After an underwhelming yr, Tesla (TSLA -1.59%) inventory soared remaining month, boosted through hopes that Trump’s victory would assist the electrical car (EV) maker, as CEO Elon Musk has made himself a detailed best friend to president-elect Trump, spending closely to assist his marketing campaign ahead of the election.

In consequence, the inventory soared after the election, and it endured to climb as traders perceived to wager that laws beneath the Trump management could be favorable to Tesla.

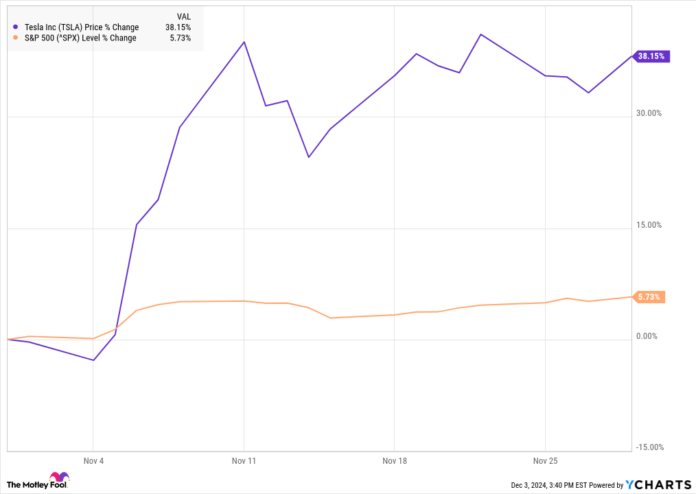

The inventory peaked on Nov. 11 after which traded sideways over the remainder of the month on blended information. In keeping with knowledge from S&P Global Market Intelligence, the inventory received 38% over November. As you’ll see from the chart beneath, the entire inventory’s good points got here within the days following the election.

TSLA knowledge through YCharts.

Musk choices the profitable horse

It is comprehensible that Tesla rose on Trump’s victory as Musk used to be considered one of his maximum visual and vocal supporters, necessarily going all-in at the former president.

Then again, whilst Musk does have Trump’s ear and is working the Division of Govt Potency, it is much less transparent how the Trump management can assist Tesla. Musk hopes that the brand new management will federalize autonomous-vehicle laws, which might assist Tesla get its new Cybercab at the highway, however the true check for the ones cars might be protection as there is prone to be an outcry if they’re allowed at the highway with out clearing affordable protection requirements.

Moreover, Trump is easily referred to as a supporter of fossil fuels and an opponent of EVs, and he has already mentioned he deliberate to take away the $7,500 EV tax credit score. Musk mentioned that the results of that transfer could be a lot higher on Tesla’s competitors than it might be on Tesla, nevertheless it nonetheless presentations that the brand new management might be much less pleasant to renewable power than the Biden management used to be, which generally is a problem for Tesla.

Symbol supply: Tesla.

What is subsequent for Tesla

As a trade, Tesla has struggled this yr with earnings stagnating and income falling for a lot of the yr, although it stunned traders with its third-quarter income file, which incorporated forged benefit expansion.

Trump’s tariff threats may additionally pose demanding situations to Tesla as may emerging tensions with China, which is a big marketplace for Tesla.

On the present valuation, there are top expectancies baked into the inventory. Whilst Musk has projected manufacturing expansion of 20% or extra subsequent yr, traders appear to be anticipating growth on autonomy and different wins associated with the Trump management.

Buyers will have to average their expectancies given the trade’s fresh demanding situations, and there is additionally the chance that the Trump management might not be as large of a assist to the corporate as traders hope.

Jeremy Bowman has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Tesla. The Motley Idiot has a disclosure coverage.