Nvidia is without doubt one of the most well liked synthetic intelligence (AI) shares available on the market. The corporate has performed a pioneering function within the proliferation of AI era through designing robust graphics playing cards and server programs that experience allowed firms to coach and deploy AI fashions.

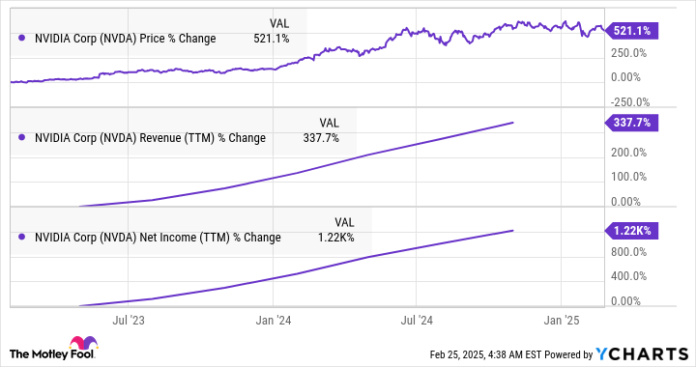

The powerful call for for Nvidia’s graphics playing cards has ended in outstanding expansion within the corporate’s earnings and profits prior to now couple of years, resulting in a large leap in its inventory value as smartly.

NVDA information through YCharts

Then again, the above chart additionally presentations that Nvidia has misplaced momentum in fresh months. Extra in particular, Nvidia inventory is down 8% prior to now 3 months as of this writing. This can also be attributed to a couple of elements. Those come with the proposed restrictions on gross sales of Nvidia’s chips to international nations, the worry of a slowdown in AI spending, and the new declare through DeepSeek that it has advanced a cheap AI type, bringing into query the billions which are being spent through tech giants on pricey {hardware}.

Now, there’s a excellent probability that Nvidia might be able to triumph over those demanding situations and get started hovering as soon as once more. Then again, buyers is also making an allowance for selection choices to capitalize at the rising adoption of AI in a bid to diversify their portfolios. That is the place Ciena (CIEN 1.97%) comes into the image.

The optical networking apparatus supplier has logged wholesome positive factors of 15% prior to now 3 months, outperforming Nvidia through a considerable margin. Extra importantly, the inventory has room to run upper. Let us take a look at the the explanation why.

AI-fueled networking call for will energy Ciena’s expansion

The requirement for speedy networking speeds has larger following the appearance of AI in order that large quantities of information can also be accessed and moved briefly in servers for processing functions. Any slowdown in networking speeds may just negatively affect the efficiency of AI fashions. No longer strangely, gross sales of networking apparatus to reinforce generative AI programs are anticipated to extend at an annual fee of 34% via 2028.

Ciena has began taking advantage of this profitable alternative, witnessing robust expansion in orders for its optical networking apparatus that permits high-speed information transmission. Cloud suppliers now account for 4 of the corporate’s best 10 consumers. Control’s feedback at the December 2024 profits convention name point out that cloud suppliers are more likely to transfer the needle in a larger manner for the corporate due to AI. In step with CEO Gary Smith: “With cloud and AI, now the lead drivers of call for, we imagine bandwidth expansion will upward thrust above the ones historic ranges over the approaching years. And to be transparent, AI isn’t just an information middle phenomenon to monetize the large AI tremendous cycle of compute investments; visitors is already flowing out of the knowledge middle and impacting all portions of the community as of late.”

The AI-powered networking call for explains why the orders booked through Ciena within the earlier quarter have been upper than its quarterly earnings. The corporate used to be at first anticipating orders to stay underneath its quarterly earnings. Then again, the numerous investments being made through cloud carrier suppliers to construct AI infrastructure gave Ciena a spice up.

Buyers have already observed how briskly the call for for AI-related networking apparatus is about to develop over the following 3 years. This explains why Ciena is anticipating its addressable marketplace to extend through $12 billion via 2028 to $26 billion. What is extra, the corporate has been ranked as the highest seller of optical networking apparatus in North The us through a couple of third-party analysis firms, because of this that it’s in a forged place to benefit from the profitable end-market alternative.

Forged monetary expansion must pave the best way for extra inventory upside

Ciena control is anticipating the corporate’s earnings to develop at an annual fee of 8% to 11% over the following 3 years, together with an adjusted working margin of 15% to 16% in fiscal 2027. For comparability, Ciena’s non-GAAP (adjusted) working margin landed at 9.7% in fiscal 2024.

The powerful expansion within the corporate’s earnings and margins must pave the best way for terrific expansion within the corporate’s final analysis over the following 3 years. That is exactly what consensus estimates are suggesting.

CIEN EPS Estimates for Current Fiscal Year information through YCharts

The chart above makes it transparent that Ciena’s profits are set to develop at a gorgeous wholesome tempo from fiscal 2024 ranges of $1.82 in step with percentage (Ciena’s fiscal 12 months results in November). If the corporate certainly delivers $4.17 in step with percentage in profits after 3 years and trades at 34 instances profits at the moment, consistent with the tech-laden Nasdaq-100 index’s profits a couple of, its inventory value may just leap to $142 in 3 years.

That represents a leap of 77% from present ranges, suggesting that this tech inventory continues to be price purchasing even after the positive factors it has clocked prior to now few months.

Harsh Chauhan has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a disclosure coverage.