No source of revenue investor buys stocks of a dividend-paying corporate anticipating that it is going to droop its distributions in the future. Somewhat the opposite, dividend buyers need the ones payouts to stay going and rising for so long as conceivable — ideally perpetually. Sadly, many firms will, in the future, must lodge to dividend cuts as a result of industry demanding situations.

On the other hand, in my opinion, Visa (V 0.12%) and Novartis (NVS 0.86%) glance more likely to steer clear of this long run, and each are price making an investment in and conserving onto for just right. Let us take a look at each.

1. Visa

Visa, a number one cost community corporate, has a very good dividend monitor report. It’s been paying dividends since 2008 when it went public, and it has greater its payouts yearly.

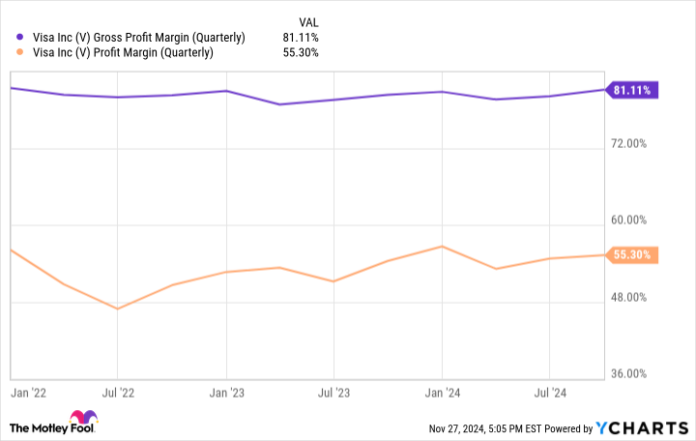

Visa can find the money for it: It generates constant and rising earnings, profits, and unfastened money drift. Its cost community is helping facilitate masses of hundreds of thousands of bank card transactions day-to-day, with the corporate taking a small reduce of each and every. Its industry additionally generates superb margins. The corporate’s gross margins are most often round 80%, whilst it generally nets about $0.50 for each buck in earnings.

V Gross Profit Margin (Quarterly) information by means of YCharts.

That level of profitability is unusual for a corporation as massive as Visa, however it isn’t an twist of fate. Visa’s cost community is already in position. Further transactions upload little in the best way of prices, leading to robust margins.

Additional, Visa’s ecosystem of banks, customers who raise bank cards bearing its emblem, and companies that settle for the ones playing cards for cost is such that it turns into extra precious because it grows, making it a herbal instance of the community impact. Visa has few direct competition of be aware to talk of, neither is the corporate letting the greater digitization of bills problem its dominance.

The corporate has been adapting its industry to the converting nature of the monetary business. Finally, it must nonetheless have various progress alternatives, with trillions of bucks price of transactions nonetheless being carried out outdoor the scope of the categories that Visa’s community helps. The continuing displacement of money and digitization of bills will supply an impressive long-term tailwind to the corporate.

Visa is well-positioned to ship superb returns and constant dividend progress all through all of it.

2. Novartis

There’s all the time a prime call for for necessary prescribed drugs of the categories that Novartis provides. It’s been within the drug-making industry for a very long time, and its portfolio comprises many “blockbusters” — medicine that generate greater than $1 billion in annual gross sales. It mechanically develops more moderen merchandise to interchange the ones shedding gross sales to patent expirations and pageant.

Maximum vital for buyers, its monetary effects are most often robust, and the 3rd quarter hewed to that development. Income greater by means of 9% 12 months over 12 months to $12.8 billion, whilst profits consistent with percentage rose 18% to $2.06. Its unfastened money drift additionally rose 18% to about $6 billion. It must have the ability to stay handing over an identical effects for some time in spite of fresh adjustments to its industry.

The corporate spun off its generic and biosimilar unit as Sandoz simply over a 12 months in the past, and has slimmed down its clinical-stage pipeline by means of 40% in recent times. That provides the industry much less diversification. On the other hand, it additionally prevents the corporate from spreading its assets too skinny, and positions it to as a substitute center of attention on higher-growth alternatives.

Even after whittling down its pipeline, Novartis nonetheless boasts a number of dozen systems in construction. The corporate must have the ability to proceed profitable sufficient new regulatory approvals and label expansions to stay its earnings and profits transferring in the suitable course for a very long time. Novartis has additionally been paying and elevating its dividends for some time. The corporate’s streak of payout will increase stands at 27 consecutive years — an outstanding monitor report.

On the present percentage value, Novartis has a aggressive dividend yield of three.65% — the S&P 500’s reasonable yield is just one.32%. The drugmaker is dedicated to rewarding its shareholders on this manner, and that is the reason probably not to switch anytime quickly. Novartis is a brilliant dividend inventory to shop for and dangle for just right.