Nvidia (NVDA 3.16%) has been probably the most dominant shares available in the market in 2023 and 2024. On the other hand, 2025 hasn’t been so type to the computing massive, as its inventory is down over 18% from its January highs.

There are fears that the huge AI spending wave might be suffering from an unsure financial outlook or that Nvidia’s biggest purchasers would possibly glance somewhere else to meet their computing energy calls for. But none of the ones fears have surfaced but, and Nvidia’s CEO and founder Jensen Huang simply gave an astonishing outlook into how he initiatives spending on AI computing.

Nvidia’s enlargement trajectory strains up with Huang’s daring prediction

All over Nvidia’s GTC convention (its annual convention about its merchandise), Huang said that Nvidia’s knowledge middle infrastructure income will hit $1 trillion via 2028. No corporate on earth has income that giant, with Walmart recently protecting the highest spot at $673.8 billion in annual income. Moreover, that is simplest knowledge middle income; it does not come with any of Nvidia’s different segments. On the other hand, if Nvidia’s knowledge middle income reaches $1 trillion via 2028, that may dwarf another section’s income general.

That is an enormous quantity, however it sensible?

Over the last 4 quarters, Nvidia generated knowledge middle income of $115.3 billion. On the other hand, this section is seeing outstanding enlargement, as This autumn knowledge middle income was once up 93% from a yr in the past. So, if Nvidia continues at this 93% tempo and helps to keep it up over the following 4 years (thru 2028), will that be sufficient to hit $1 trillion?

The solution? Sure.

Must Nvidia proceed at its 93% enlargement price, it will in fact produce $1.6 trillion in knowledge middle income via 2028. That is a whole overshoot of Huang’s projections. Nvidia would simplest want to develop its income at a compound annual enlargement price (CAGR) of 72% thru 2028 to make the $1 trillion projection occur.

So, to peer how sensible this steering is, traders want to track Nvidia’s knowledge middle income enlargement all over every quarterly revenue document. It wishes to stick increased above that threshold all over the primary few years for Nvidia to stick on course. If it does not, then it would possibly not be unexpected if Nvidia misses its $1 trillion objective.

Whilst a 72% CAGR turns out extremely constructive, what can traders be expecting if Huang is true?

Nvidia could be a fantastic performer if it reached $1 trillion in income

If Nvidia had been to succeed in $1 trillion in income and care for its 56% benefit margin, it will produce $560 billion in earnings. That is a mind-boggling determine that no corporate is even with reference to at the moment, and it will supply jaw-dropping returns.

Even supposing Nvidia traded on the marketplace reasonable price-to-earnings (P/E) ratio of twenty-two.3 (that is what the S&P 500 trades at at the moment), that might give Nvidia a marketplace cap of $12.5 trillion. Making an allowance for that Nvidia’s marketplace cap is recently at $2.9 trillion, that might point out Nvidia’s inventory would upward push kind of 330% over the following 4 years. Any investor could be proud of returns like that over a four-year duration, which makes Nvidia an intriguing inventory to shop for now.

However what if he is improper and Nvidia falls wanting expectancies? Nvidia nonetheless looks as if a excellent purchase now.

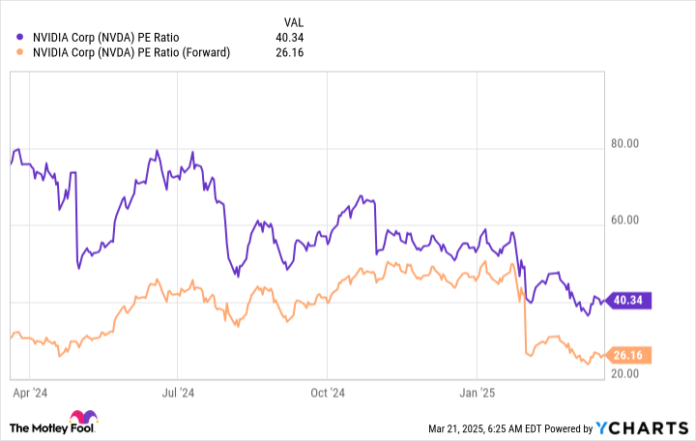

NVDA PE Ratio knowledge via YCharts

Nvidia’s inventory not trades at an enormous top rate. It is now priced at 26 instances ahead revenue, which is inexpensive than a lot of its large tech friends. So, although Nvidia nonetheless grows however falls wanting its $1 trillion in income objective, then it will have to nonetheless be a a success funding, as it isn’t beginning off with an unrealistic valuation.