Stocks of Past Meat (BYND -1.54%) have been a number of the losers final week because the as soon as high-flying expansion inventory reported disappointing ends up in its third-quarter income record in November.

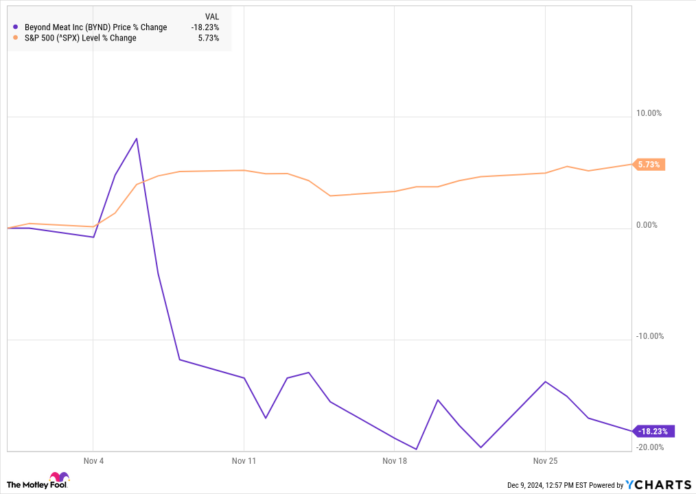

In consequence, the inventory completed the month down 18%, in keeping with S&P Global Market Intelligence. As you’ll be able to see from the chart underneath, the inventory fell early within the month at the income record and stayed down from there even because the large marketplace received on hopes following the election, and normally sturdy financial information and income effects.

BYND information by means of YCharts.

Past Meat’s struggles proceed

Past Meat returned to expansion in Q3, however the industry persisted to fight, and expectancies for a significant restoration gave the impression to dim. The inventory fell 11% on Nov. 7 at the record.

The plant-based meat manufacturer posted earnings of $81 million within the quarter, up 7.6%, which edged out the consensus at $80.7 million.

U.S. earnings rose 15% to $49.5 million, whilst the global section struggled with earnings down 2% to $31.6 million.

Gross benefit progressed from a lack of $7.3 million within the quarter a 12 months in the past to $14.3 million, giving it a gross margin of 17.7%. Its adjusted income sooner than pastime, taxes, depreciation, and amortization (EBITDA) loss narrowed from $57.5 million to $19.8 million because of cost-cutting efforts like layoffs.

On the base line, its loss in step with proportion narrowed from $1.09 to $0.41, which was once somewhat forward of the consensus at $0.44.

CEO Ethan Brown famous, “We returned to expansion, expanding web earnings on a year-over-year foundation, whilst proceeding to enlarge gross margin and cut back working bills on each a sequential and year-over-year foundation.”

Over the remainder of the month, the inventory necessarily traded because it was once not able to capitalize at the broader upswing available in the market.

Symbol supply: Past Meat.

What is subsequent for Past Meat

In spite of the go back to expansion, control reduced its full-year steering, calling for earnings of $320 million to $330 million for the 12 months, down from a previous vary of $320 million to $340 million.

It didn’t supply steering on the base line.

Past Meat’s momentum has obviously light, and the trail to profitability and constant expansion has narrowed at this level. Its overall selection of distribution retailers has fallen from 137,000 within the quarter a 12 months in the past to 129,000, which turns out to underscore waning call for for the product.

Until it will possibly overhaul its charge construction and faucet into a brand new buyer base, the inventory turns out more likely to proceed to underperform.

Jeremy Bowman has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Past Meat. The Motley Idiot has a disclosure coverage.