In earlier crypto bull marketplace cycles, Ethereum (ETH -4.35%), XRP (XRP -3.88%), and Chainlink (LINK -9.13%) were most sensible performers. In consequence, many buyers could also be anticipating an encore efficiency this 12 months.

However that is 2025, no longer 2021 or 2017. The tempo of trade within the crypto trade is very speedy, and new blockchain challengers are rising always. So which of those former crypto marketplace standouts nonetheless belong to your portfolio?

Ethereum

Many buyers nonetheless bring to mind Ethereum as a “blue chip” crypto with an impregnable financial moat. Sure, it nonetheless ranks because the second-largest cryptocurrency on the planet, with a staggering $400 billion marketplace cap. And, sure, it’s nonetheless the premier Layer-1 blockchain on the planet. It even has the implicit beef up of President Donald Trump, who not too long ago invested $47 million into it by the use of Global Liberty Monetary.

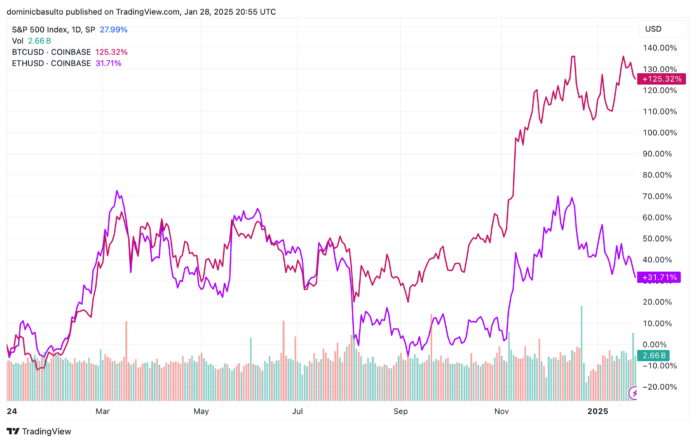

S&P 500 chart by way of TradingView

However fresh marketplace efficiency is troubling. For the reason that get started of 2024, when the brand new spot exchange-traded finances (ETFs) introduced, Bitcoin (CRYPTO: BTC) is up 125%, whilst Ethereum is up 31%. Even after Ethereum won spot ETFs of its personal in July, it might no longer stay alongside of Bitcoin. In reality, that used to be precisely when the efficiency of those two cryptos started to diverge. Ethereum has been a marketplace underperformer for months now.

The outlook for Ethereum turns into much more worrisome while you believe that blockchain competitors akin to Solana (CRYPTO: SOL), Cardano, Avalanche, and Sui — all of which now rank a few of the most sensible 15 cryptocurrencies by way of marketplace cap — proceed to realize marketplace percentage. At the moment, Solana is consuming Ethereum’s lunch, particularly within the space of decentralized finance (DeFi). The next move is to devour Ethereum’s dinner and dessert as smartly.

In January, a coalition of most sensible Ethereum blockchain builders met to deal with what they admit is a rising drawback. The chatter presently is that Ethereum is not as related because it as soon as used to be. Relatively merely, Ethereum remains to be too gradual and costly (even with annual tech upgrades), and has turn out to be too depending on a mishmash of greater than 50 other Layer-2 blockchains to fend off smaller, extra nimble competitors.

XRP

XRP has been below a regulatory cloud for greater than 4 years now. Again in December 2020, the Securities and Change Fee (SEC) made up our minds that XRP used to be in truth a “safety.” Since then, the SEC has been waging an epic fight with Ripple, the corporate at the back of the XRP crypto token. Final August, Ripple agreed to pay $125 million in consequences for promoting unregistered securities. And the case continues to tug on in 2025.

Thus, it is onerous to think about some other crypto that would receive advantages extra from the Trump management’s pro-crypto regulatory means. And, certainly, for the reason that election, XRP is up greater than 500%.

In line with the XRP bulls, a crypto-friendly SEC will make a decision to take a recent means with Ripple. As a part of an “anything else is going” option to crypto, the SEC would possibly make a decision that XRP isn’t, and hasn’t ever been, a safety. In concept, that will transparent the deck for an enormous rally in the cost of XRP.

However is that in point of fact the case? At one time, XRP would possibly were the token powering a world-class blockchain community. However what about now? Within the four-plus years of regulatory uncertainty, new crypto competitors have emerged which are sooner and extra environment friendly in processing monetary transactions.

And, to make issues worse, the XRP blockchain nonetheless does no longer have sensible contract capability. That is vital as a result of sensible contracts are the construction blocks of decentralized finance. Thus, the entire application of XRP is a lot more restricted than many of us suppose.

Chainlink

In any case, there may be Chainlink. Of the 3 cryptocurrencies indexed right here, I believe that is the person who has achieved the most efficient activity of reinventing itself. In 2025, Chainlink appears to be catching fireplace, and is now up 15% for the 12 months. That is even higher than Bitcoin, which is up 8%.

Chainlink is getting a spice up from the Trump management, which not too long ago invested $4.7 million into it by the use of Global Liberty Monetary. In doing so, Global Liberty Monetary additionally gave Chainlink crucial endorsement as a long run DeFi spouse.

Symbol supply: Getty Pictures.

DeFi is in point of fact just the beginning for Chainlink, which could also be at the vanguard of the real-world asset (RWA) tokenization pattern. In line with most sensible consulting companies, this has the prospective to turn out to be a multitrillion-dollar marketplace alternative.

Merely mentioned, RWA tokenization comes to changing conventional monetary property into virtual property that continue to exist the blockchain. As soon as those property are at the blockchain, there may be the potential of monumental potency beneficial properties. The most obvious use instances are genuine property and personal fairness. Consider with the ability to put money into a high-profile genuine property venture, just by purchasing a crypto token.

Oldies, however nonetheless sweets?

At one time, all 3 of those cryptocurrencies have been no-brainer investments. However XRP has been round for greater than a decade, and hasn’t ever as soon as traded upper than $3.84. And Ethereum has been a marketplace underperformer for just about six months now. They each would possibly leap in worth in 2025, however there are without a doubt issues whenever you peek below the hood.

If compelled to select amongst those 3 oldies however sweets, I might pick out Chainlink. It kind of feels to be within the excellent graces of the Trump management, and is gaining steam as a play on each DeFi and asset tokenization. In case you are in search of a high-risk, high-reward crypto to diversify your portfolio, it may well be value a more in-depth glance.