Stocks of Intel (INTC 0.70%) have been spiraling once more final month because the wonder “retirement” of former CEO Pat Gelsinger introduced extra proof of the disarray the corporate is in because it struggles to stay tempo within the booming chip sector.

Buyers have grasped directly to hopes of a restoration, however the CEO ouster is the most recent proof of steep demanding situations at a time when the corporate can in poor health have the funds for to fall at the back of.

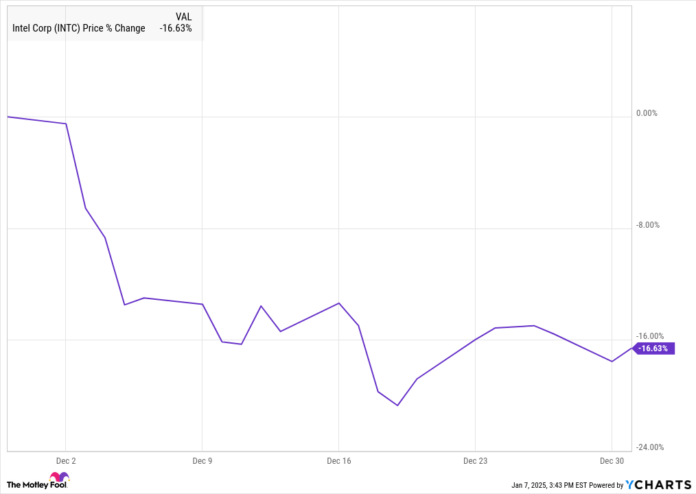

In consequence, the inventory completed the month down 17%, in step with information from S&P Global Market Intelligence. As you’ll see from the chart, the inventory plunged in a while after the CEO announcement, and stayed down from there, falling once more after the Federal Reserve trimmed its rate-cut forecast for 2025.

INTC information through YCharts

Intel is going from dangerous to worse

Buyers first of all reacted favorably to the scoop that Gelsinger used to be stepping down, despite the fact that it did not take lengthy for that shine to put on off, and traders looked as if it would understand the plan to interchange him used to be missing.

Intel named two meantime co-CEOs in Gelsinger’s position, CFO David Zinsner and Michelle Johnston (MJ) Holthaus, the CEO of Intel Merchandise. The transfer leaves Intel with out a everlasting chief when it is in the course of a large transition, having mentioned it might lay off 15% of its staff in August, as it is in the course of a years-long pivot to a brand new foundry fashion that opens up its factories to outdoor shoppers.

Pushing Gelsinger into retirement with out a substitute leaves the corporate with out leverage in govt negotiations, and the placement is usually a tricky promote, given the struggles of the industry, the floundering inventory worth, and its transition to the foundry fashion.

Subsequently, it is not sudden that the corporate hasn’t crammed that place greater than a month after Gelsinger’s departure.

What is subsequent for Intel?

Intel did make another strikes final month, together with including two new board participants, and rumors swirled that it would absolutely spin off the foundry industry. Alternatively, the adverse media consideration across the corporate’s efforts to discover a new CEO additionally looked as if it would weigh at the inventory.

Stocks had been flat to begin January, as The Wall Side road Magazine piled onto the grievance, pronouncing that the corporate is dropping marketplace percentage in more than one spaces and has even fallen at the back of AMD in information heart earnings.

Buyers additionally shrugged off the discharge of the corporate’s newest AI PC chips at CES in Las Vegas this week, whilst Nvidia received many of the consideration.

There is not any query Intel is in a deep hollow at this level. A proficient chief might be able to dig the corporate out, however it kind of feels like the corporate’s issues gets worse ahead of they recuperate, in the event that they ever do.

Jeremy Bowman has positions in Complex Micro Units and Nvidia. The Motley Idiot has positions in and recommends Complex Micro Units, Intel, and Nvidia. The Motley Idiot recommends the next choices: quick February 2025 $27 calls on Intel. The Motley Idiot has a disclosure coverage.