The us’s second-largest financial institution and Warren Buffett’s third-largest keeping turns out like a no brainer.

It’s possible you’ll know Financial institution of The us (BAC 0.28%) as some of the international’s greatest monetary establishments. This can be a well known consumer-facing financial institution with over $3.2 trillion in property nowadays. You may additionally understand it for the arguable bailout cash it and its friends gained following the monetary disaster of 2007-2008.

You may additionally affiliate Financial institution of The us with well-known investor Warren Buffett, who has owned inventory in it thru Berkshire Hathaway for years. Financial institution of The us is Berkshire’s third-largest keeping, accounting for roughly 12% of its portfolio.

Both approach, many of us (together with myself) put money into the corporations they know, making Financial institution of The us a sizzling subject. It most certainly does not wish to be stated that Financial institution of The us is a get-rich-quick inventory. The corporate is already massive, with a $350 billion marketplace cap nowadays.

However can Financial institution of The us make you wealthy slowly? Can it compound for many years, probably making you a millionaire over the process your making an investment lifestyles?

The boom-and-bust nature of the massive banks

A financial institution’s trade is modest in the beginning look. A financial institution can pay you hobby at the cash you deposit. The financial institution takes your cash and loans it to anyone else at a better rate of interest. The financial institution makes cash (web hobby source of revenue) from the variation between the hobby they earn at the mortgage and what they pay on deposits.

Giant banks, reminiscent of Financial institution of The us, are way more complicated. They contact nearly each and every side of the economic system, together with non-public and trade banking, mortgages, pupil loans, business actual property, and the monetary markets. Banks may also be very profitable when the economic system is firing on all cylinders, and folks and companies borrow so much.

However it is going the wrong way, too. When one thing is going improper within the monetary markets or the economic system, it normally impacts the banks. Consider the housing crash and monetary disaster of 2007-2008? It used to be in part because of a bubble in subprime mortgages — to which, you guessed it, Financial institution of The us and different large banks had main publicity. Their heavy losses induced monetary intervention from the federal government.

The U.S. economic system is a juggernaut over the long run, however occasionally, issues damage for one reason why or some other. When this occurs, Financial institution of The us and its friends have a tendency to really feel it, too. It comes with the territory of being so deeply ingrained on this planet’s greatest economic system. This creates a boom-and-bust nature for giant banks, and their dimension and notoriety can occasionally lead them to a regulatory goal.

Banking meltdowns devour into the inventory’s long-term efficiency

Over the years, the occasional disaster or recession has dragged Financial institution of The us inventory down.

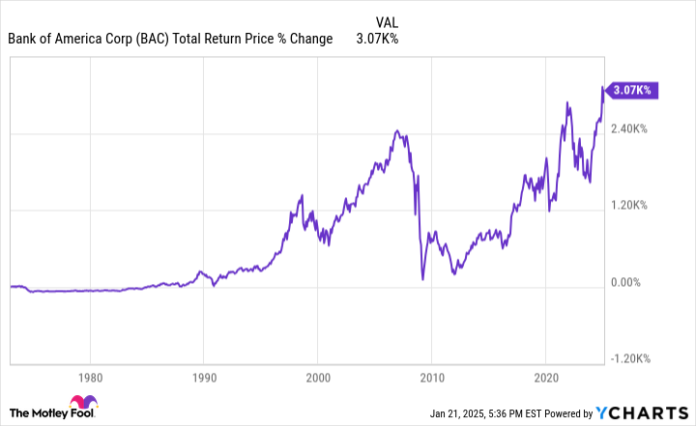

Within the chart underneath, you’ll be able to see that Financial institution of The us’s 2008-2009 crash burnt up a long time of funding returns. Maximum financial institution inventory downturns don’t seem to be that critical, however Financial institution of The us inventory isn’t any stranger to sharp declines. Once in a while, it may take a number of years to recuperate.

BAC Total Return Price knowledge by means of YCharts.

Even nowadays, there are attainable dangers. Emerging rates of interest have piled $108 billion in unrealized losses on hold-to-maturity securities onto Financial institution of The us’s stability sheet. Now, so long as not anything forces Financial institution of The us to the touch the ones securities, it would possibly not have to understand the ones losses. Ultimately, the ones loans will mature harmlessly.

Nonetheless, traders mustn’t totally brush aside the danger. Who is aware of what may occur one day? Who foresaw a world pandemic in 2020?

Can Financial institution of The us make you a millionaire?

Financial institution of The us has been an out of this world inventory for Warren Buffett since he invested in 2011. However as nice as Buffett is, do not purchase Financial institution of The us just because he did. Warren Buffett struck a singular deal for most popular inventory and warrants throughout a time of want for the massive financial institution. It is not the similar as purchasing not unusual inventory at the open marketplace nowadays. Berkshire has trimmed its stake within the corporate during the last 12 months, despite the fact that Financial institution of The us stays a core keeping.

The lesson? Do not purchase (or promote) based totally only on anyone else’s movements, even the ones of a legend like Buffett.

There is a lot to love in Financial institution of The us. It is nonetheless some of the international’s greatest banks and can most probably continue to grow along the U.S. economic system. Analysts be expecting more or less 10% annualized income enlargement over the following 3 to 5 years. The corporate can pay a solid dividend that yields 2.2% nowadays, making it a cast keeping in a assorted portfolio. And, in case you purchased and held thru the entire ups and downs, the inventory has returned over 3,000% for the reason that early Seventies.

However a millionaire-maker nowadays? Almost definitely no longer. Giant banks are too susceptible to crisis, and Financial institution of The us is simply too massive and mature now to ship the explosive enlargement you’ll want for life-changing funding returns anytime quickly.

Financial institution of The us is an promoting spouse of Motley Idiot Cash. Justin Pope has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Financial institution of The us and Berkshire Hathaway. The Motley Idiot has a disclosure coverage.