SoundHound AI has been one among the freshest synthetic intelligence (AI) shares in the marketplace in 2024, clocking shocking beneficial properties of 936% as of this writing at the again of a number of favorable traits similar to its remarkable enlargement, an funding from AI pioneer Nvidia, and sure protection on Wall Side road of overdue from analysts who imagine that this voice AI answers supplier is usually a giant winner ultimately.

The nice section is that SoundHound AI has been rising at an implausible tempo and appears to be taking advantage of the large addressable alternative on be offering within the voice AI answers marketplace via development a cast buyer base. On the other hand, the dangerous section is that the inventory is terribly dear presently following its outstanding surge in 2024.

It’s now buying and selling at 109 occasions gross sales. For comparability, AI bellwether Nvidia has a price-to-sales ratio of 31 even after the phenomenal enlargement that it’s been clocking in fresh quarters and the dominant place that it enjoys within the AI chip marketplace. So, buyers would do smartly to search for possible choices to SoundHound in the event that they want to soar directly to the AI bandwagon.

Complex Micro Units (AMD -0.93%) is one such selection that buyers can imagine purchasing presently to benefit from the proliferation of AI. Listed below are one of the causes AMD might be some of the perfect AI shares to shop for heading into the brand new yr.

A cast turnaround might be within the playing cards for AMD in 2025

AMD inventory has underperformed the marketplace up to now yr, shedding 16% of its price whilst the wider PHLX Semiconductor Sector index has clocked 20% beneficial properties over the similar length. AMD’s vulnerable affect within the AI chip marketplace is without doubt one of the key causes in the back of its underperformance.

In the end, the chipmaker expects to promote simply $5 billion value of AI graphics processing gadgets (GPUs) which are deployed in information facilities. For comparability, rival Nvidia’s earnings from the knowledge heart trade got here in at a document $30.8 billion within the earlier quarter, emerging 112% from the year-ago length. On the other hand, the silver linings in AMD’s AI chip trade will have to now not be unnoticed.

The corporate’s information heart earnings greater 122% yr over yr within the 3rd quarter of 2024 to $3.5 billion, pushed via the rising gross sales of its AI GPUs and server processors. Any other factor value noting this is that AMD has saved expanding its information heart GPU gross sales forecast during 2024. It was once to start with hoping to promote simply $2 billion value of knowledge heart GPUs at first of the yr. So, the constant build up within the corporate’s gross sales forecast implies that it’s regularly gaining traction on this marketplace.

The excellent news for AMD buyers is that its information heart GPU gross sales may just continue to grow at a pleasing clip in 2025 as smartly, pushed via robust call for and an bettering provide chain. On its October 2024 profits convention name, AMD CEO Lisa Su identified that the corporate has “deliberate for vital enlargement” in its AI chip provide for 2025.

In the end, AMD’s foundry spouse, Taiwan Semiconductor Production, is reportedly going to double its complicated chip packaging capability via the top of 2025. Even supposing Nvidia has reportedly secured 60% of TSMC’s complicated chip packaging for 2025, it nonetheless implies that AMD can witness a pleasing soar in manufacturing of its AI chips subsequent yr, resulting in additional enlargement in its information heart earnings.

Importantly, AMD does not want to beat Nvidia to power really extensive enlargement in its earnings and profits. In the end, AMD control expects the AI accelerator marketplace to hit $500 billion in earnings in 2028. So, even supposing Nvidia stays the dominant participant and AMD manages to eke out even a ten% proportion of this marketplace over the following 3 years, its information heart GPU earnings may just develop tenfold from 2024 ranges.

Additionally, there’s an extra AI-related catalyst for AMD within the type of the non-public laptop (PC) marketplace. World AI PC shipments are anticipated to leap to 114 million gadgets in 2025 from an estimated 43 million in 2024, in line with Gartner, and AMD is definitely positioned to capitalize in this enlargement. In line with Su, “HP and Lenovo are on the right track to greater than triple the selection of Ryzen AI Professional platforms they provide in 2024, and we think to have greater than 100 Ryzen AI Professional industrial platforms out there subsequent yr, positioning us smartly for proportion beneficial properties as companies refresh the loads of hundreds of thousands of Home windows 10 PCs that can not obtain Microsoft technical give a boost to beginning in 2025.”

All this explains why analysts are forecasting a powerful turnaround in AMD’s monetary efficiency subsequent yr.

More potent enlargement and a wonderful valuation make the inventory value purchasing

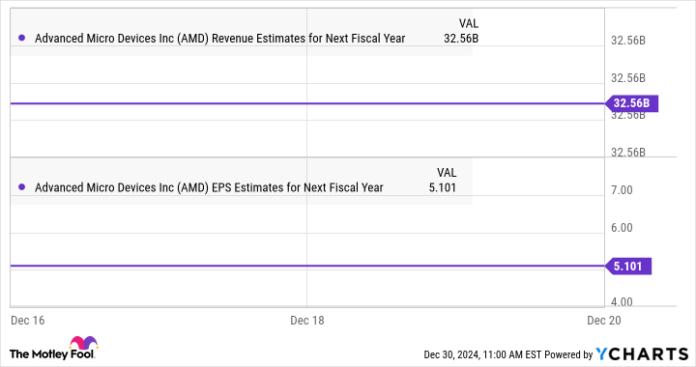

Analysts expect AMD’s earnings to extend 13% in 2024 to $25.6 billion, along side a 26% soar in the base line to $3.33 consistent with proportion. The next chart obviously presentations {that a} vital acceleration is anticipated in AMD’s enlargement in 2025.

AMD Revenue Estimates for Next Fiscal Year information via YCharts

The inventory is lately buying and selling at 25 occasions ahead profits, which is a bargain to the tech-laden Nasdaq-100 index’s profits more than one of 33 (the usage of the index as a proxy for tech shares). Assuming AMD trades at even 30 occasions profits after a yr and achieves $5.10 consistent with proportion in profits in 2025, its inventory fee may just soar to $153. That may be a 25% soar from present ranges.

In fact, extra upside can’t be dominated out if AMD manages to ship more potent bottom-line enlargement and the marketplace makes a decision to praise it with a better valuation consequently. That is why buyers taking a look to shop for an AI inventory that is buying and selling at an inexpensive valuation and has the possible to ship wholesome beneficial properties in 2025 will have to imagine taking a more in-depth have a look at AMD as a substitute of expensively valued shares similar to SoundHound.

Harsh Chauhan has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Complex Micro Units, HP, Microsoft, Nvidia, and Taiwan Semiconductor Production. The Motley Idiot recommends Gartner and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.