The Nasdaq has hit some turbulence this 12 months. It is lately down greater than 10% from its contemporary top, which places it in correction territory. Some shares have offered off much more.

I in fact love it when the marketplace takes a breather as it permits me to shop for some fine quality shares at significantly better costs. I latterly did simply that, purchasing extra stocks of era titan Alphabet (GOOG -0.27%) (GOOGL -0.30%). Here is why I could not withstand the chance to shop for extra stocks of this “Magnificent Seven” inventory, which has tumbled 20% from its contemporary top.

Essentially the most magnificent of the seven

Alphabet is one in every of seven main tech firms dubbed the Magnificent Seven because of their robust enlargement potentialities and inventory fee efficiency in recent times. Even with the new decline, Alphabet stocks are up greater than 150% over the last 5 years, simply outperforming the S&P 500 (greater than 90% acquire).

One of the vital greatest components using my resolution so as to add to my Alphabet place is its valuation:

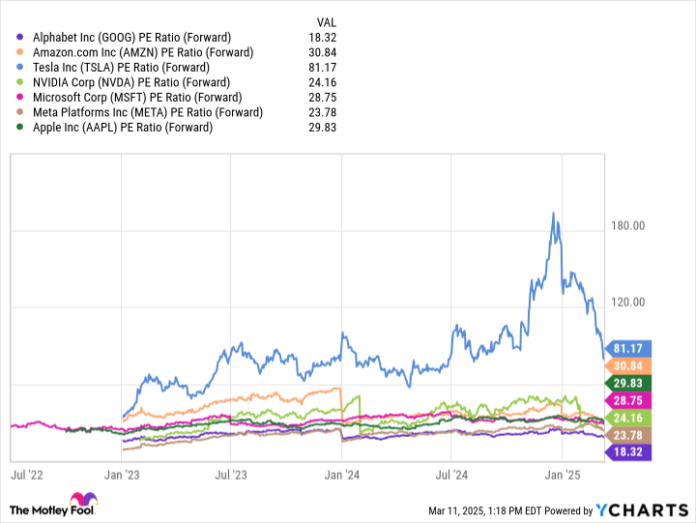

GOOG PE Ratio (Forward) knowledge by means of YCharts.

As that chart presentations, it has the bottom ahead price-to-earnings (P/E) ratio some of the Magnificent Seven. Its ahead P/E ratio of a little bit greater than 18 occasions could also be less expensive than the wider marketplace. The Nasdaq-100 trades at over 25 occasions ahead revenue even after its correction, whilst the S&P 500 sells for greater than 21 occasions its ahead P/E.

That is a discount for the sort of fine quality enlargement inventory. Its earnings rose 15% final 12 months to $350 billion, whilst its web source of revenue surged greater than 35% to $100 billion. That is a strong enlargement charge for an organization as giant as Alphabet.

The AI-powered enlargement accelerator

Synthetic intelligence (AI) has been a large issue using the surging valuations of Magnificent Seven shares in recent times. Alphabet is capitalizing on that very same enlargement catalyst. CEO Sundar Pichai commented on its AI-driven enlargement catalysts within the corporate’s fourth-quarter revenue press free up:

This autumn used to be a powerful quarter pushed by means of our management in AI and momentum around the industry. We’re construction, trying out, and launching merchandise and fashions sooner than ever, and making vital growth in compute and using efficiencies. In Seek, advances like AI Overviews and Circle to Seek are expanding consumer engagement. Our AI-powered Google Cloud portfolio is seeing more potent buyer call for, and YouTube remains to be the chief in streaming watchtime and podcasts.

Its AI investments are obviously having an affect. Google Cloud revenues surged 30% in that quarter to $12 billion, led by means of enlargement in AI infrastructure and generative AI answers.

Like lots of its opponents, Alphabet is making an investment closely to boost up its enlargement and capitalize at the AI alternative. It plans to take a position $75 billion into capital expenditures this 12 months, up from $52.5 billion final 12 months. That further cash will allow it to shop for extra servers and construct further knowledge facilities, amongst different issues. The corporate could also be expanding spending so as to add ability associated with AI.

The ones investments set Alphabet up for persisted enlargement. It is turning into a pace-setter in AI infrastructure, which must proceed to pressure enlargement in its cloud platform. In the meantime, it is creating ever-improving AI fashions in response to its Gemini platform. It is usually using analysis breakthroughs in quantum computing. In spite of everything, the corporate is integrating AI into its merchandise and platforms, making them much more user-friendly. Those drivers must allow Alphabet to proceed rising its earnings and revenue at wholesome charges within the coming years.

A powerful enlargement inventory on sale

Alphabet’s sell-off is a smart purchasing alternative. With its proportion fee slumping 20%, the era titan trades on the lowest valuation some of the Magnificent Seven shares (and at a cut price to the wider marketplace). In the meantime, it is rising briskly, which must proceed. That enlargement for the sort of cheap fee is a chance I could not withstand, which is why I latterly added to my place and can purchase much more stocks if the cost continues to say no.

John Mackey, former CEO of Complete Meals Marketplace, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of marketplace construction and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Matt DiLallo has positions in Alphabet, Amazon, Apple, Meta Platforms, and Tesla and has the next choices: brief Would possibly 2025 $275 calls on Apple. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.