It is nearly onerous to imagine somewhat over a decade in the past that automakers similar to Ford Motor Corporate (F -1.88%) have been grilled for now not coming into China’s booming car marketplace quicker. China’s marketplace used to be in any case meant to turn out to be a moment area that might rival the spectacular earnings present in North The united states; it used to be the place automakers appeared to for large enlargement.

Basic Motors (GM -3.15%) even offered extra automobiles in China than the U.S. for a few years, however that is all modified now, and the sorrowful section is China’s profitable marketplace might by no means be the chance it as soon as used to be for overseas automobiles — so how are the Detroit juggernauts adjusting?

Long gone, however now not forgotten

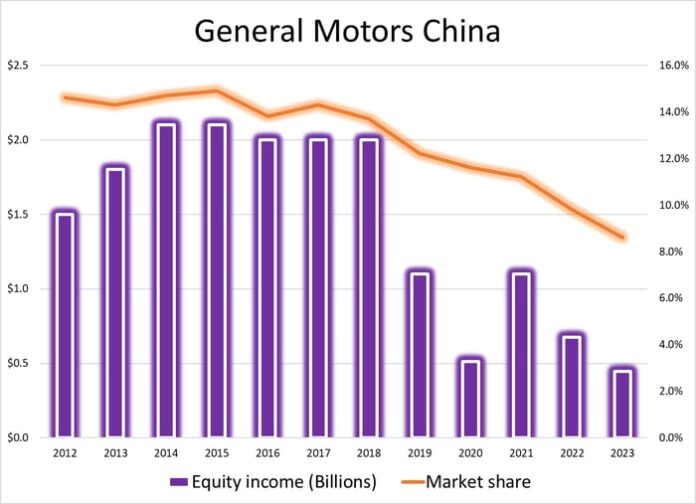

Basic Motors as soon as thrived in China and generated kind of $2 billion once a year for its base line. In truth, you’ll be able to see the abrupt alternate in GM’s China leads to the graphic underneath.

Knowledge supply: Basic Motors filings with the Securities & Alternate Fee. Chart through creator.

“China as an entity I feel shall be smaller than it’s been traditionally,” mentioned GM Leader Monetary Officer Paul Jacobson, in keeping with The Wall Boulevard Magazine. “However we have now at all times dedicated to getting it to profitability and making sure that it might strengthen itself.”

In case you are questioning what took place to overseas automakers in China, it used to be merely a speedy evolution towards electrical automobiles. China’s govt backed its EV business in hopes to extra temporarily expand generation and EVs that might compete now not most effective in China, however around the world.

The tactic labored, and it labored nearly too smartly because it brought about a flood of pageant that created a brutal price competition with automakers racing to the ground of value tags to trap in entry-level customers. China’s call for for EVs soared along side its rising prowess, and shortly new-energy automobiles — which come with hybrids, plug-in hybrids, and entire EVs — accounted for kind of part of China’s car gross sales.

For context, know that over the process a couple of years, China’s EV makers have been in a position to deliver EV costs right down to beneath $20,000 in some cases, at a time when overseas automakers are combating to plot for $30,000 EVs.

What is an automaker to do?

The excellent news for GM traders is that the corporate is not exiting China with no struggle. GM took a $5 billion restructuring fee to revive its China operations to a extra sustainable industry, and it returned to an adjusted benefit all the way through the fourth quarter — an excellent reversal from the prior 3 quarters.

Knowledge supply: Basic Motors’ This fall Presentation. Chart through creator.

Ford has additionally modified up its recreation plan in China through streamlining its product providing, additionally decreasing capital expenditures as GM is doing, and exporting automobiles from China — it is all had a good affect. This is Ford CEO Jim Farley all the way through the second-quarter convention name: “As you understand, we flipped our world operations a few years in the past from deep losses to now earnings and sure money go with the flow with extra alternatives forward, and that incorporates China.”

There are nonetheless significant tactics for China’s marketplace to be a chance for overseas automakers, particularly as the corporations turn out to be extra aggressive in EVs. Ford’s showcasing that with its China export technique, and in all probability GM can use its deep three way partnership ties to be informed a factor or two from its Chinese language opposite numbers, as they did from overseas automobiles over a decade in the past.

It is a construction traders need to stay conscious about, and it is important to notice that China is not a “holy grail” area that can develop right into a moment pillar of earnings, subsequent to North The united states, for Detroit automakers anytime quickly. For traders, the present hope is that Ford and GM would not have to spend a lot capital in China to maintain winning operations whilst the mud settles in this sort of impulsively evolving marketplace.

Daniel Miller has positions in Ford Motor Corporate and Basic Motors. The Motley Idiot recommends Basic Motors. The Motley Idiot has a disclosure coverage.