Stocks of Sweetgreen (SG -11.95%) took a dive these days, because it used to be certainly one of a number of eating place shares to react negatively to President Trump’s “Liberation Day” tariff announcement ultimate evening.

On an afternoon when the S&P 500 (^GSPC -4.84%) fell 4.8%, Sweetgreen completed down 12%.

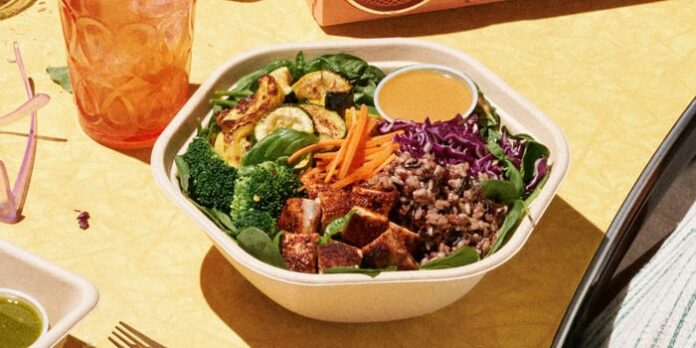

Symbol supply: Sweetgreen.

What is Sweetgreen’s tariff publicity?

Regardless that Sweetgreen resources maximum of its components locally, it does import some meals merchandise from out of doors the U.S., together with Mexico, and counts on parts from China for its Countless Kitchen programs.

Then again, Sweetgreen and its eating place friends is also extra uncovered to any weak spot in client spending that effects than from the have an effect on of the price lists without delay. Finally, client self belief has been swiftly falling, and the price lists may result in a recession, which has a tendency to hit eating place shares exhausting, as they’re depending on discretionary spending. Shoppers can select to devour meals from the grocer as a substitute, or convey their very own lunches into paintings.

Can Sweetgreen get well?

Sweetgreen inventory had tumbled previous within the yr, as the corporate gave disappointing steering, due partly to the have an effect on of the wildfires in Los Angeles. Then again, its investments within the Countless Kitchen, an automatic machine it is deploying to extra eating places, may assist give it a bonus over different eating place chains by means of serving to it save on exertions.

In the long run, the price lists should not disrupt Sweetgreen’s long-term enlargement trail. It is a distinctive industry because the chief within the fast-casual salad house, and it has an extended runway of enlargement forward of it. Whilst the price lists and any ensuing financial headwinds may provide a setback, they should not derail the corporate’s enlargement plans.