Those 12 leading edge firms may just ship exponential returns over the following quarter century.

The U.S. stays the worldwide epicenter of innovation, the place groundbreaking concepts become into world-changing firms. Thru Wall Boulevard’s democratic buying and selling surroundings, on a regular basis traders can take part within the development tales of the following day’s trade leaders.

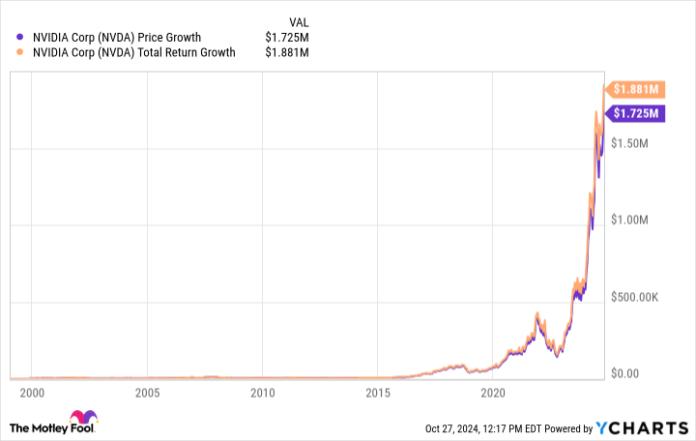

A modest $500 funding can flourish into seven figures with the fitting corporate and enough persistence. Simply have a look at Nvidia (NVDA 0.05%)-a speculative gaming chip maker in 1999 became synthetic intelligence (AI) titan, turning a $500 preliminary stake into $1.88 million over 25 years with reinvested dividends.

NVDA knowledge through YCharts

Let’s read about 12 leading edge firms that would ship an identical transformative returns over the following quarter century. Whilst every faces vital dangers and demanding situations, those firms are focused on large marketplace alternatives with step forward applied sciences.

City air mobility takes flight

1. Archer Aviation (ACHR 6.29%), valued at $1.26 billion, is pioneering electrical vertical takeoff and touchdown (eVTOL) airplane for city transportation. The corporate targets to release advertisement operations through 2025, following a an identical trajectory to Tesla’s early days in disrupting conventional transportation.

2. Joby Aviation (JOBY 2.62%), commanding a $4.46 billion valuation, is a pacesetter within the eVTOL race with vital partnerships together with Toyota Motor Corp. The corporate has completed an important FAA certification milestones on this possible $1 trillion marketplace, regardless that skeptics level to battery generation and adoption charges as key hurdles.

Gene modifying’s transformative possible

3. Intellia Therapeutics (NTLA 4.89%) stands at the leading edge of genetic drugs. The corporate’s $2.02 billion marketplace cap may just explode increased if its CRISPR-based remedies end up a hit towards hard-to-treat genetic problems.

4. CRISPR Therapeutics (CRSP 4.93%), valued at $4.03 billion, become the primary commercial-stage CRISPR specialist past due final 12 months. Whilst adoption is also gradual to ramp on account of logistical hurdles, the inventory seems considerably undervalued in mild of its first-mover benefit and partnership with Vertex Prescribed drugs.

5. Top Medication (PRME 3.23%) is pioneering high modifying, a groundbreaking strategy to genetic drugs, whilst keeping up a reasonably modest $483 million marketplace valuation. The corporate targets to seize a percentage of the worldwide gene remedy marketplace, projected to surpass $52 billion through 2033. Whilst Top Medication’s generation holds transformative possible, the corporate faces conventional biotech building hurdles because it advances its early degree healing systems.

Computing’s subsequent frontier

6. Implemented Virtual (APLD 4.73%), valued at $1.85 billion, builds and operates knowledge facilities specialised for AI and blockchain programs. The corporate’s earnings is rising exponentially as it really works to turn out to be the following main supplier of virtual infrastructure.

7. Navitas Semiconductor (NVTS 9.80%) is reworking energy supply with its environment friendly gallium nitride charging generation. The corporate’s $467 million marketplace cap belies its rising adoption amongst main electronics producers for next-generation charging answers.

House exploration and innovation

8. Rocket Lab USA (RKLB 2.50%), valued at $5.56 billion, is a pacesetter in small satellite tv for pc release services and products with its confirmed Electron rocket platform. The corporate’s rising release backlog and building of the bigger Neutron rocket show its increasing functions within the advertisement house trade.

Symbol Supply: Getty Photographs.

9. Intuitive Machines (LUNR 7.74%), valued at $507 million, demonstrated its lunar functions with a a hit moon touchdown in February 2024. The corporate is pioneering advertisement lunar services and products as the distance economic system strikes towards a projected $1 trillion valuation through 2040.

Long term mobility and AI integration

10. Virgin Galactic (SPCE 10.64%), valued at $201 million, operates within the rising house tourism marketplace. Whilst the corporate has begun advertisement operations and stays on target to release its extra environment friendly Delta elegance spaceships in 2026, its excessive money burn price items an important problem to its development trajectory.

11. SoundHound AI (SOUN 10.08%), valued at $1.78 billion, is advancing voice AI generation with rising adoption around the car and eating place industries. The corporate’s conversational AI answers are gaining traction with main undertaking shoppers as voice interfaces turn out to be more and more crucial to industry operations.

Automation revolution

12. Serve Robotics (SERV 19.92%), valued at $417 million, is growing independent sidewalk robots for last-mile supply. The corporate is increasing its operations throughout main towns via rising partnerships with eating places and supply services and products.

A disciplined strategy to high-growth making an investment

Those rising generation firms constitute vital development possible, however their valuations and early degree standing call for cautious portfolio control. Whilst a few of these firms might ship outstanding returns, others face really extensive operational and marketplace dangers.

A prudent technique comes to restricting place sizes to what you’ll be able to come up with the money for to lose, and keeping up a varied portfolio the place those higher-risk investments constitute a small portion of your holdings. Many of those positions will also be considered as long-term name choices on rising applied sciences, complementing core holdings like large marketplace exchange-traded budget (ETFs).

It bears emphasizing that these kinds of speculative development shares will have to by no means be bought the use of borrowed cash, whether or not via margin accounts, non-public loans, or through leveraging belongings like properties or automobiles. The risky nature of early degree firms method traders will have to simplest use capital they are able to come up with the money for to lose fully.

As with every high-growth funding technique, thorough analysis, menace overview, and place sizing are essential for long-term good fortune. Those firms might constitute the way forward for their industries, however they require each persistence and disciplined funding control.

George Budwell has positions in Archer Aviation, CRISPR Therapeutics, Intuitive Machines, Joby Aviation, Navitas Semiconductor, Nvidia, Top Medication, and Rocket Lab USA. The Motley Idiot has positions in and recommends CRISPR Therapeutics, Intellia Therapeutics, Nvidia, Serve Robotics, and Tesla. The Motley Idiot recommends Rocket Lab USA. The Motley Idiot has a disclosure coverage.