Traders searching for a supply of revenue that grows can have spotted a inventory with some thrilling options. Leading edge Commercial Houses (IIPR -2.60%) has raised its payout through about 1,170% since it all started providing a dividend in 2017.

Leading edge Commercial Houses is a web hire actual property funding believe (REIT) with plenty of dividend raises in its historical past, however 0 discounts. Regardless of an excellent observe file, the marketplace is behaving as though a payout relief is across the nook. The inventory has fallen through greater than three-quarters from its earlier top and provides a huge 11.158% yield at contemporary costs.

When you’ve got a lot revel in chasing ultra-high-yield dividend shares, you recognize that what glitters is not all the time gold. Here is a have a look at why this inventory has been providing a double-digit yield to look if it can be a good purchase for other people searching for a brand new income-generating funding.

Why Leading edge Commercial Houses’ inventory is down

In a nutshell, Leading edge Commercial Houses’ inventory is far down since the REIT’s greatest tenant, PharmaCann, has fallen at the back of on hire. On Dec. 19, PharmaCann defaulted on responsibilities to pay hire for the month of December beneath six of eleven rentals.

PharmaCann made excellent on $90,000 value of hire for 5 of its rentals, however this was once of little comfort to traders. The condominium bills it ignored totaled $4.2 million.

Leading edge Commercial was once ready to use safety deposits to make up the adaptation. With PharmaCann accountable for 16.5% of the REIT’s general condominium earnings, keeping up its dividend payout within the quarters forward shall be extraordinarily difficult if the built-in hashish manufacturer does not briefly flip itself round.

All over the 3rd quarter of 2024, sooner than PharmaCann defaulted, Leading edge Commercial reported $2.25 consistent with proportion in adjusted price range from operations (FFO), a proxy for income used to judge REITs. That is enough to fulfill a dividend legal responsibility these days set at $1.90 consistent with quarter, however there is not a lot room to take in a large hire default.

If Leading edge Commercial loses any longer of PharmaCann’s incoming condominium bills, FFO most likely would possibly not be enough to fulfill its dividend dedication. That suggests an important dividend relief may well be across the nook.

Do not hang your breath looking forward to a turnaround tale

Leading edge Commercial owns some retail homes however, to its credit score, 98% of its homes are used to domesticate, procedure, or distribute hashish merchandise. When pronouncing PharmaCann’s default in December, the REIT informed traders it anticipated to aggressively put in force its rights, which might imply an eviction.

Whilst there is a likelihood that Leading edge Commercial can evict PharmaCann and substitute it with a brand new tenant, it would possibly not remedy the important thing downside that resulted in PharmaCann’s default: pageant. Hashish is a high-margin sport for early movers, however handiest whilst they are one in all a couple of approved manufacturers of their location.

Top-margin hashish gross sales are brief scenarios that have a tendency to finish once there is a wholesome stage of pageant. Now that there are 24 states with leisure hashish systems, I’m going to be very shocked if PharmaCann is the ultimate large borrower that has bother making hire bills to Leading edge Commercial Houses.

Hashish benefit margins are getting slender, however they might shrink a lot additional because of a criminal rescheduling of hashish on the federal stage. Whilst this may be nice for customers, an exploding choice of new cultivators and processors now not limited through federal legislation will perhaps reason benefit margins for this REIT’s already unprofitable tenants to shrink even additional.

Stay taking a look

As a primary mover within the hashish business, this web hire REIT submit a blinding efficiency in previous years. Sadly, it has extra large tenants that would quickly have a difficult time making ends meet.

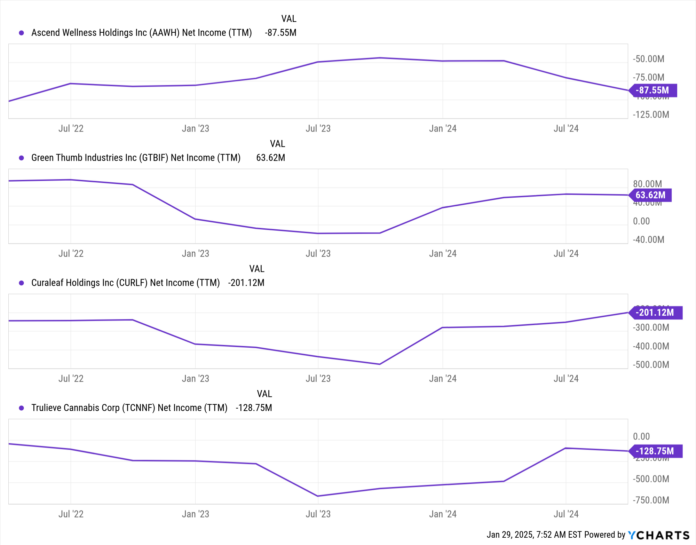

In descending order, PharmaCann, Ascend Wellness, Inexperienced Thumb Industries, Curaleaf Holdings, and Trulieve Hashish are this REIT’s greatest tenants. Whilst their operations had been producing sufficient money to make hire bills, Inexperienced Thumb is the one the sort of companies reporting sure web revenue on a most often authorized accounting ideas (GAAP) foundation.

AAWH Net Income (TTM) knowledge through YCharts

Nearly all of this REIT’s tenants have been having bother reporting earnings when pageant of their respective places was once somewhat mild. Sadly for the ones manufacturers, native costs on retail hashish merchandise can plummet as soon as a handful of operations start competing in opposition to every different.

Leading edge Commercial’s double-digit dividend yield proportion is tempting, however it is exhausting to look how it is going to care for its payout if PharmaCann does not flip itself round straight away. With a loss of profitability amongst 4 of its 5 greatest tenants, extra issues appear most probably. With this in thoughts, there are many higher ultra-high-yield shares to imagine.