President Donald Trump’s “Liberation Day” tariff program prompt a string of worries and despatched the markets tumbling on Thursday and Friday. New fears about how the price lists may cause a recession despatched buyers working towards more secure tools like U.S. Treasury expenses. Analysts at J.P. Morgan raised their forecast for the chance of a recession to 60%.

The inventory marketplace misplaced about $3.1 trillion simply on Thursday, its worst day since 2020, and the S&P 500 (^GSPC -5.97%) dropped 4.8%. On Friday, the S&P 500 fell even farther, losing every other 5.9% and making a two-day general share lack of 10.5%.

As buyers paintings to decide which shares are prone to get hit toughest by way of the price lists (and reciprocal price lists leveied in wheat could be a industry warfare), some evident applicants rise up. Amazon (AMZN -3.92%) inventory is a kind of shares and it dropped 12.8% because the price lists had been introduced, and it is misplaced all its features from the previous 12 months.

Amazon is prone to the tariff affect in numerous techniques. Listed here are 3 ways the price lists can have an effect on Amazon and what it will imply for the corporate and the inventory.

1. Imported items bought on Amazon are prone to get costlier

The highest 4 U.S. import classes contain cars, auto portions, prescription drugs, and crude oil. Amazon has restricted publicity to 2 of the ones classes (auto portions and prescription drugs). The following 4 classes, in keeping with Statista, are essential Amazon merchandise: computer systems, mobile phones, electronics, and pc equipment. Amazon is the biggest U.S. e-commerce store, controlling round 40% of the U.S. marketplace, and it is the second-largest U.S. corporate by way of general gross sales, with $638 billion in 2024 gross sales, trailing most effective Walmart.

Amazon has been slowly shifting over from being an solely product-based corporate to embracing a extra service-based fashion. Within the 2024 fourth quarter, product-based gross sales accounted for approximately 68% of the overall, which remains to be considerably upper than service-based income. Upper price lists on all non-U.S. manufactured merchandise may significantly affect Amazon’s gross sales if costs cross upper and shoppers reduce on spending. That is what the worry of recession is all about.

Amazon is healthier situated to maintain this than different outlets since it is extremely all for conserving costs low. In keeping with e-commerce research corporate Profitero, it had the bottom costs of the vacation season for the 8th 12 months in a row, averaging about 14% less than identical outlets. It just lately introduced a brand new mission known as Amazon Haul, which aggregates lower-priced pieces for simple buying groceries. On the other hand, cutbacks are cutbacks, and grocery is not Amazon’s major trade. Walmart may set up higher via a possible recession as a result of it is all for groceries, that are necessities, and it is a bargain store. If shoppers gradual spending on computer systems, electronics, and different discretionary classes, Amazon may really feel the blow.

Any other argument in Amazon’s prefer is that it performs the lengthy recreation. There may be at all times a dance for outlets between gross sales and earnings, and Amazon may sacrifice its margins for the sake of conserving shoppers on its platform and conserving or enlarging its marketplace percentage. Smaller outlets do not in most cases have that choice in the event that they need to keep alive.

2. Amazon has global operations which are prone to get stuck up in quite a lot of industry wars

The brand new price lists may cause a broader world industry warfare, and that would affect Amazon much more significantly, as it operates the world over. Amazon services and products about 130 global places, some with native supply and achievement choices and a few with supply from the U.S. A world industry warfare may create retail upheaval and disappointed Amazon’s global operations, however once more, as a cast chief in retail with different operations that may hedge towards product problems, Amazon can higher resist the force than smaller corporations.

3. Amazon’s inventory goes to get less expensive

A two-day 10.5% wipeout is a whopper for buyers, however skilled long-term buyers know to take such temporary volatility in stride. This is not the primary time Amazon inventory has dropped, and it is at all times bounced again even higher. As only one instance, buyers could have already forgotten that Amazon inventory misplaced a complete 50% of its price in 2022, or even with this week’s decline, it is nonetheless greater than doubled from the ones lows.

It isn’t about what is taking place now, it is about what makes a robust, viable corporate. And when you consider Amazon has an improbable trade, you’ll see this, and no matter turmoil occurs over the following few weeks, as a chance to shop for at the dip.

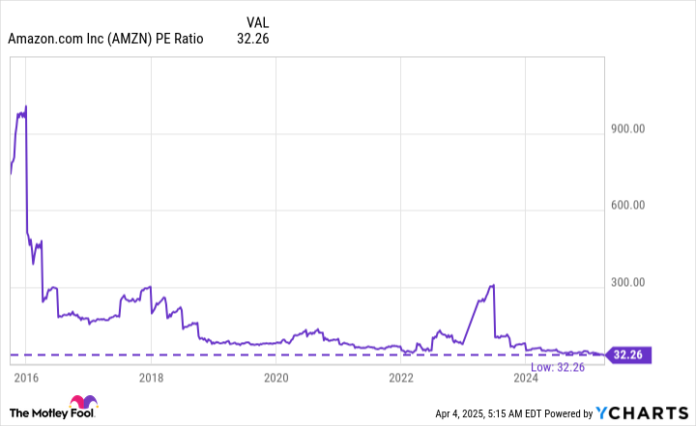

On the present value, Amazon inventory trades at its lowest P/E ratio in additional than a decade.

Information by way of YCharts.

I would not be stunned to listen to that many billionaire buyers scoop up stocks of Amazon at those costs, and when you’ve got a very long time horizon, it’s possible you’ll need to additionally.

JPMorgan Chase is an promoting spouse of Motley Idiot Cash. John Mackey, former CEO of Entire Meals Marketplace, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Jennifer Saibil has positions in Walmart. The Motley Idiot has positions in and recommends Amazon, JPMorgan Chase, and Walmart. The Motley Idiot has a disclosure coverage.