Even if synthetic intelligence (AI) has been a well-liked making an investment theme during the last two years, there may be nonetheless a lot of room for extra expansion in 2025. The tech international is simply getting began with one of the crucial maximum essential portions of AI implementation, which means that that many corporations with vital AI publicity are a long way from achieved knowing their doable good points.

If in case you have $1,000 to devote on your portfolio now, two shares which might be no-brainer choices to shop for with it at this time are Nvidia (NVDA -1.10%) and Meta Platforms (META -2.31%). Either one of those were wildly a success choices during the last two years, and I feel 2025 can be every other a success yr for this duo.

Nvidia

Nvidia has been the go-to AI funding for some time, and I feel it nonetheless merits a spot on the height of the pecking order. The rationale? It is in truth creating wealth from the AI development.

Lots of the greatest tech avid gamers are pouring billions of bucks into AI infrastructure, and an enormous bite of that cash goes to Nvidia. As a result of Nvidia’s graphics processing gadgets (GPUs) — and its CUDA device, which helps them — have turn into the trade usual, it has established itself because the chief on this box. As AI hyperscalers proceed to spend extra on computing energy in 2025 — as a lot of them have indicated they’re going to do — Nvidia will benefit.

For its fiscal 2026, which leads to January 2026, Wall Boulevard analysts on reasonable venture that Nvidia will develop its earnings by way of 52%. That isn’t dangerous for an organization whose earnings is on target to double in its soon-to-end fiscal 2025. Powering subsequent yr’s expansion trajectory can be its next-generation Blackwell-architecture chips. Those chips outperform its earlier among the finest Hopper chips considerably on duties like AI coaching. Actually, Blackwell chips are reportedly 4 occasions quicker in coaching AI fashions than Hopper chips. Buyers can make sure that the most important avid gamers within the tech house can be clamoring to procure those state-of-the-art GPUs as they turn into extra readily to be had.

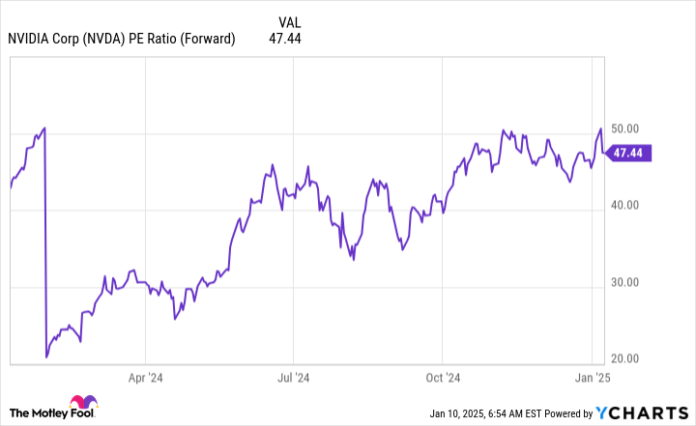

There is a perception that Nvidia’s inventory is amazingly pricey now and will have to be have shyed away from. I do not believe that is true, as Nvidia trades for an inexpensive (bearing in mind its expansion) 47 occasions ahead income.

NVDA PE Ratio (Forward) information by way of YCharts.

Different giant tech shares like Apple (NASDAQ: AAPL) and Amazon (NASDAQ: AMZN) industry at 33 and 36 occasions ahead income, respectively. On the other hand, neither of them is rising just about as temporarily as Nvidia, so this top rate is smart, as Nvidia’s income are much more likely to “catch up” in years to come and justify the next income more than one lately.

Nvidia remains to be one of the crucial height tactics to put money into AI, and traders mustn’t let it slip away.

Meta Platforms

Meta is dumping billions of bucks into AI analysis. On the other hand, it is doing that to be sure that its social media platforms keep related. Meta’s number one earnings streams come from advert gross sales on its “circle of relatives of apps”: Fb, Instagram, Threads, WhatsApp, and Messenger.

It additionally has made vital investments in augmented truth (AR) and digital truth (VR) that have yet to repay but, however they may if Meta can ship a shopper product that integrates top-tier AI at a aggressive worth level.

Regardless, the ones investments are years clear of paying off, in the event that they ever do. However in Meta Platforms’ present industry state, they are nonetheless a fantastic funding.

Meta is projected to develop its earnings by way of 15% subsequent yr, which is not as speedy as Nvidia, however you additionally shouldn’t have to pay an enormous top rate to possess the inventory.

META PE Ratio (Forward) information by way of YCharts.

At 24 occasions ahead income, Meta is moderately priced for a large tech inventory. That is very true in the event you believe the upside that Meta has if one of the crucial merchandise it is growing sooner or later hits it giant. The inventory is most effective being valued for its social media promoting industry, which remains to be an improbable explanation why to put money into it.

Meta is a large AI participant, however it nonetheless has a powerful base industry to pay its expenses whilst we look forward to AI to turn into absolutely built-in into its operations.

Randi Zuckerberg, a former director of marketplace construction and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Marketplace, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Keithen Drury has positions in Amazon and Nvidia. The Motley Idiot has positions in and recommends Amazon, Apple, Meta Platforms, and Nvidia. The Motley Idiot has a disclosure coverage.