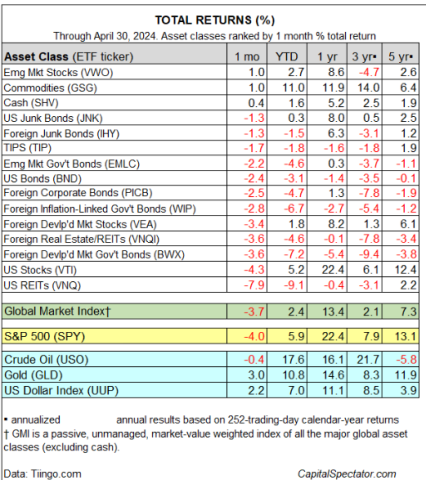

April witnessed a retreat throughout primary asset categories, marking the worst month for world markets in 2025, as in step with a collection of ETFs. Rising markets shares (VWO), commodities (GSG),and a money proxy (SHV) stood as upside outliers amidst a sea of losses.

Supply: Making an investment.com

US actual property funding trusts (VNQ) suffered the private loss, plummeting 7.9% — the steepest setback in just about two years. US shares (VTI) additionally fell, marking the primary per 30 days decline in 2024, whilst US bonds (BND) declined 2.4%.

Yr-to-date, maximum primary asset categories are within the purple, except for commodities (GSG), which can be up 11.0%. US shares (VTI) practice with a 5.2% acquire.

Supply: Making an investment.com

Supply: Making an investment.com

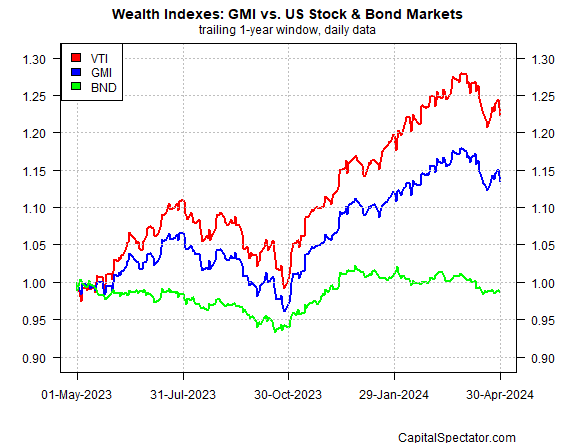

April marked the top of the successful streak for the World Marketplace Index (GMI), losing 3.7%. Yr up to now, GMI holds a modest 2.4% advance, whilst its one-year efficiency stays robust at 13.4%. US shares (VTI) proceed to outperform, with a go back exceeding 22% during the last yr, whilst US bonds (BND) stay in damaging territory, falling 1.4% in comparison to the former yr.

The put up Commodities Outperform Amid April Losses gave the impression first on Dumb Little Guy.