Greggory DiSalvo/iStock by means of Getty Photographs

Realty Source of revenue (NYSE:O) is legendary for its dividend. It’s referred to as the Per month Dividend Corporate and has raised its dividend for 110 consecutive quarters. This popularity had 2 key affects:

A devoted investor base, offering O with an inexpensive value of fairness capital. Drive to handle the streak of dividend raises.

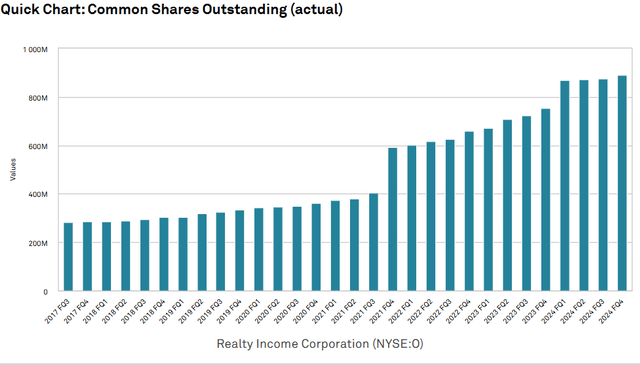

The primary has certainly been really useful to the corporate. O’s fairness has served as superb forex, letting them factor stocks and purchase new property at huge spreads. The corporate appropriately used its top AFFO more than one and top rate to NAV to factor bizarre quantities of fairness. Percentage depend has tripled within the closing 7 years.

S&P International Marketplace Intelligence

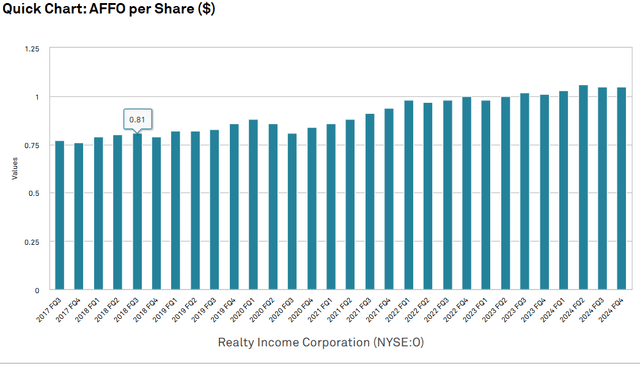

Because of the top AFFO more than one at which the fairness was once issued, those purchases have been accretive and AFFO/percentage grew well.

Marketplace costs, alternatively, are fickle. An especially dependable dividend corresponding to the only O guarantees is much less fascinating to the marketplace when treasuries can necessarily ensure an investor nearly 5% yields. It seems, fewer other people need a dividend with fairness possibility when a in a similar way sized dividend is subsidized by means of the U.S. executive.

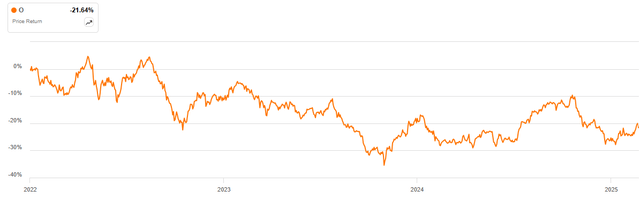

The surge in treasury yields took down almost about each dividend inventory, nevertheless it specifically harm the marketplace worth of O on account of its popularity as a dividend centered corporate.

SA

This created a little bit of a problem for O. They nonetheless needed to handle their streak of dividend will increase, however now not had overpriced inventory to make use of as forex.

Issuing fairness at as of late’s 13.15X AFFO more than one is way more difficult to make accretive than their former 18X more than one (value of fairness capital higher to 7.6%).

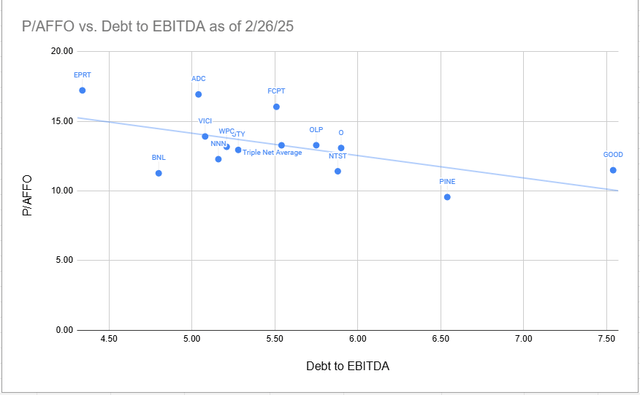

This downside isn’t distinctive to O. REITs normally have change into discounted to honest price, and O sits in the midst of triple nets in regards to leverage adjusted valuation.

Portfolio Source of revenue Answers

The issue this is distinctive to O is its wish to stay that dividend streak going.

Capital allocation for a REIT is a fantastic science, requiring other approaches to other situations. In marketplace environments the place fairness is flowing, O’s perennial technique of issuing fairness to shop for billions of greenbacks of property is the right kind method.

Alternatively, in additional adversarial marketplace environments, corresponding to the only from 2022-2024 for REITs, a distinct method is beneficial. Cap charges to be had on acquisitions remained moderately low regardless of the price of capital being upper, which made spreads much less favorable to REITs within the 2022-2024 window.

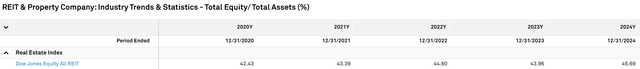

As such, it was once no longer a time to be looking to develop swiftly. Maximum REITs selected to hunker down and concentrate on high quality of houses and stability sheet. REITs extensively diminished leverage, with fairness as a share of property expanding to 45.69%.

S&P International Marketplace Intelligence

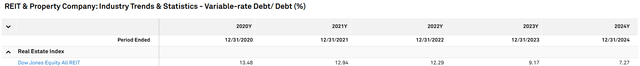

REITs additionally paid off or refinanced variable fee debt, bringing variable fee debt right down to 7.27% of general debt.

S&P International Marketplace Intelligence

Peer triple internet REITs actually all in favour of high quality of houses.

W. P. Carey (WPC) removed necessarily all of its workplace property, leaving a far leaner portfolio of business and retail.

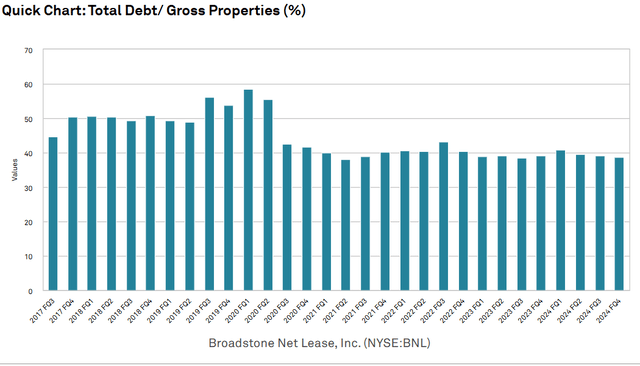

Broadstone Internet Hire (BNL) in a similar way offered off its workplace and clinical property to additionally arrive at the next natural expansion portfolio. BNL extensively utilized the time frame to considerably scale back leverage.

S&P International Marketplace Intelligence

I imagine this is proper capital allocation. When the surroundings is making exterior expansion much less favorable, it’s sensible to concentrate on high quality growth moderately than proceeding to shop for property at tiny spreads.

That is the place it might appear O was once deprived by means of its mandate. 100+ consecutive quarters of dividend expansion is an excellent streak, and it might be a disgrace to lose it. So the corporate needed to stay elevating its dividend and with the intention to do this responsibly, it had to continue to grow AFFO/percentage.

AFFO/percentage expansion is most often a just right purpose for a REIT to have, nevertheless it reasons issues when it’s pursued on the expense of high quality. From time to time it’s proper for a REIT to take a success to AFFO/percentage, as WPC did in an effort to greatly enhance high quality.

With its mandate to stay elevating the dividend, O didn’t appear to really feel like that they had the liberty to concentrate on the longer term, as a substitute making a large number of selections to strengthen close to time period AFFO/percentage. In that sense, they succeeded, as AFFO/percentage grew well even during the doldrums of 2022-2024.

S&P International Marketplace Intelligence

Nevertheless it got here at an enormous value. High quality has degraded considerably, and cracks are beginning to display in a subject matter method.

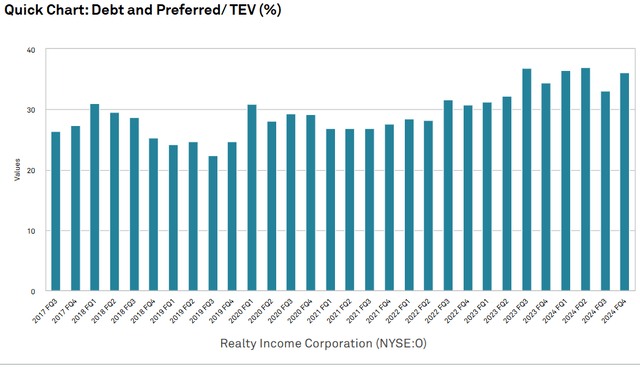

In contrast to friends who used the doldrums to scale back leverage, O stored purchasing property and when fairness ran dry, they purchased with debt, leading to upper leverage.

S&P International Marketplace Intelligence

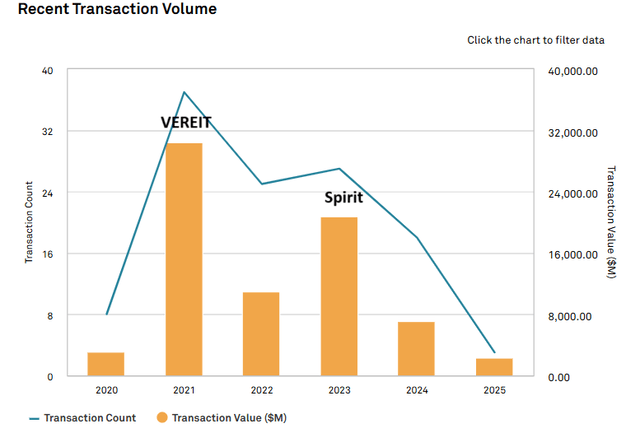

O was once purchasing unmarried property in addition to complete corporations. Their fresh transactions are summarized within the graph underneath.

S&P International Marketplace Intelligence

Each VEREIT and Spirit had some junky property of their portfolios. The 2021 VEREIT acquire was once a just right choice, personally, as a result of O had one of these top inventory worth on the time that the magnitude of AFFO/percentage accretion made it price taking over some junky houses.

By means of 2023, alternatively, O’s inventory worth had declined significantly, making the Spirit acquire a lot much less accretive and, personally, no longer price taking at the junky houses.

High quality deterioration

On the floor degree, it’s not simple to identify the standard deterioration. Headline numbers glance actually just right as in step with their This fall’24 income presentation:

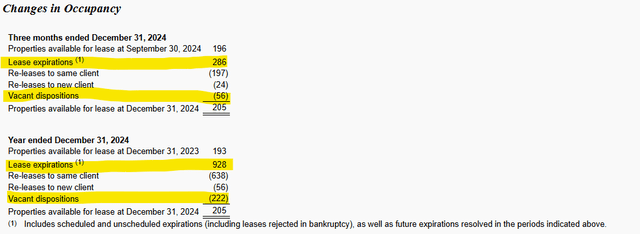

Occupancy at year-end was once 98.7%. For the yr, hire recapture throughout 833 renewed rentals was once 105.6%.

Leasing spreads of +5.6% is fairly just right for a triple internet, and 98.7% occupancy is cast.

What’s lacking from those numbers is what occurs to the rentals which can be NOT renewed.

Profits Liberate

Of the 928 rentals that expired in 2024, 638 have been re-leased to the similar tenant. 56 have been leased to new tenants.

The remainder 234 went vacant. This is emptiness on 25% of expiring rentals.

So how is occupancy nonetheless 98.7%?

Neatly, O offered 222 vacant houses in 2024 and as soon as a assets is offered it’s now not counted as vacant. The sale of emptiness appears to be accelerating with a considerable quantity offered within the 4th quarter, in step with Sumit Roy’s (O’s CEO) observation at the income name:

To that finish, within the fourth quarter, we offered 80 houses for general internet proceeds of $138 million of which $50 million was once associated with vacant houses.

Promoting vacant property is a wholly customary factor for a triple internet REIT to do. The issue right here is simply what number of vacant property that they had.

We imagine extra vacancies are at the horizon with a slew of afflicted tenants:

At the identical This fall’24 income name, Sumit Roy mentioned their higher provision for credit score loss:

Our forecast features a provision for 75 foundation issues of attainable hire loss in addition to an have an effect on from the transfer out of a giant workplace tenant.

Past the afflicted workplace, O will get a good portion of its revenues from afflicted outlets.

Walgreens – 3.3% CVS – 1.2% AMC 1.1%

Striking it into context

Triple nets naturally develop over the years from escalators constructed into their rentals and rolling apartment charges up upon renewal.

Those slow positive aspects are offset by means of assets screw ups corresponding to tenant chapter or failure to discover a new tenant upon rent expiry. Maximum triple nets are extremely varied, with hundreds of person houses and huge tenant rosters.

In any given yr, a number of the houses will nearly all the time fail, but the web have an effect on will have to be certain for the reason that escalators at the vast majority of succeeding houses outweigh the few that fail. As such, the natural expansion fee of a triple internet REIT is in large part decided by means of the portion in their houses which can be succeeding relative to the vacancies.

O, because of its competitive pursuit of near-term AFFO within the shape of shopping for portfolios, together with junky houses, has set itself as much as have the next portion of its property suffering. We confirmed the 25% emptiness on expiring rentals and the multitude of recently afflicted tenants.

With the next interior assets failure fee, O’s natural expansion is more likely to lag at the back of that of peer triple nets.

Against this, BNL and WPC sacrificed some temporary expansion in 2022 thru 2024 by means of eliminating weak spot and shoring up their stability sheets. Eliminating susceptible property is sort of all the time dilutive within the close to time period as a result of susceptible houses or houses with susceptible tenants promote at top cap charges, making it a adverse unfold to start with. Alternatively, this kind of high quality enhancement improves long-term expansion charges. This may display up as rentals roll over. The next share of tenants will renew, and hire roll-ups usually are greater. They have got situated themselves for more potent ahead natural expansion.

O’s myopic center of attention on fast time period AFFO/percentage presentations up in the best way they have a look at acquisitions. A lot of the closing 2 income calls have been faithful to speak about the non-public fund industry O is putting in. When requested about which acquisitions would move to the fund and which might move to O, Sumit Roy drew the honor in keeping with entering into spreads.

As a result of there have been positive transactions we selected to stroll clear of, which checked nearly the entire packing containers aside from for the preliminary unfold that we’d like with the intention to do issues on stability sheet. This is why we are saying that the fund industry is complementary.

Necessarily, O isn’t purchasing the rest that does not have an instantly accretive unfold, despite the fact that the valuables appears promising in the long run.

O were given its near-term AFFO/percentage expansion within the 2022-2024 duration, however basics recommend its expansion will considerably lag that of colleagues going ahead. As such, I proceed to imagine O is overestimated relative to friends, even because it trades in the midst of the pack.

This isn’t some kind of doomsday forecast. O is a big corporate with a extremely varied portfolio. It has certain cashflows and top margins. O is rather more likely to generate a good go back to shareholders. I merely assume the go back will probably be disappointing in comparison to that of colleagues, which might be higher situated for long run expansion because of their high quality enhancements of the previous few years.