Galeanu Mihai

Curb Your Enthusiasm

Supply: J.P. Morgan Asset Control

Supply: J.P. Morgan Asset Control

Evaluation and Outlook

4Q

YTD

1-12 months

3-12 months

5-12 months

Wedgewood Composite Internet

5.5

29.1

29.1

7.6

16.8

Usual & Deficient’s 500 Index

2.4

25.0

25.0

8.9

14.5

Russell 1000 Expansion Index

7.1

33.4

33.4

10.5

19.0

Russell 1000 Worth Index

-2.0

14.4

14.4

5.6

8.7

10-12 months

15-12 months

20-12 months

25-12 months

30-12 months

Wedgewood Composite Internet

12.5

13.6

10.9

8.8

13.2

Usual & Deficient’s 500 Index

13.1

13.9

10.4

7.7

10.9

Russell 1000 Expansion Index

16.8

16.5

12.6

7.8

11.6

Russell 1000 Worth Index

8.5

10.8

7.9

7.4

9.8 1

Click on to magnify

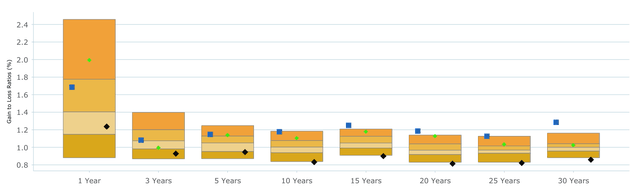

Supervisor vs Universe:Achieve to Loss Ratio (As of September 2024)

1 YEAR

3 YEARS

5 YEARS

10 YEARS

15 YEARS

20 YEARS

25 YEARS

30

YEARS

Median

1.40

1.07

1.05

1.00

1.05

0.97

0.97

1.00

Centered Massive Cap Expansion Wedgewood

Complete

1.69

1.08

1.15

1.18

1.25

1.19

1.13

1.29

Russell 1000 Expansion

1.99

0.99

1.14

1.10

1.18

1.13

1.03

1.02

S&P 500 (SP500, SPX)

1.24

0.93

0.95

0.83

0.90

0.81

0.82

0.86

Legitimate Depend

769.00

763.00

726.00

635.00

516.00

387.00

240.00

133.00

Click on to magnify

Supply: PSN Massive Cap Supervisor Database. Knowledge calculated for managers on gross-of-fee returns. See net-of-fees above. Previous efficiency is noguarantee of long term effects. Long run effects would possibly fluctuate materially from previous effects. Please see further disclosures p. 29.

1 Portfolio returns and contribution figures are calculated internet of prices. Contribution to go back calculations are initial. The holdings recognized don’t constitute the entire securities bought, offered, or beneficial. Returns are offered internet of prices and come with the reinvestment of all source of revenue. “Internet (precise)” returns are calculated the usage of precise control prices and are lowered by way of all prices and transaction prices incurred. Previous efficiency does now not ensure long term effects. Further calculation data is to be had upon request.

Click on to magnify

This autumn Most sensible Participants

Avg. Wgt.

Contribution to Go back

Texas Pacific Land (TPL)

1.65

1.60

Taiwan Semiconductor Production (TSM)

8.38

1.16

Alphabet (GOOG,GOOGL)

7.88

1.07

Visa (V)

6.96

1.02

Reserving Holdings (BKNG)

5.12

0.86

This autumn Backside Participants

CDW

3.46

-0.97

UnitedHealth (UNH)

6.22

-0.73

Tractor Provide Corporate (TSCO)

5.12

-0.44

Previous Dominion Freight Line (ODFL)

2.23

-0.21

Pool Corp (POOL)

2.21

-0.17

2024 Most sensible Participants

Avg. Wgt.

Contribution to Go back

Taiwan Semiconductor Production

7.51

5.74

Meta Platforms (META)

8.69

5.68

Alphabet

7.74

2.62

Texas Pacific Land

1.61

2.59

Motorola Answers (MSI)

5.38

2.55

2024 Backside Participants

CDW

4.46

-0.98

Pool Corp

2.61

-0.32

Previous Dominion Freight Line

2.59

-0.20

Edwards Lifesciences (EW)

4.44

0.16

UnitedHealth

6.07

0.18

Click on to magnify

Most sensible efficiency individuals for the fourth quarter come with Texas Pacific Land, Taiwan Semiconductor Production, Alphabet, Visa and Reserving Holdings. Most sensible efficiency detractors for the fourth quarter come with CDW, UnitedHealth, Tractor Provide Corporate, Previous Dominion Freight Line and Pool Corp.

Most sensible efficiency individuals for the yr come with Taiwan Semiconductor Production, Meta Platforms, Alphabet, Texas Pacific Land and Motorola Answers. Most sensible efficiency detractors for the yr come with CDW, Pool Corp, Previous Dominion Freight Line, Edwards Lifesciences and UnitedHealth Team.

All the way through the quarter we offered Texas Pacific Land.

Texas Pacific Land used to be a most sensible contributor to efficiency all the way through each the quarter and the yr. Texas Pacific Land is still an awfully distinctive and successful trade. The Corporate owns over 800,000 floor acres of land within the Texas Permian Basin. The majority of this land used to be got within the yr 1888 and extra not too long ago (i.e. the ultimate 15 years) this land changed into extremely productive oil and gasoline royalty acreage thank you to fashionable drilling and finishing touch tactics and applied sciences. In spite of all of those deserved accolades, we liquidated our positions after the inventory rallied moderately sharply upon being consecutively added to 2 primary inventory indexes during the last seven months. The income energy of the Corporate has now not considerably modified during the last seven months (for higher or worse). On the other hand, passive indexes and the investors and executives that carefully observe and benchmark towards the ones indexes successfully tripled their appraisal of the Corporate’s company price, whilst that price by no means modified. We can proceed to observe Texas Pacific Land from the sidelines and would hope to spend money on them once more, most likely after the marketplace’s “animal spirits” subside.

Taiwan Semiconductor Production used to be some other most sensible contributor to efficiency all the way through the quarter and for the yr. The Corporate’s income expansion dramatically speeded up in comparison to ultimate yr because the Corporate’s wafer fabrication and packaging volumes soared in 2024. As well as, the Corporate buyer costs rebounded within the face of extra normalized capital expenditures. The Corporate maintains a near-monopoly within the fabrication of just about each and every new AI accelerator delivered to marketplace during the last two years. They proceed making an investment tens of billions to construct and fill long term capability with orders for what appears to be insatiable hyperscale call for for speeded up computing. The inventory ended the yr buying and selling at a consensus ahead income a couple of this is a number of issues less than extensive cap expansion benchmarks, in spite of the Corporate’s dominant place in a very powerful trade this is riding some of the biggest technological shifts in a technology.

Edwards Lifesciences used to be a contributor to quarterly efficiency however simplest fairly impacted annual portfolio efficiency. As we famous previous this yr, the Corporate’s flagship transcatheter aortic valve alternative (TAVR) franchise slowed as in comparison to the Corporate’s contemporary historical past. Whilst the TAVR marketplace is maturing, it’s nonetheless a long way from saturated, as contemporary medical trial effects demonstrated. Many aortic stenosis sufferers previous to searching for TAVR remedy showcase hostile signs, incessantly prompting them to get the assistance of a health care provider within the first position. On the other hand, there’s a extensive inhabitants stricken with aortic stenosis that don’t showcase signs which is monitored reasonably than handled with TAVR. Edwards offered knowledge from its EARLY TAVR trial that confirmed 45 % of untreated asymptomatic aortic stenosis exhibited no signs, nonetheless ended up death, suffered a stroke, or have been hospitalized for cardiac occasions in comparison to simplest 26 % that were handled with TAVR. The usual of handle a illness equivalent to most cancers is quick intervention reasonably than looking forward to signs to irritate. The EARLY trial may just assist place aortic stenosis remedy on a equivalent medical footing as most cancers remedy. Even though this is only one find out about, it provides to the really extensive frame of information that Edwards has created via its R&D investments, emphasizing how necessary their remedies are for sufferers. Edwards is definitely located for double-digit income expansion over the following a number of years as they extend its structural center franchise into new populations and indications.

O’Reilly Car modestly contributed to efficiency for the quarter and for the yr. After a couple of years of oversized income and income expansion, O’Reilly delivered extra normalized gross sales and income expansion in 2024 however continues to dominate within the extremely fragmented automobile portions trade. As we now have famous up to now, the Corporate has a most commonly singular focal point at the U.S. marketplace, whilst a number of competition have diverted their consideration and investments clear of the massive and fragmented home marketplace towards non-U.S. or nonautomotive markets. O’Reilly has taken benefit proportion, specifically within the sooner rising do-it-for-me (DIFM) finish markets, by way of focusing each its hiring and capital expenditures on their U.S. retail outlets and distribution infrastructure, whilst restricting acquisitions. We might believe including to our positions sooner or later if momentary buyers ever soured on stocks because of protracted bouts of delicate climate.

Tractor Provide Corporate detracted from efficiency all the way through the quarter after reporting a slight decline in income on gross sales that have been rather 7lat. Tractor Provide Corporate is still a best-in-class store, eager about serving their area of interest consumers that are living in and take care of rural properties and homesteads, incessantly with higher-than-average earning. All the way through the peak of Covid-19 within the U.S., the Corporate grew considerably sooner than its ancient charges. Since then, and as shopper spending patterns have over-corrected again in opposition to products and services, we now have observed expansion normalize. On the other hand, the Corporate continues to showcase superb returns on capital and keeps considerable addressable marketplace to proceed riding anticipated double-digit income expansion via 2030.

CDW used to be a number one detractor from efficiency all the way through the quarter and for the yr. CDW is a distributor and reseller of generation answers – together with {hardware}, device, and products and services – basically serving small companies. A standard CDW buyer has a couple of dozen staff and little if any devoted IT pros. This lengthy tail of shoppers is tricky for enormous generation distributors to succeed in, making CDW an crucial spouse for plenty of {hardware} and device carrier suppliers. Even if synthetic intelligence is at the most sensible of buyers’ minds, lots of CDW’s small trade consumers are nonetheless within the strategy of adopting elementary IT answers which can be “previous information” to maximum buyers, equivalent to cloud computing and virtual safety. As political winds within the U.S. shift towards supporting U.S. companies, specifically via decrease taxes, small companies may just receive advantages, which will have to assist force IT investments. CDW’s scale normally lets in the Corporate to take proportion in small trade IT spend, so we might be expecting any small trade upturn to reaccelerate CDW’s expansion profile.

Corporate Commentaries

Synthetic Intelligence (‘AI’)

In our year-end Letter ultimate yr, we mentioned our collective AI publicity in 4 of our holdings: Alphabet, Apple, Meta Platforms and Taiwan Semiconductor Production. This yr we wish to proceed to proportion our evolving ideas on AI.

Why AI?

There were triple-digit returns and trillions of bucks in marketplace capitalization added to a number of publicly traded firms pushed by way of surging call for for AI-specific {hardware} and device during the last few years. Whilst Wall Side road’s appreciation of those firms turns out to head larger by way of the day, Primary Side road’s appreciation and working out most certainly is not there but. Imaginations are getting used to fill within the yawning hole between what the marketplace is implying and what AI can in fact do for other folks nowadays. Chatbots are occasionally a laugh to speak to however lovely dull to discuss. As a rule, conversations about AI veer in opposition to the fanciful, if now not hackneyed, imaginary long term of robots roaming the panorama.

There is nonetheless the nagging suspicion that AI is an answer looking for an issue. Informal use of AI chatbots automatically returns flawed data. Why are masses of billions of bucks chasing one thing that may’t rely? ( https://neighborhood.openai.com/t/incorrect-count-of- r-characters-in-the-word-strawberry/829618) AI champions incessantly counter that the wonders of AI can not most likely be recognized at this day and age. As though each and every flaw in any AI’s output is most certainly a false impression or laziness by way of the person and only a “hallucination” by way of this system. Mistakes sound higher when they are referred to as hallucinations, versus being categorized as “bullshit!” (Hicks, Michael Townsen, et al. “ChatGPT is Bullshit.” Ethics and Data Era, vol. 26, no. 38, 2024, doi: 10.1007/s10676-024-09775-5).

Our view on AI is way much less progressive or fanciful and extra gradualist and incremental. AI did not fall out of a coconut tree in early 2023. It is been hiding in undeniable sight. We’ve got owned Alphabet for over 15 years and Meta Platforms during the last just about seven years. Each firms are cloud-native and feature been profitably serving billions of customers each day for over a decade. Off-the-shelf {hardware} answers for those firms is incessantly now not economically appropriate with that more or less person call for. As an alternative, homegrown {hardware} and device answers to unravel company-specific issues had been standard for Meta and Alphabet. With a view to serve their large person bases, the Corporations had been depending on system studying. For instance, Alphabet’s Google subsidiary launched TensorFlow early in 2015 after spending years deploying a equivalent machine throughout their homes. ( https:// www.bloomberg.com/news/articles/2015-10-26/google-turning-its-lucrative- web-search-over-to-ai-machines?embedded-checkout=true) All the way through one among Alphabet’s 2015 income convention calls, a Wall Side road analyst dutifully requested control to give an explanation for how “system studying could make [Google Apps] extra helpful” as ML hadn’t actually been mentioned on calls ahead of.

Perhaps that query used to be now not in contrast to nowadays, as we ask, “Why AI?”

But we all know from 2015 on, Alphabet would move to spend a cumulative $250 billion on analysis and construction and $200 billion in capital expenditures for {hardware} and device to extend system studying throughout its complete fleet, serving to Alphabet generate virtually $500 billion in gross cumulative money go with the flow. Alphabet’s Tensor Processing Devices emerged as key {hardware} inventions that served the Corporate’s necessities for coaching and inference at the huge quantities of incoming knowledge, the place trade same old CPUs weren’t technically or economically as useful.

Not like Alphabet, Meta has relied extra on GPUs supplied by way of Nvidia to do a lot of its system studying paintings, despite the fact that the Corporate extra not too long ago started the usage of proprietary ASICs. ( https://engineering.facebook.com/2015/12/10/ml-applications/facebook-to-open- source-ai-hardware-design/). On the other hand, Meta used to be a pioneer in the usage of those GPUs at scale, once more, out of necessity for maintaining with the information its billions of customers have been developing each day. During the last decade, Meta has spent round $160 billion in R&D and $130 billion in capex whilst producing cumulative gross money flows of $280 billion.

Astonishing returns for each Alphabet and Meta Platforms. So, the solution to “Why AI now”

As a result of it is been right here all alongside!

S&P World

Wedgewood has owned S&P World (SPGI) for simply over 5 years. It’s been a reasonably peculiar maintaining, in that we took an preliminary place of simply 2.5% 5 years in the past in past due 2019, and we now have neither added to nor trimmed our place since. It’s time to supply an replace at the Corporate.

A lot of you’ll keep in mind S&P World was once referred to as Usual & Deficient’s, lengthy recognized firstly as a credit score scores company and a go-to supply of economic data. Based within the Nineteen Sixties by way of Henry Varnum Deficient, the beginning of the corporate used to be a chain of books revealed by way of Deficient offering monetary and working statistics for U.S. railroads.

Supply: Archive.org

A long time later, Luther Lee Blake based the Usual Statistics Bureau, reasonably brilliantly hitting at the thought of doing what Deficient did, apart from protecting each and every trade within the U.S. One would possibly chortle that this used to be a time and position just about unfathomable to many people within the funding career, when the entire monetary knowledge we might ever want used to be now not to be had at our fingertips on a PC, computer, or smartphone. Usual, as an example, delivered monetary details about firms on – would you imagine – index playing cards, that have been up to date (simply) a number of occasions according to yr. We think your intrepid funding skilled of the time would seek the advice of one thing like an enormous rolodex of index playing cards to guage attainable investments for purchasers. Junior analysts would get the process of slipping the up to date playing cards into position.

Through the years, a chain of commercial combos first introduced the 2 firms in combination within the Nineteen Forties. They then handed in the course of the writer, McGraw-Hill, for a number of many years ahead of numerous funding banking offers ultimately break up the corporate into a couple of items, leaving us now with S&P World – kind of returning to the heritage of the previous Usual & Deficient’s.

The trade nowadays provides numerous data products and services, together with the essential bond scores trade, the place it successfully operates as a duopoly with long-time competitor Moody’s. Moreover, S&P World runs the extremely successful marketplace Indices trade and offers large marketplace and commodity marketplace knowledge, amongst different products and services.

Once we first bought the inventory, we highlighted our trust that the corporate may just keep growing revenues at a wholesome, mid-to-high single-digit share vary, with alternatives to toughen its already remarkable, duopoly-like profitability, resulting in constant double-digit income expansion. We anticipated the flagship scores trade, which generates kind of 1/2 of the corporate’s income, to be a long-term beneficiary from apparently eternally low rates of interest at the moment – as central banks have been additionally serving to to spur the marketplace by way of actively buying company debt. The Marketplace Intelligence phase, a low-price data carrier providing, used to be anticipated to develop its person base, because it prolonged its buyer base achieving past nonfinancial trade verticals. Moreover, passive asset fairness flows, together with the rising ETF marketplace, have been anticipated too to force the extremely successful Indices phase.

Having a look again during the last 5 years, we might say that little has modified in our interested by the Corporate all the way through our maintaining duration. Little too has modified in regards to the Corporate’s methods or operations both. On the other hand, the stunning outbreak of Covid-19 in a while when we initiated our maintaining ended in a number of years of exaggerated financial swings and competitive executive coverage responses, which means that almost not anything has been standard between 2020-2023 on the subject of the Corporate’s marketplace prerequisites. Whilst inventory efficiency has been quite cast during the last five-plus years, the inventory has lagged the Russell 1000 Expansion Index and the S&P 500 Index. The inventory has been a relative loser for us over all of the maintaining duration. So, you could ask us, very quite, how we will say that our considering hasn’t modified, and why we nonetheless have optimism within the trade?

First, elementary efficiency in fact has been moderately excellent all the way through our maintaining duration. Income and income according to proportion expansion has speeded up all the way through the primary few years we held the inventory, even though there have been advantages, we had now not expected from early executive and central financial institution responses to Covid-19. As you’ll be able to see within the desk underneath, as soon as central banks began elevating rates of interest to fend off the numerous ranges of inflation that surged internationally, capital marketplace process dried up – after a duration of artificially excessive process – leaving the Corporate and lots of different companies with a little of an air pocket in 2022.

S&P World Monetary Metrics 2016-2024

(9 months)

2016

2017

2018

201G

2020

2021

2022

2023

2024

Income expansion

6.6%

7.1%

3.2%

7.1%

11.1%

11.5%

-4.0%

11.8%

14.0%

EPS expansion

18.1%

18.9%

33.6%

12.1%

22.7%

17.2%

-4.0%

12.6%

26.0%

Click on to magnify

Supply: Corporate stories and FactSet Knowledge Programs

On the other hand, shifting into 2023-2024, as central banks started slicing rates of interest once more, you’ll be able to see too that the trade picked up once more, rising at charges comparably favorable to the duration simply previous to our unique acquire in 2019.

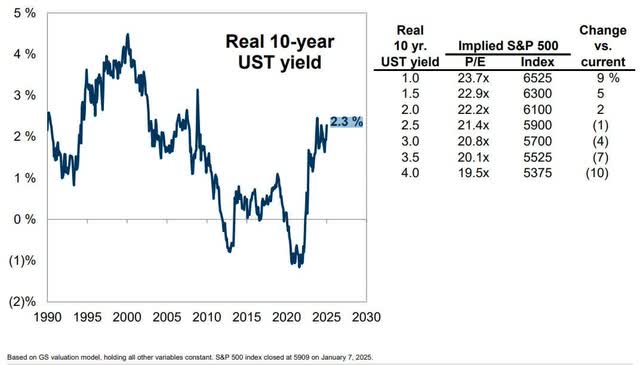

Our number one argument for the inventory is this trade fashion is a profitable fashion in anything else comparable to a regular marketplace. A lot of this trade is pushed by way of converting rates of interest and company debt refinancing. Whilst most blatant within the 7lagship scores trade – the place decrease charges inspire entities to hunt to extra borrowing, maximum markets usually might be extra lively when charges are decrease reasonably than larger. Decrease charges beget larger capital formation, larger valuations for all sorts of commodities and draw in extra contributors searching for data and alternatives to shop for or promote.

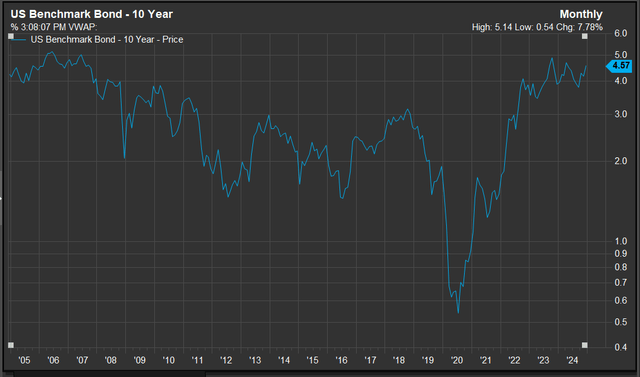

The U.S. and many of the advanced global had been in a declining or low-interest fee atmosphere for many years. Govt and central fiscal coverage usually had been very unfastened for the reason that 2007-2009 world monetary disaster – if truth be told, throughout the duration after we first bought this inventory, as you’ll be able to see within the chart appearing the ultimate two decades of U.S. Treasury yields, underneath.

Supply: FactSet Knowledge Programs

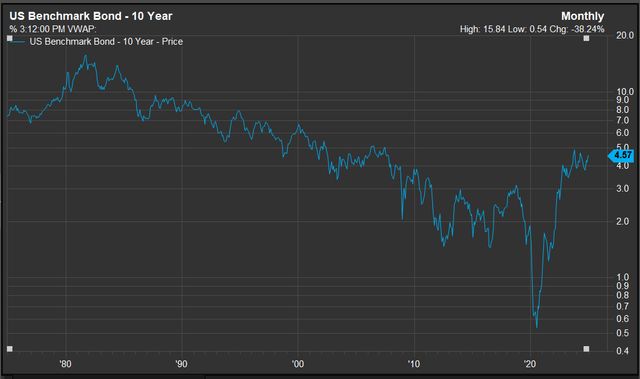

A lot of you’ll additionally know that the USA, plus a lot of the advanced global, has been in a loosening rate of interest atmosphere for for much longer, many years if truth be told.

Supply: FactSet Knowledge Programs

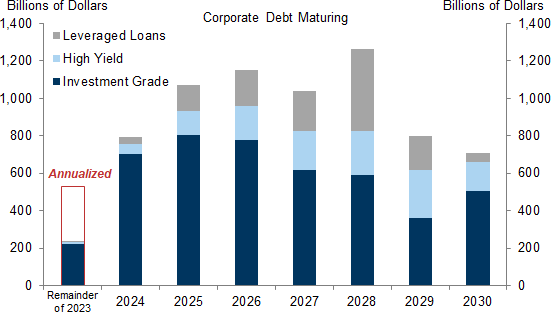

Atmosphere apart arguments in regards to the rationale at the back of long-term Federal Reserve and federal executive coverage or any near-term debates in regards to the most probably results of coverage selections by way of the incoming Trump management, we argue that there’s a transparent long-term bias in desire of looser fiscal coverage. One simplest want to see the marketplace’s (and the Fed’s) contemporary fascination with bringing rates of interest go into reverse once more, in spite of a reasonably wholesome financial system and above- goal inflation. Whilst low rates of interest have lengthy been a device for exciting a suffering financial system, it kind of feels that too many contributors now view low rates of interest because the default. If we – and the 50 years of charts laid out above – are right kind, we might argue that the ultimate 5 inconsistent years of rates of interest, debt issuance, and capital formation are an anomaly reasonably than a long-term development, and we might be expecting S&P World’s trade to revel in a extra favorable atmosphere over the following a number of years as a wall of debt refinancings loom in the following few years.

Supply: Goldman Sachs

This leads us to 1 different think about our funding in S&P World: we imagine the drivers of the Corporate’s trade supply a modest hedge to our funding procedure. Our valuation and profitability disciplines, coupled with a large-cap expansion benchmark pushed ruled by way of generation shares that incessantly don’t fit both of those disciplines, can mix to make it harder for our procedure to overcome stated benchmark within the most powerful marketplace rallies. Those rallies incessantly coincide with declining rate of interest cycles, or a minimum of expectancies of declining charges, simply as observed in 2024. Thus, we imagine it’s useful to possess a beautiful, successful expansion trade equivalent to S&P World, particularly as a result of its biggest scores phase has a tendency to be supercharged by way of declining charges. Whilst we wouldn’t personal the inventory simplest because of this, we do respect that this high quality, remarkably successful, near-monopolistic trade fashion to accomplish higher in environments when our funding procedure has a tendency to have a rather harder time.

Curb Your Enthusiasm

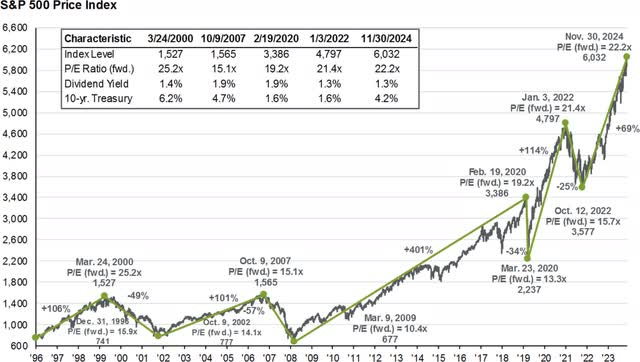

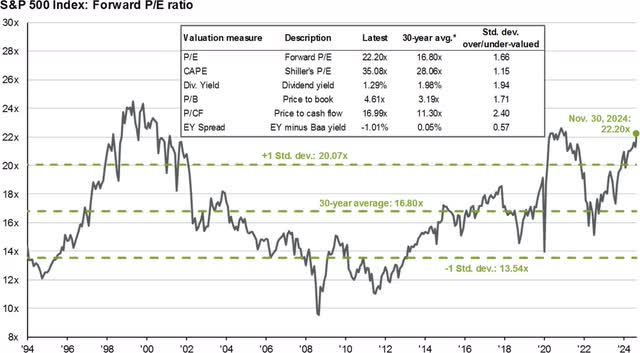

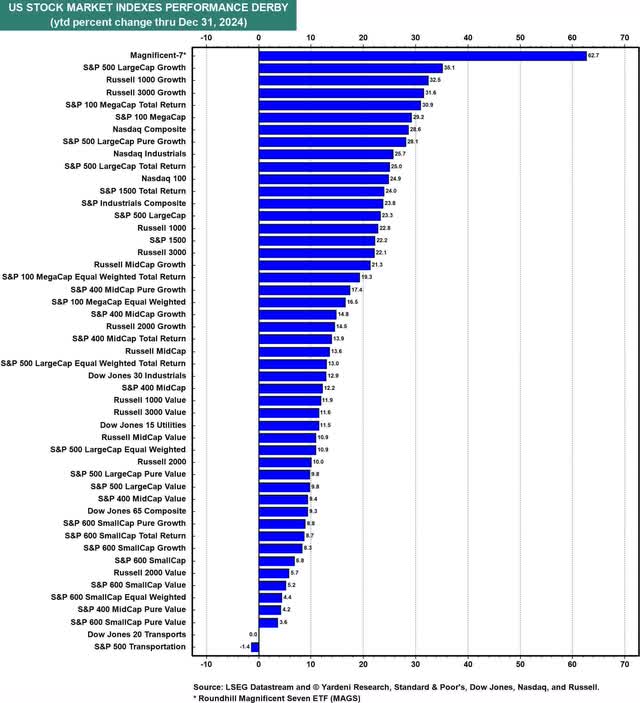

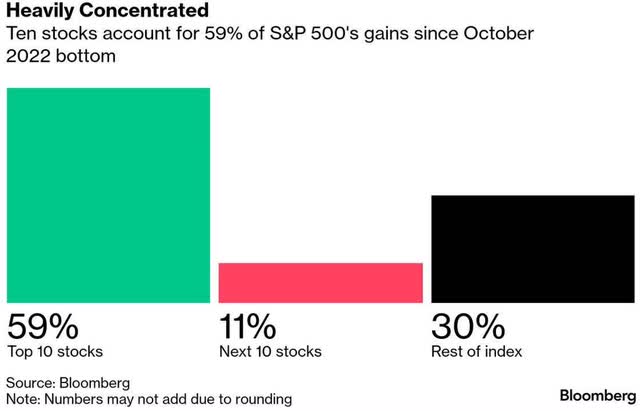

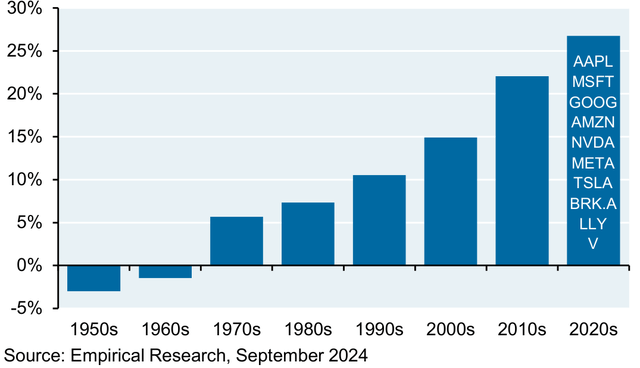

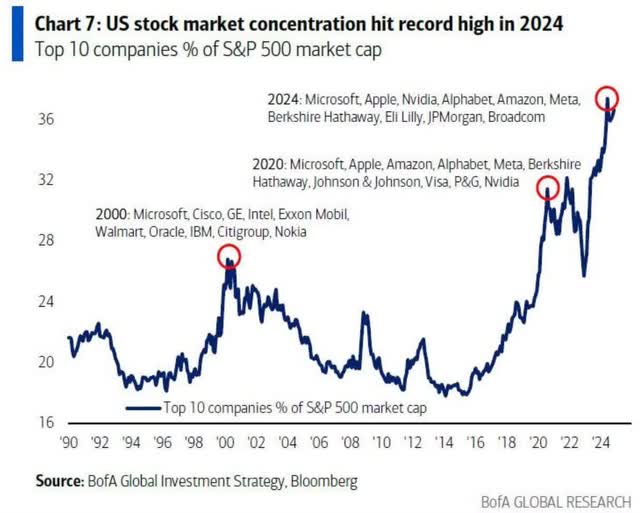

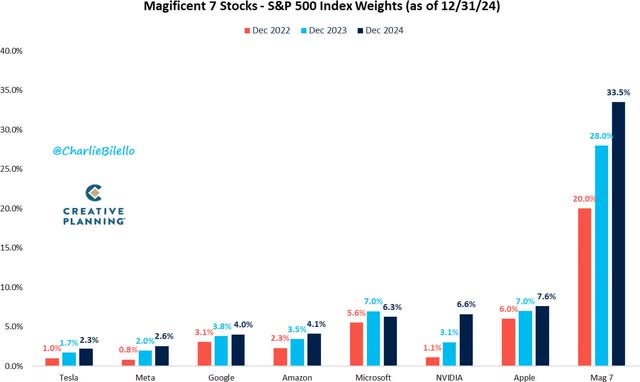

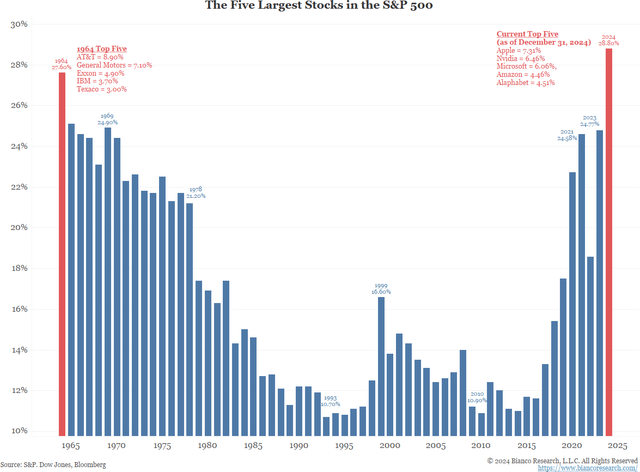

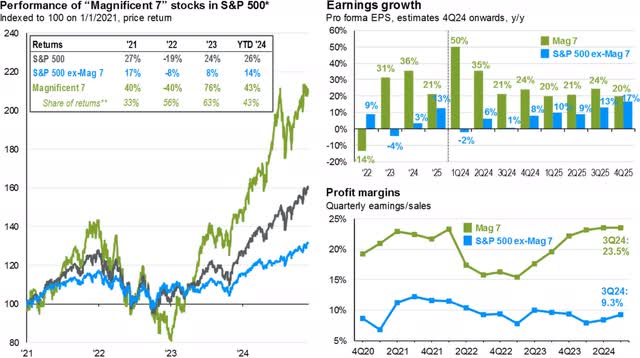

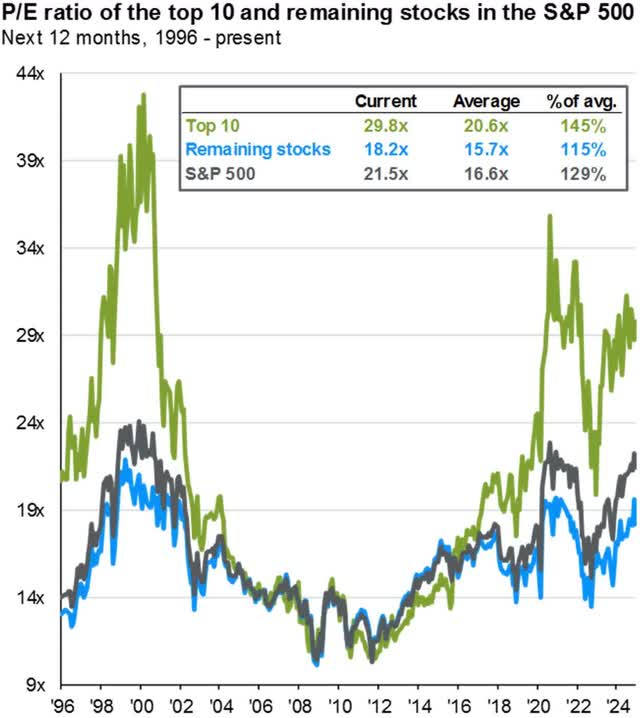

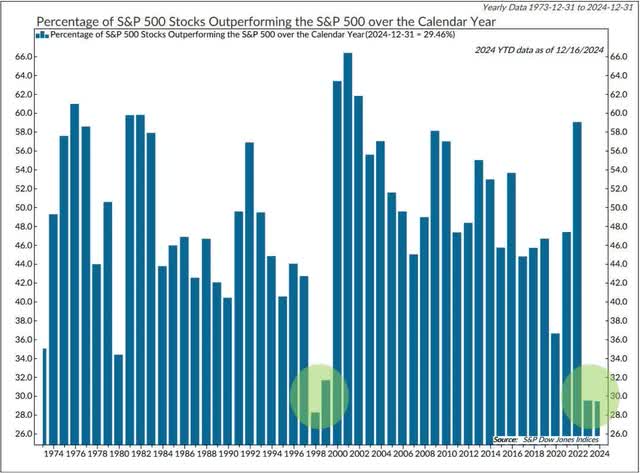

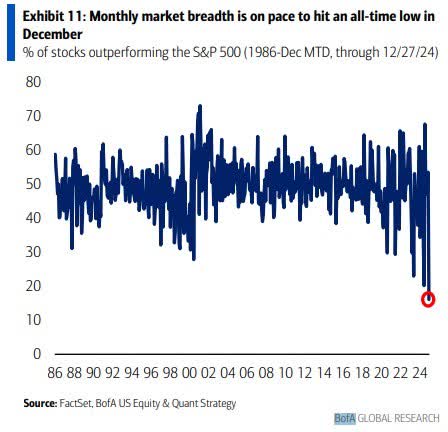

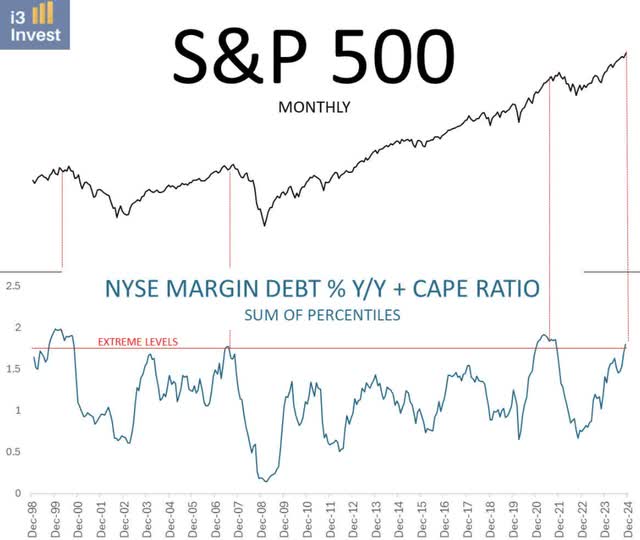

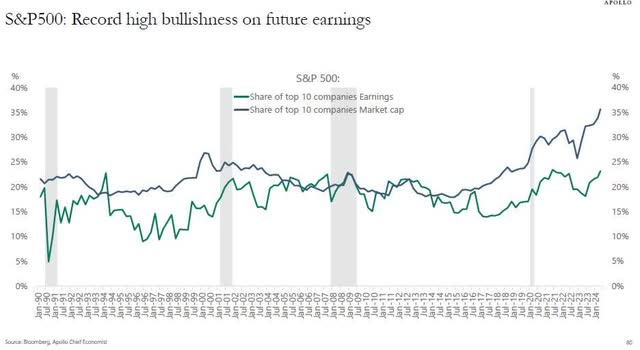

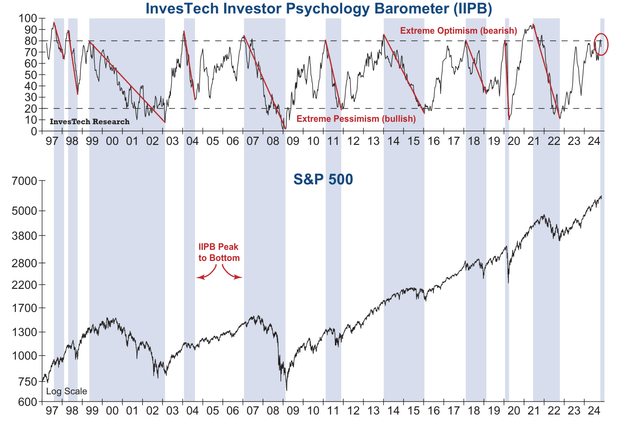

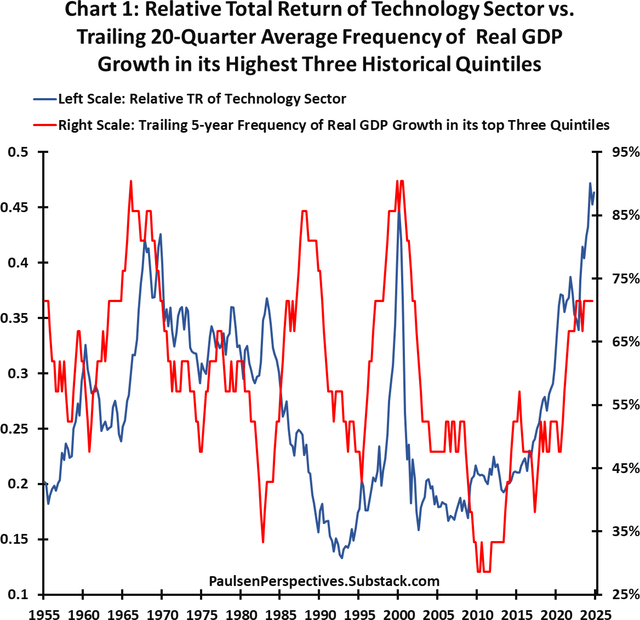

2024 used to be actually a repeat of 2023. The S&P 500 Index won +25%, following a +26% acquire in 2023, or +58% – posting the most efficient two-year acquire since 1997-1998. The positive factors in 2024 have been as soon as once more led by way of the “Magnificent 7” – which as soon as once more, ended in a difficult yr for lively inventory pickers. (Notice: The equal-weighted S&P 500 Index used to be up simply shy of +13% in 2024 – and simply +28% during the last two years.) The oversized positive factors in those seven generation shares – plus a couple of different of the biggest marketplace cap shares – are none too sudden given their endured collective relative oversized higher profitability, resulting in oversized positive factors in income relative to the remainder of the S&P 500 Index. That stated, the robust a couple of enlargement of various of the biggest shares has now not been met with the similar tempo as income expansion. Additional highlighting this development, Seth Golden reported that each ahead company income expectancies and ahead P/E ratios higher by way of double-digits in 2024 – simplest the 3rd incidence up to now 29 years. (See following charts and graphics for added main points.)

Loose money go with the flow margins by way of decade for the 10 biggest shares, 1952-2024, P.c

Supply: J.P. Morgan Asset Control

For the reason that short-lived Covid-19 lows in March 2020, the S&P 500 Index has won +167%. From the quick undergo marketplace lows in past due 2022, the index climbed +62% and simply for the reason that transient marketplace sell-off in past due October 2023, it has won +45%. Speculative juices are flowing. Remember the fact that, valuations have transform worryingly stretched, whilst investor (speculator) expectancies are actually off the charts. So far as the inventory marketplace is going, everybody appears to be within the pool.

(An apart: For recreation, watch the affect – bullish or bearish – of Nvidia inventory may just neatly affect large swaths of the inventory marketplace. The meteoric upward push of the inventory has been one thing to behold. Congratulations to present shareholders. We owned the inventory some years previous however utterly ignored the hot run. That mea culpa apart, believe a couple of date issues from Bianco Analysis: Nvidia’s marketplace cap is these days virtually 12% of U.S. GDP, greater than double the marketplace cap of Cisco on the top of the Dot-Com bubble, which used to be “simplest” 5.5% of U.S. GDP. The one inventory ETF (NVDL), which provides 2X publicity to Nvidia’s fee, began the yr with $220 million in property and ended the yr with $5.4 billion in property – a 24X building up. And talking of leveraged ETFs, the Kobeissi Letter stories, “Heading into 2025, there are actually 100 TIMES extra property in leveraged lengthy budget than leveraged quick budget. During the last 8 weeks, this ratio has DOUBLED, exceeding the report excessive set in December 2021.” Moreover, Bloomberg notes that property in leveraged-long ETFs exceed bearish inverse budget by way of a report virtually 12 occasions!)

InvesTech Investor Psychology Barometer (IIPB)

In our view, the certain basics underlying the positive factors within the inventory marketplace in 2024 would possibly portend net-bullish tides in 2025. That stated, right here a couple of of our favourite being concerned issues in 2025:

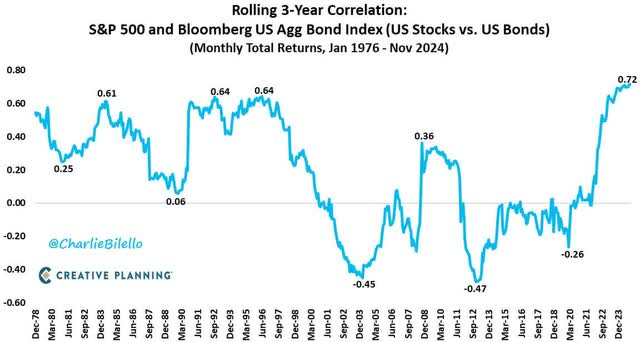

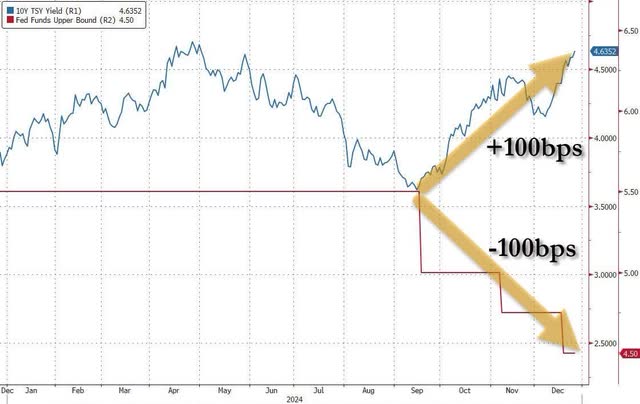

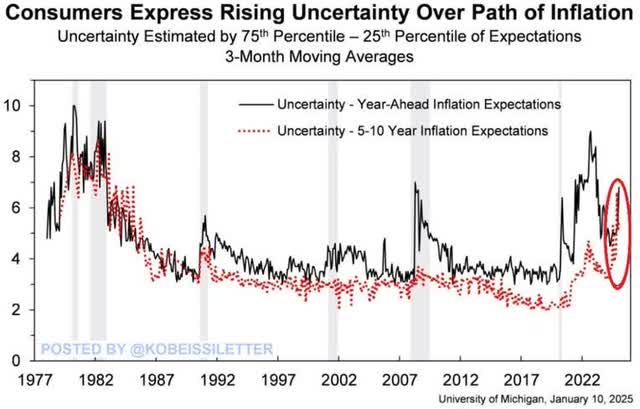

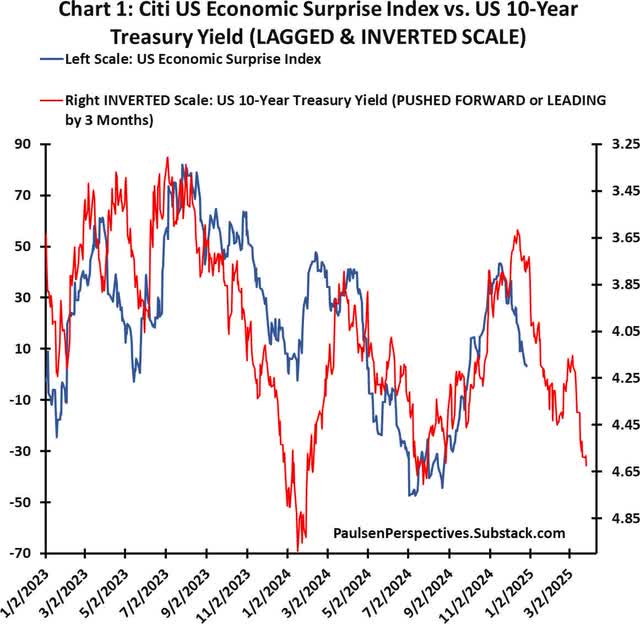

The bond marketplace and inventory marketplace are hip-tied at correlations infrequently skilled during the last half-century. As such, the bond marketplace tail would possibly significantly wag the inventory marketplace canine in 2025. For inventory costs to upward push materially larger, bond costs will have to advance in lockstep – which might most probably require decrease longer-term rates of interest – plus a decrease U.S greenback, which these days sits a 26-month highs.  Bond vigilantes punishing response to endured Federal Reserve easing, as though Powell & Co. are creating a (some other?) coverage mistake within the face of emerging in7lation expectancies, that have driven yields larger, (now 4.8% from 3.6% simply ultimate September) – which satirically exerts a tightening impact as a headwind to financial expansion.

Bond vigilantes punishing response to endured Federal Reserve easing, as though Powell & Co. are creating a (some other?) coverage mistake within the face of emerging in7lation expectancies, that have driven yields larger, (now 4.8% from 3.6% simply ultimate September) – which satirically exerts a tightening impact as a headwind to financial expansion.

Supply: 0 Hedge

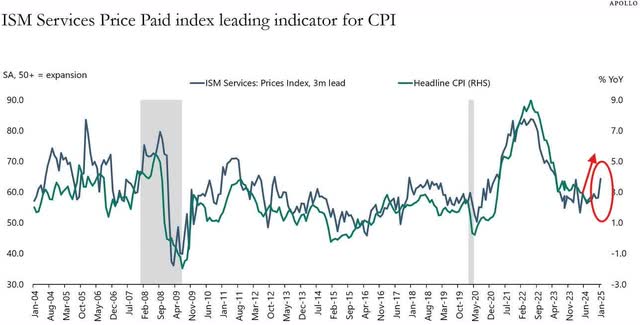

The Kobeissi Letter stories the latest ISM knowledge, a key main indicator for CPI, displays costs paid by way of buying managers are at 22-month excessive. Particularly, the ultimate time ISM Costs Paid have been this excessive used to be in February 2023. In7lation within the U.S. then used to be+6.0%.

Merely put, emerging actual bond yields will serve, at a minimal, as a valuation headwind or tailwind on inventory costs. To this point, in early 2025, they’re a headwind.

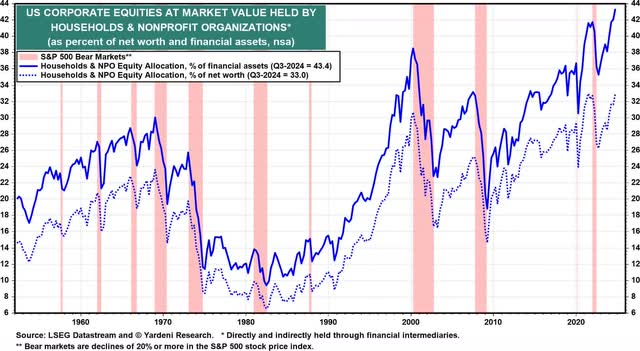

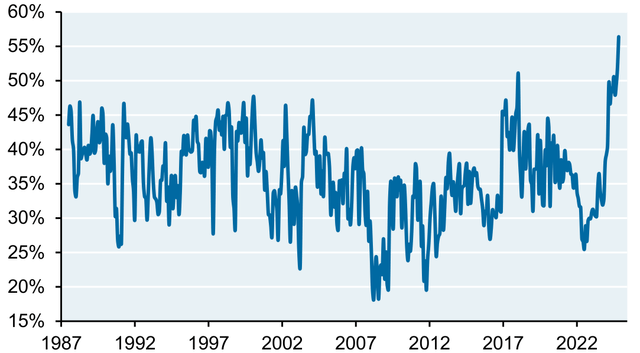

Merely put, emerging actual bond yields will serve, at a minimal, as a valuation headwind or tailwind on inventory costs. To this point, in early 2025, they’re a headwind.  John and Jane Q. Investor would possibly want to curb their inventory marketplace enthusiasm. Families now grasp traditionally oversized weighting in shares. If bond yields proceed their ascent, bonds will transform moderately sexy festival to long term inventory returns.

John and Jane Q. Investor would possibly want to curb their inventory marketplace enthusiasm. Families now grasp traditionally oversized weighting in shares. If bond yields proceed their ascent, bonds will transform moderately sexy festival to long term inventory returns.

Proportion of US families anticipating larger inventory costs in one year, P.c of respondents

Supply: Convention Board, Bloomberg, JPMAM, November 30, 2024

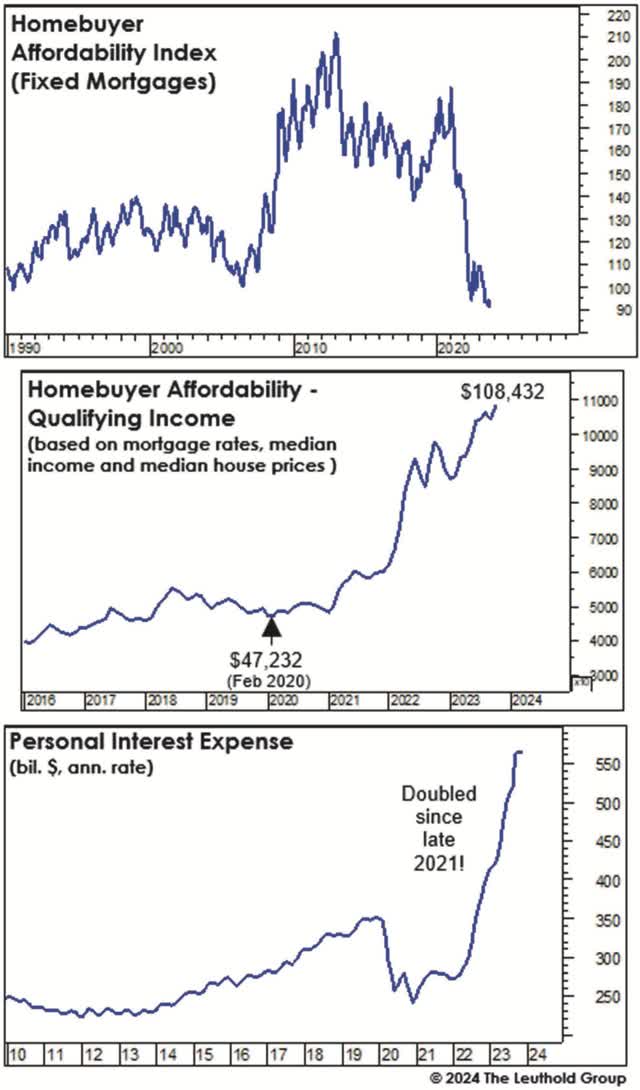

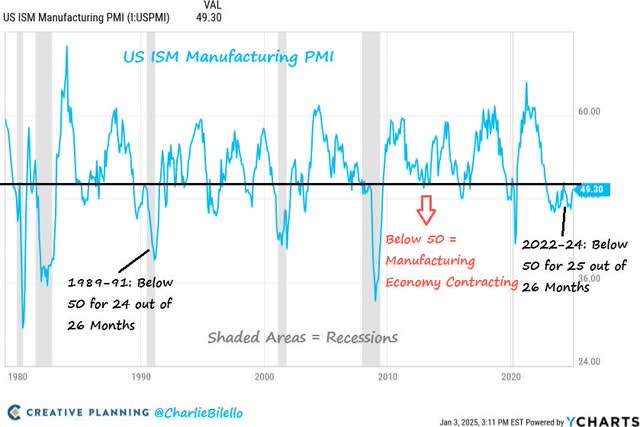

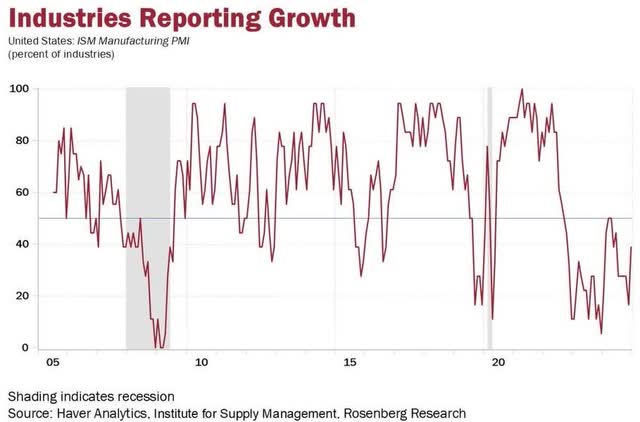

The financial system can not maintain excessive nominal expansion with out the pressure multiplier inherent within the large housing financial system.  Era shares have dramatically outperformed the S&P 500 Index 9 out of the previous 10 years, apparently impervious to adjustments in GDP, adjustments in rates of interest and adjustments within the U.S. greenback. On the other hand, generation firms have a protracted historical past of suffering all the way through decrease ranges of GDP expansion or excessive ranges of upper U.S. greenback alternate charges. In line with Charlie Bilello,“the ISM Production PMI has been underneath 50 (in contraction) for 25 out of the ultimate 26 months. With knowledge going again to 1948, that is by no means came about ahead of.” This implies 2025 may just neatly check generation shares decade-long open box working as opposed to maximum different shares.

Era shares have dramatically outperformed the S&P 500 Index 9 out of the previous 10 years, apparently impervious to adjustments in GDP, adjustments in rates of interest and adjustments within the U.S. greenback. On the other hand, generation firms have a protracted historical past of suffering all the way through decrease ranges of GDP expansion or excessive ranges of upper U.S. greenback alternate charges. In line with Charlie Bilello,“the ISM Production PMI has been underneath 50 (in contraction) for 25 out of the ultimate 26 months. With knowledge going again to 1948, that is by no means came about ahead of.” This implies 2025 may just neatly check generation shares decade-long open box working as opposed to maximum different shares.

Will the U.S. production sector get away of its multiyear recession in 2025? If this is the case, alternative knocks right here.

Will the U.S. production sector get away of its multiyear recession in 2025? If this is the case, alternative knocks right here.

We additionally fear in regards to the dimension, scale and scope of the U.S. federal debt. Admittedly, we recall equivalent worries after we began on this trade of ours lengthy again within the mid-Nineteen Eighties. But, such worries during the last drawing near 4 many years appear now to had been a waste of fear and time. Perhaps debt and deficits don’t subject in spite of everything. Lately, we doubt it despite the fact that – specifically given the skyrocketing price to finance our skyrocketing nationwide debt. In the end, bond vigilantes will render the marketplace’s verdict in this rating – specifically if the danger that the Fed would possibly want to opposite route in 2025 and as soon as once more elevate charges if inflation heats up once more.

We’ve infrequently commented on debt and deficits in those Letters during the last few many years. We’re the first to confess our analytical obstacles on such issues. On the other hand, after we believe the next information and figures circa-2025 we do take pause of the which means of all of it – specifically the closer long term trail of longer-term rates of interest:

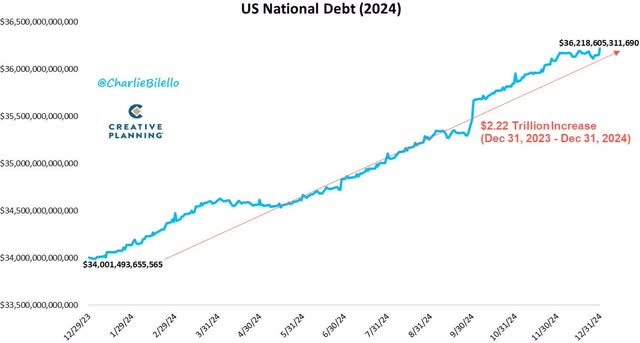

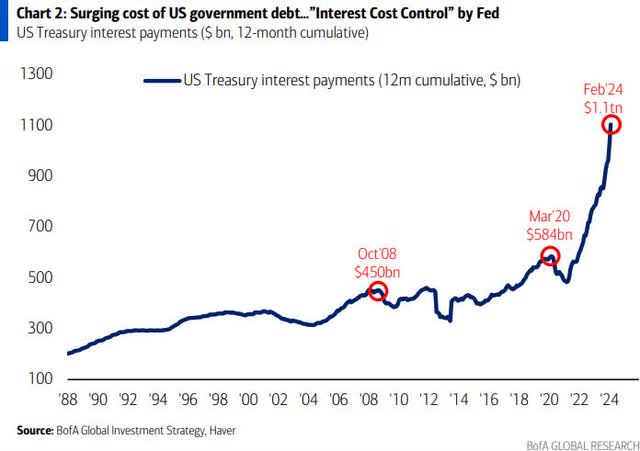

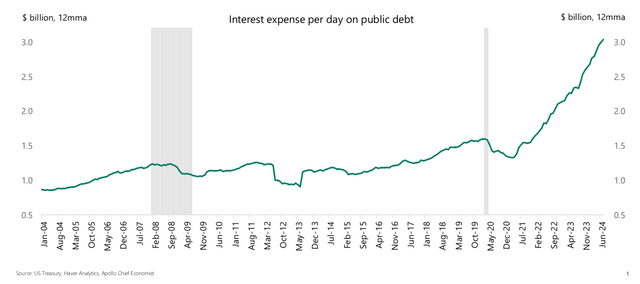

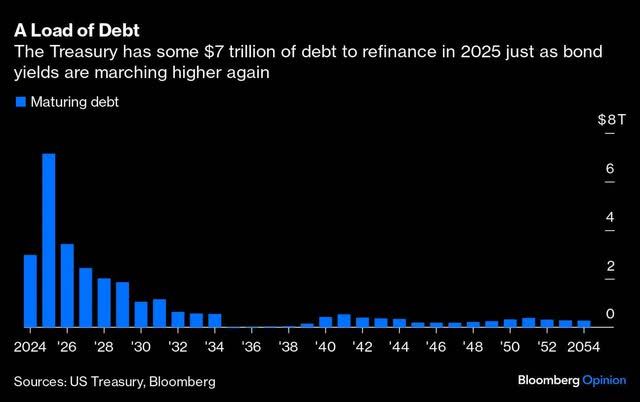

The U.S. holds a report $36.2 trillion of nationwide debt. Since 2020, overall U.S. debt has higher by way of $10 trillion. The usdebt higher by way of $2.2 trillion in 2024, following will increase of $2.6 trillion in 2023, $1.8 trillion in 2022, $1.9 trillion in 2021, and $4.5 trillion in 2020. Annualized curiosity expense on U.S. debt has eclipsed $1 trillion and is instantly emerging. Simply 2 years in the past, annual curiosity expense on U.S. debt used to be “simplest” $450 billion. Deficit spending during the last few years has been financed “at the reasonable” with gigantic issuances of momentary debt. That “reasonable” will have to be refinanced to the song of$7 trillion in 2025 at most probably markedly larger rates of interest.

Moderate curiosity expense on US executive debt now over $3 billion according to day

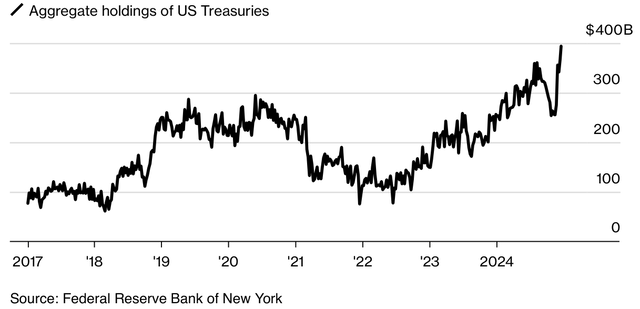

Within the annals of essentially the most unique U.S. golf equipment – assume Augusta Nationwide, The Knick, The Union Membership, Cosmo Membership, Fishers Island, The California Membership, Cypress Level and Pine Valley – finance has its personal elite circle: the unique broker community of U.S. treasury number one sellers serving the New York Federal Reserve. Since 1960, club has been by way of unique invitation simplest. Club has lengthy conferred distinctive privileges – and naturally, distinctive income. On the other hand, by way of circa-2024, dangers have fastened as broker steadiness sheet holdings of U.S. Treasuries have escalated into report territory.

Broker Holdings of US Treasuries Are at an All-Time Prime

In line with the Federal Reserve Financial institution of New York, there are these days two dozen number one broker participants. Dealing with the international locations financing “plumbing” of $32 trillion in debt luggage isn’t white-shoe bean bag in this day and age. The debt’s dimension, complexity, liquidity and attendant number one broker ever shrinking relative steadiness sheet dimension will see to that. Yet one more fear so as to add to the record.

In the end, our issues on inventory particular valuations are glaring in our contemporary sale of Texas Pacific Land, and our relative benchmark underweights in Apple and Microsoft. By way of comparability, the 12-month ahead P/Es of our 3 biggest holdings (Alphabet, Meta Platforms and Taiwan Semiconductor Production) chime in at extra cheap valuations of 21X, 24X and 23X, respectively.

At Wedgewood, we’ve curbed our enthusiasm. We think larger inventory marketplace volatility in 2025 than witnessed ultimate yr. Accordingly, we’re patiently looking forward to higher costs for each new positions, in addition to including to current positions.

January 2025

David A. Rolfe, CFA

Michael X. Quigley, CFA

Christopher T. Jersan, CFA

Leader Funding Officer

Senior Portfolio Supervisor

Portfolio Supervisor

Click on to magnify

The guidelines and statistical knowledge contained herein had been bought from resources, which we imagine to be dependable, however by no means are warranted by way of us to accuracy or completeness. We don’t adopt to advise you as to any exchange in Figures or our perspectives. This isn’t a solicitation of any order to shop for or promote. We, our associates and any officer, director or stockholder or any member in their households, could have a place in and would possibly now and again acquire or promote any of the above discussed or similar securities. Previous effects aren’t any ensure of long term effects.

This file comprises candid statements and observations referring to funding methods, person securities, and financial and marketplace prerequisites; then again, there’s no be sure that those statements, reviews or forecasts will turn out to be right kind. Those feedback might also come with the expression of reviews which can be speculative in nature and will have to now not be depended on as statements of reality.

Wedgewood Companions is dedicated to speaking with our funding companions as candidly as imaginable as a result of we imagine our buyers take pleasure in working out our funding philosophy, funding procedure, inventory variety method and investor temperament. Our perspectives and reviews come with “forward-looking statements” which would possibly or is probably not correct over the long run. Ahead-looking statements can also be recognized by way of phrases like “imagine,” “assume,” “be expecting,” “await,” or equivalent expressions. You will have to now not position undue reliance on forward-looking statements, which might be present as of the date of this file. We disclaim any legal responsibility to replace or modify any forward-looking statements, whether or not on account of new data, long term occasions or in a different way. Whilst we imagine we now have an affordable foundation for our value determinations and we now have self assurance in our reviews, precise effects would possibly fluctuate materially from the ones we await.

The guidelines supplied on this subject matter will have to now not be thought to be a advice to shop for, promote or grasp any specific safety.

Click on to magnify

Editor’s Notice: The abstract bullets for this text have been selected by way of In the hunt for Alpha editors.

Editor’s Notice: This newsletter discusses a number of securities that don’t industry on a big U.S. alternate. Please pay attention to the hazards related to those shares.