its $274 billion equities portfolio that holds primary shares like Apple, Financial institution of The united states, Coca-Cola, and plenty of extra. Berkshire additionally has different vital income streams from the Burlington Santa Fe Railroad, its power belongings, and different managed companies within the production, servicing, and retail sectors.

As I discussed, Berkshire additionally comes with an skilled control crew that is aware of navigate the commercial cycle. Final 12 months, many buyers puzzled why Berkshire selected to be a internet vendor of shares and hoard money all over a bull marketplace. Neatly, now the ones strikes do not glance so dangerous — actually they seem extremely sensible and forward-looking.

Set it and put out of your mind it

Should you practice the inventory marketplace, you then most probably know that Buffett and Berkshire were giant winners for many years. Between 1965 and 2024, Berkshire’s inventory generated compound annual positive factors of nineteen.9%, in comparison to the wider marketplace’s 10.4% together with dividends.

No, Berkshire isn’t going to be a multi-bagger over a brief length like some high-flying synthetic intelligence shares all over a bull marketplace. However it is a corporate constructed to final and prevail over a protracted length. One explanation why Berkshire has been such a success is as it has controlled to keep away from lots of the storms brought about by way of one of the vital largest marketplace meltdowns in historical past.

Berkshire additionally has a struggle chest of money must it see compelling alternatives. It made a number of successful investments following the Nice Recession of 2008. Even in those tricky marketplace prerequisites, buyers can purchase Berkshire inventory, set it, and put out of your mind it.

Financial institution of The united states is an promoting spouse of Motley Idiot Cash. JPMorgan Chase is an promoting spouse of Motley Idiot Cash. Bram Berkowitz has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Apple, Financial institution of The united states, Berkshire Hathaway, and JPMorgan Chase. The Motley Idiot has a disclosure coverage.