Stocks of Micron (MU 2.67%) had been sliding ultimate month after the memory-chip maker introduced disappointing steering in its fiscal first-quarter income document.

The sell-off following the document burnt up some cast positive aspects, because the inventory rose previous within the month after the Trade Division finalized a $6.17 billion subsidy associated with the CHIPS Act for the corporate to construct new production vegetation in New York and Idaho.

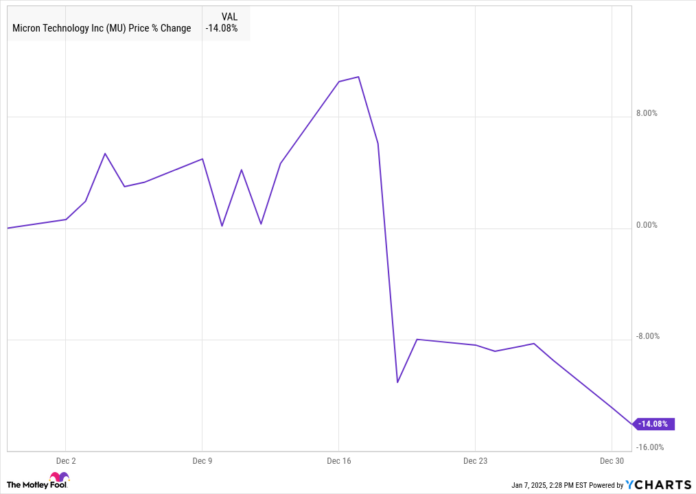

In line with knowledge from S&P Global Market Intelligence, the inventory completed the month down 14%. As you’ll be able to see from the chart, stocks fell sharply after the income document got here out in the course of the month and stayed down from there.

MU knowledge by way of YCharts

Steering journeys up Micron

Previous to the income document, the one vital information on Micron was once the CHIPS Act award being finalized, however that cost were extensively anticipated, so it is unclear if it at once fueled Micron’s positive aspects within the first part of the month.

The inventory then plunged 16% on Dec. 19 after it launched first-quarter effects. The corporate in fact edged previous estimates within the quarter and posted robust year-over-year expansion. Income jumped 84% to $8.71, necessarily matching estimates at $8.7 billion, and altered income in line with proportion got here in at $1.79, which in comparison to a per-share lack of $0.95 within the quarter a yr in the past, and crowned the consensus at $1.77.

On the other hand, traders balked at fiscal second-quarter steering, as the corporate known as for a sequential decline in earnings and earnings, seeing earnings of $7.7 billion-$8.1 billion, which was once neatly beneath the consensus at $8.97 billion, and altered EPS of $1.33-$1.53, additionally beneath the consensus at $1.77.

Control blamed vulnerable near-term call for in “consumer-oriented markets” however anticipated a go back to expansion in the second one part of the yr.

![]()

Symbol supply: Getty Photographs.

What is subsequent for Micron?

Micron stocks have rebounded to start out 2025 within the wake of pleasure round Nvidia naming the corporate as a key provider for its GPUs. Nvidia is thought to be Micron’s largest buyer, so the connection seems to be getting more potent, which will have to be profitable for Micron.

Via Jan. 7, the inventory is up 21% for the month. It continues to appear to be a discount, buying and selling at a ahead P/E ratio of 14.5, and it is rising swiftly following an previous lull in reminiscence chips.

The inventory may simply transfer upper from right here, particularly if the substitute intelligence (AI) growth alternatives up steam.

Jeremy Bowman has positions in Micron Era and Nvidia. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a disclosure coverage.