COVID 19 profoundly modified the condominium trade. Loose to paintings from any place, American citizens uprooted and migrated to towns with cheaper price actual property, more room, decrease source of revenue taxes, and higher climate. That translated to a mass exodus to Sunbelt puts like Phoenix, Dallas, Tampa, Nashville, Atlanta, and Las Vegas. Multifamily landlords had been fast to needless to say they may lift Austin condominium rents through 20% and a employee transplanted from San Francisco would nonetheless be saving cash. Quickly all of the condominium REITs had invested within the Country’s freshest housing markets and so had everybody else. Through 2023, builders with get right of entry to to reasonable capital had began supply of the most important new condominium provide in virtually 50 years.

The large new provide started to outpace nonetheless robust call for; occupancy dropped, rents stopped emerging and, in some markets, if truth be told reversed. Thankfully, economies sooner or later in finding equilibrium; swiftly emerging rates of interest close off the spigot to reasonable capital and successfully made new building uneconomic. After a coarse 2023, the chant on multifamily income calls changed into “Live on till `25”.

On this Sector Highlight, we will be able to read about the place we are actually within the realm of multifamily REIT funding. We evaluate marketplace valuations relative to AFFO/proportion, Web Asset Price (NAV), and 3Q24 Identical-Retailer Web Working Source of revenue (SSNOI).

2024 Returns

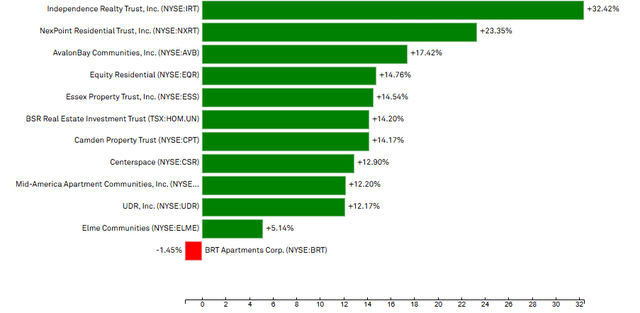

Impressive hire enlargement early within the pandemic generated unbridled investor optimism and driven condominium REIT income multiples up within the vary of 25 to 30x. When hire enlargement stalled, multifamily proportion costs fell again to earth. 2024 used to be a wait-and-see duration and, with multifamily outperforming the wider REIT marketplace, optimism could also be returning.

Multifamily REITs – 2024 Returns

S&P Capital IQ

Supply: S&P Capital IQ as of 01/02/2025

Marketplace Valuations

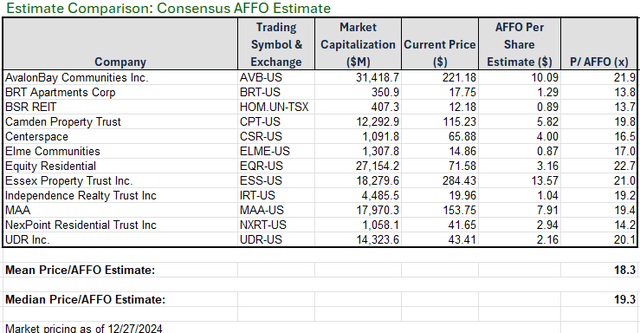

More than a few metrics will also be carried out to know an organization’s intrinsic worth relative to its marketplace valuation. At Portfolio Source of revenue Answers, we put vital accept as true with in Adjusted Price range from Operations (AFFO/proportion) measures as a result of they degree the income enjoying box in a peer set. At year-end, the AFFO/proportion multiples of the Multifamily REIT sector appear to be this.

2MCAC with knowledge derived from S&P Capital IQ

Supply: 2MCAC with knowledge compiled from S&P Capital IQ

With P/AFFO multiples starting from ~14x to nearly 23x and a mean P/AFFO more than one of 18.3x, the sphere is a lot more modestly valued than it used to be on the condominium funding frenzy height of 25x to 30x of 2021. Nonetheless, a median 19.3x is a significant top rate to the 16.4x moderate more than one of the entire fairness REIT universe.

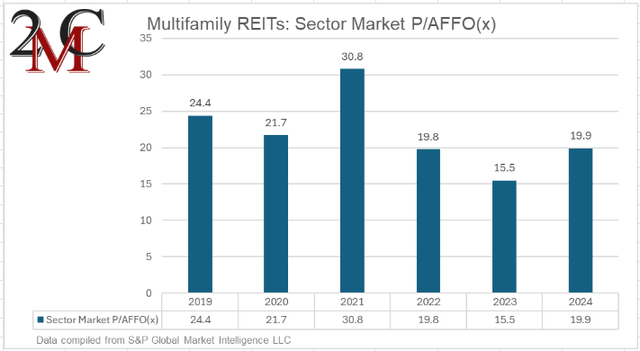

2MCAC with knowledge derived from S&P Capital IQ

Supply: 2MCAC with knowledge compiled from S&P International Marketplace Intelligence

With maintaining energy in the United States jobs marketplace, condominium call for and family formation are anticipated to stay prime. With new provide diminishing, buyers could also be pricing stocks in anticipation of landlords reassuming the higher hand in condo price negotiations.

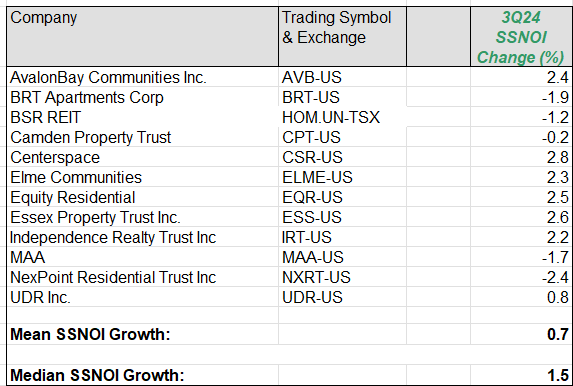

Identical-Retailer Web Working Source of revenue

3rd quarter reporting indicated that whilst the multifamily sector nonetheless noticed robust call for, waves of competing new provide have suppressed each hire enlargement and occupancy. The result’s a pattern of extra tepid SSNOI enlargement for the ones sectors. On moderate, the condominium REIT sector noticed same-store money NOI develop 0.7% in comparison to 3Q23. With robust proportion worth efficiency in 2024, it sort of feels conceivable that buyers consider that income can have troughed, and the long run seems brighter.

2MCAC with knowledge compiled from corporate filings

Supply: 2MCAC with knowledge compiled from corporate filings

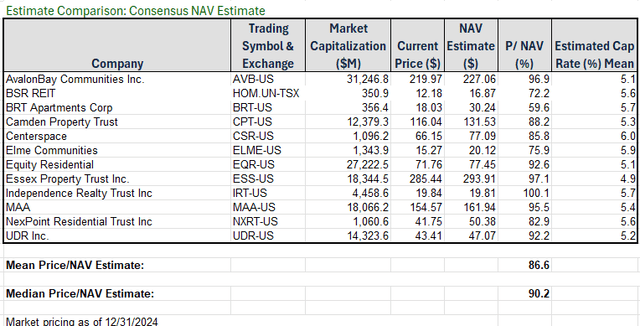

Web Asset Price

NAV is widely thought to be an invaluable metric for comparability of worth relative to marketplace proportion worth and to friends. One year in the past, fairness REITs traded at a prime teenagers cut price to Web Asset Price. Nowadays they industry at just about NAV valuations, and that approximates pricing for the multifamily sector as smartly. In prior years, investor enthusiasm or pessimism driven proportion costs to vital premiums or reductions, respectively. Nowadays, the common multifamily REIT proportion is priced at a couple of 10% cut price to consensus NAV.

2MCAC with knowledge compiled from S&P Capital IQ

Supply: 2MCAC with knowledge compiled from S&P Capital IQ

When making an allowance for NAVs, it is very important needless to say the worth is derived from the usage of an assumed capitalization price. Because the desk above describes, the carried out Cap Charges right here range in a decent band from 4.9% as much as 6.0%; the decrease the cap price carried out, the upper the NAV derived. Operationally, those firms are extraordinarily numerous, so this valuation metric is simplest a place to begin and a lot more research is needed.

Takeaways

Our economic system is turning in blended blessings. Employment stays very robust and that bolsters prime call for for all of the housing sector. Employment is without doubt one of the components within the Federal Reserve’s twin mandate, so energetic task and salary enlargement will hose down the tempo of additional price cuts.

Moderately prime borrowing prices will proceed to suppress new condominium building and that’s favorable for lowering new festival for condominium landlords. On the other hand, many REITs are levered so upper prices on refinancing will power Web Working source of revenue and decrease charges can be welcome reduction.

The number of multifamily REITs we’ve got tested listed below are numerous of their capital construction, their marketplace geographies and demographics, and, perhaps most significantly, their control group’s ability units and goals. This Sector Highlight is meant as an outline start line. Extra thorough, granular research on a person corporate foundation is warranted.

Glad making an investment.

Editor’s Notice: This newsletter discusses a number of securities that don’t industry on a significant U.S. change. Please take note of the dangers related to those shares.